Question: Here is the question, please explain without the help of a financial calculator or excel sheet. Consider the following two bonds (assume annual coupons) Bond

Here is the question, please explain without the help of a financial calculator or excel sheet.

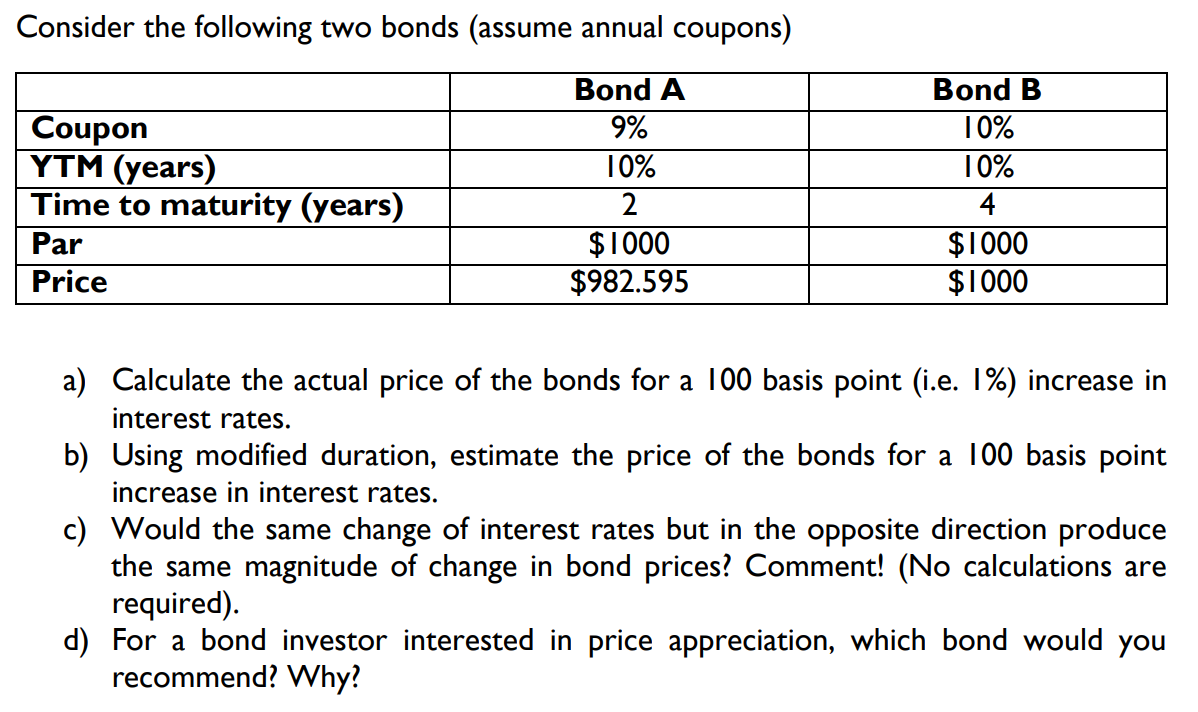

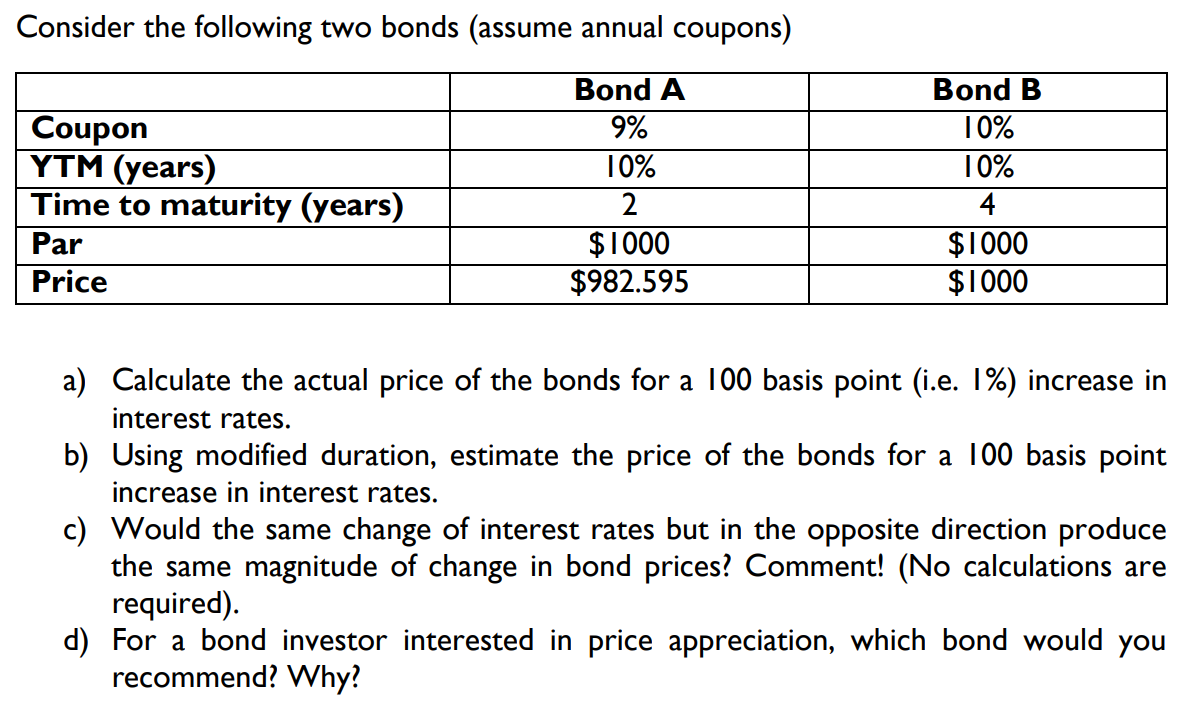

Consider the following two bonds (assume annual coupons) Bond A Bond B Coupon 9% 10% YTM (years) 10% 10% Time to maturity (years) 2 4 Par $ 1000 $1000 Price $982.595 $1000 a) Calculate the actual price of the bonds for a 100 basis point (i.e. 1%) increase in interest rates. b) Using modified duration, estimate the price of the bonds for a 100 basis point increase in interest rates. c) Would the same change of interest rates but in the opposite direction produce the same magnitude of change in bond prices? Comment! (No calculations are required). d) For a bond investor interested in price appreciation, which bond would you recommend? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts