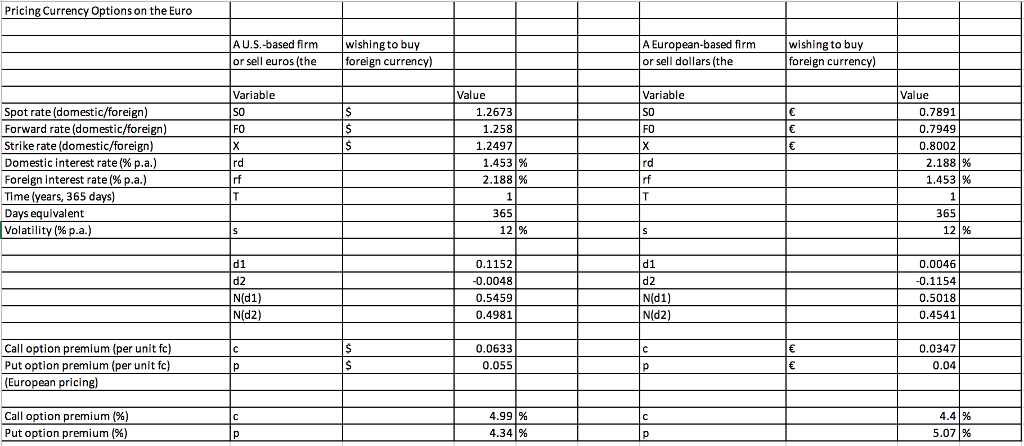

Question: Here is the table: u.s. Dollar/Euro. The tableindicates that a 1-year call option on euros at a strike rate of $1.2497/ will cost the buyer

Here is the table:

u.s. Dollar/Euro. The tableindicates that a 1-year call option on euros at a strike rate of $1.2497/ will cost the buyer $0.0633/, or 4.99%. But that assumed a volatility of 12.000% when the spot rate was $1.2673/. What would the same call option cost if the volatility was reduced to 10.500% when the spot rate fell to $1.2481 /E? The same call option cost if the volatility was reduced to 10.500% when the spot rate fell to $1.2481/ would be (Round to four decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts