Question: Here is the whole question, someone please help im stuck Entries for Payroll and Payroll Taxes The following information about the payroll for the week

Here is the whole question, someone please help im stuck

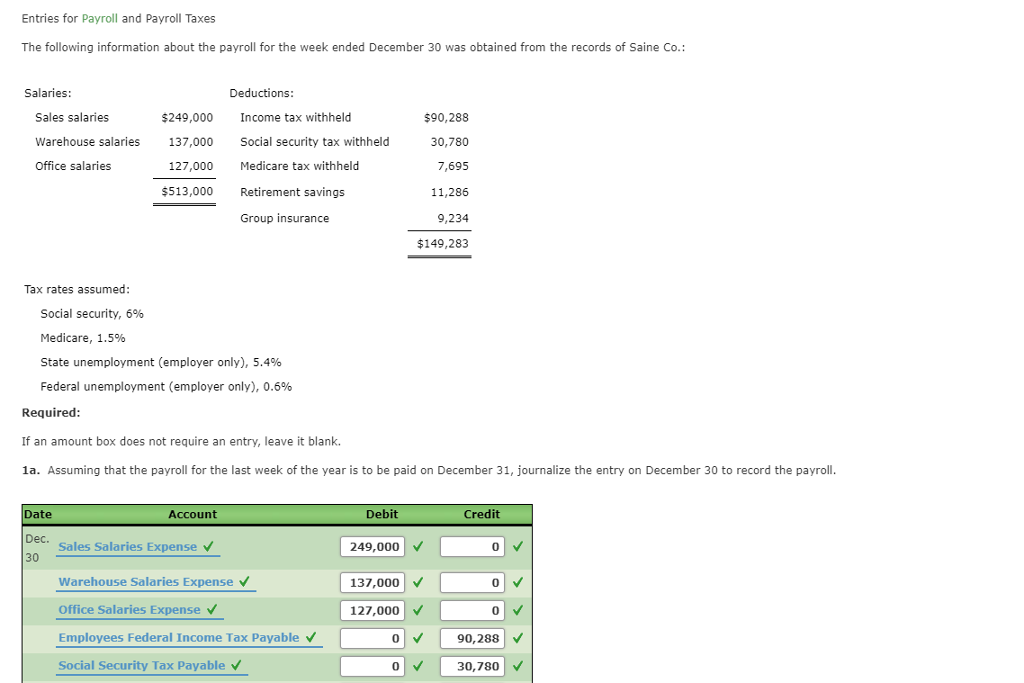

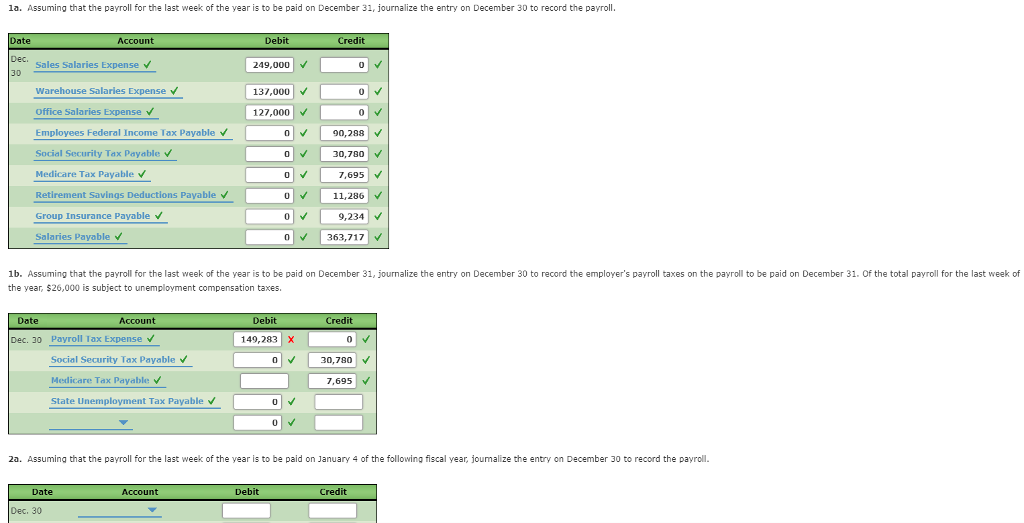

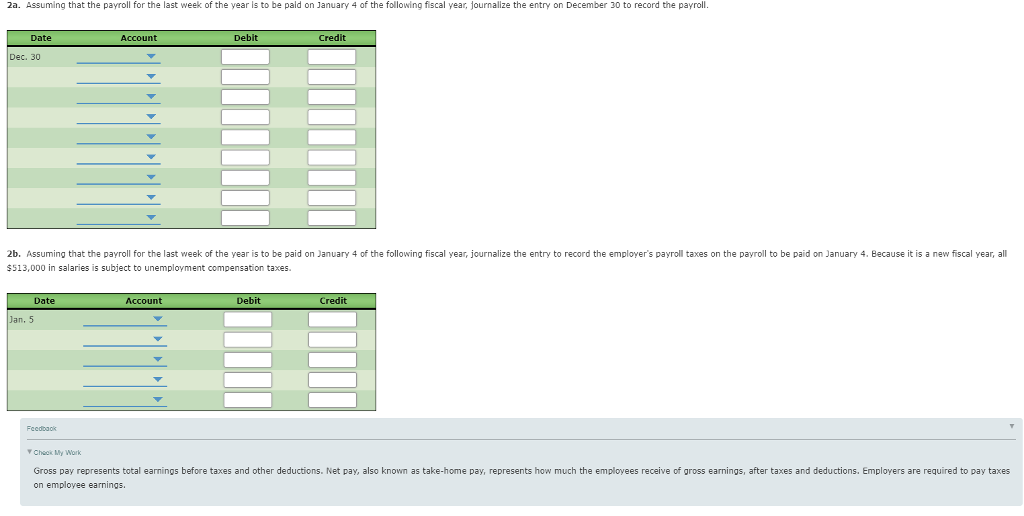

Entries for Payroll and Payroll Taxes The following information about the payroll for the week ended December 30 was obtained from the records of Saine Co.: Salaries: Deductions Salsslaries Warehouse salaries Office salaries $249,000 137,000 127,000 Income tax withheld Social security tax withheld Medicare tax withheld $90,288 30,780 7,695 11,286 9,234 $149,283 $513,000 Retirement savings Group insurance Tax rates assumed: Social security, 6% Medicare, 1.5% State unemployment (employer only), 5.4% Federal unemployment (employer only), 0.6% Required If an amount box does not require an entry, leave it blank. 1a. Assuming that the payroll for the last week of the year is to be paid on December 31, journalize the entry on December 30 to record the payroll Debit 249,000 137,000 127,000 Date Dec. 30 Account Credit Sales Salaries Expense Warehouse Salaries Expense Office Salaries Expense Employees Federal Income Tax Payable Social Security Tax Payable 090,288 0 30,780 1a. Assuming that the payroll for the last week of the year is to be paid on December 31, journalize the entry on December 30 to record the payroll Debit 249,000 137,000 127,000 Account Credit ate Dec. 30 Sales Salaries Expense Warehouse Salaries Expense Office Salaries Expense Employees Federal Income Tax Payable Social Security Tax Payable v Medicare Tax Payable V Retirement Savings Deductions Payable Group Insurance Payable Salaries Payable 90,288 030,780 1,695 9,234 0363,717V 1b. Assuming that the payroll for the last week of the year is to be paid on December 31, journalize the entry on December 30 to record the employer's payroll taxes on the payroll to be paid on December 31. Of the total payroll for the last week of the year, $26,000 is subject to unemployment compensation taxes Date Account Debit Credit Dec. 30 Payroll Tax Expense v 149,283 X Social Security Tax Payable Medicare Tax Payable v State Unemployment Tax Payable 30,780 7,695 2a. Assuming that the payroll for the last week of the year is to be paid on January 4 of the following fiscal year, joumalize the entry on December 30 to record the payroll. Date Account Debit Credit Dec. 30 2a. Assuming that the payroll for the last week of the year ls to be pald on January 4 of the following fiscal year, journalize the entry on December 30 to record the payroll Date Account Debit Credit 2b. Assuming that the payroll for the last week of the year is to be paid on January 4 of the following fiscal year, journalize the entry to record the employer's payroll taxes on the payroll to be paid on January 4. Because it is a new fiscal year, all $513,000 in salaries is subject to unemployment compensation taxes Date Account Debit Credit Feedbaok Y Chack My Work Gross pay represents total earnings before taxes and other deductions. Net pay, also known as take-home pay, represents how much the employees receive of gross earnings, after taxes and deductions, Employers are required to pay taxes on employee earnings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts