Question: If anyone can please help me out with this question Saved He [The following information applies to the questions displayed below.] One Product Corporation (OPC)

![[The following information applies to the questions displayed below.] One Product Corporation](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/671805646883d_49167180563cd45e.jpg)

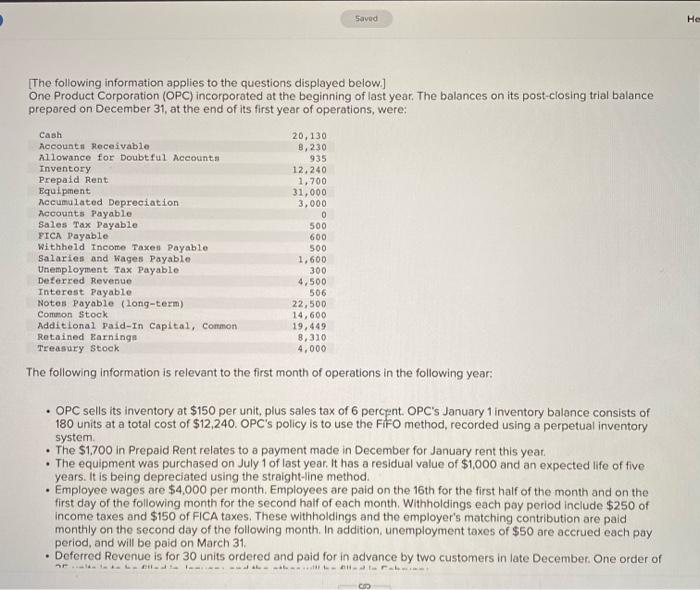

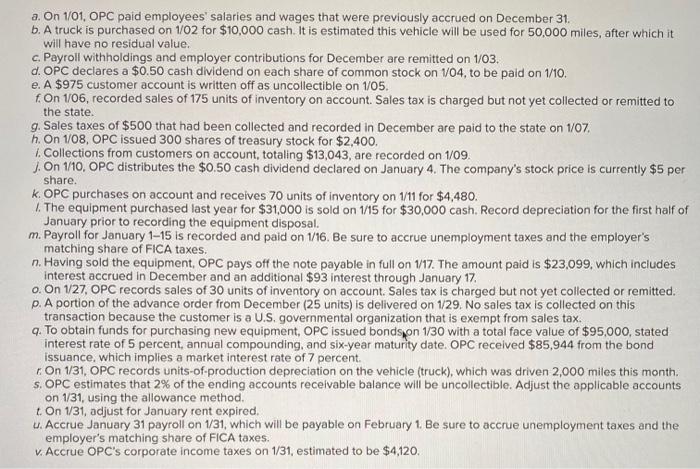

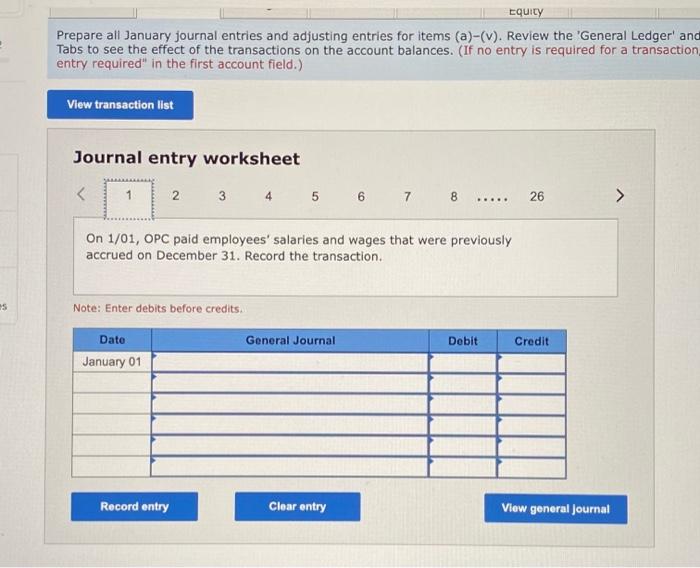

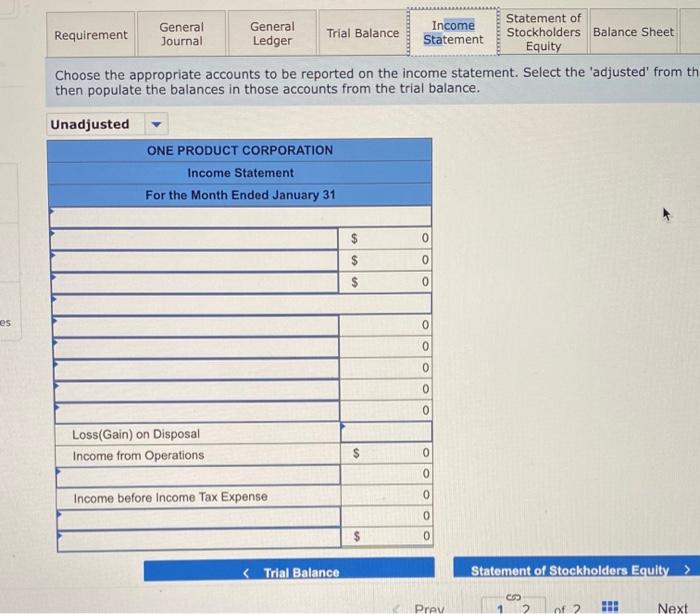

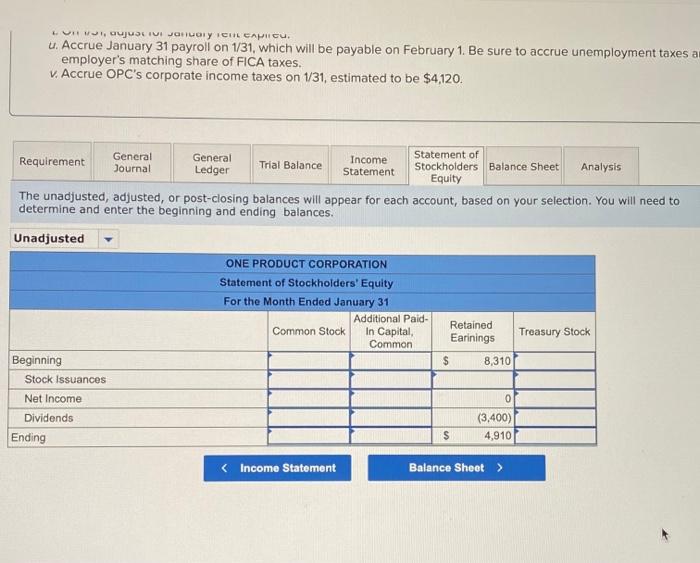

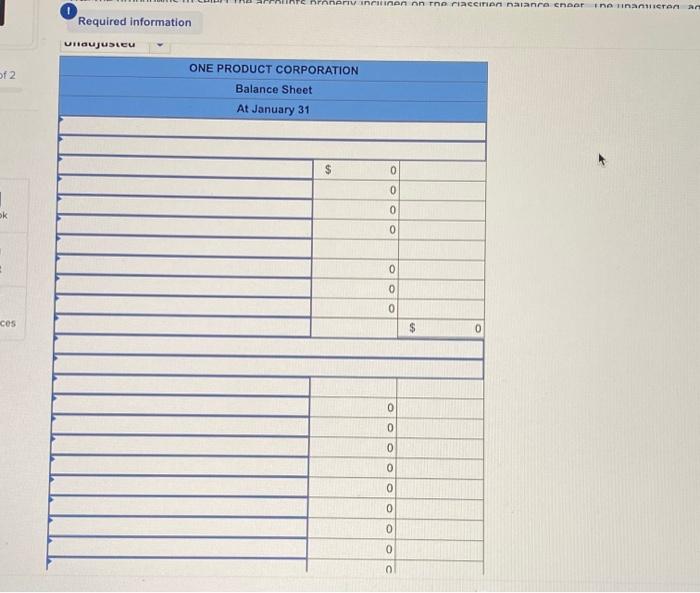

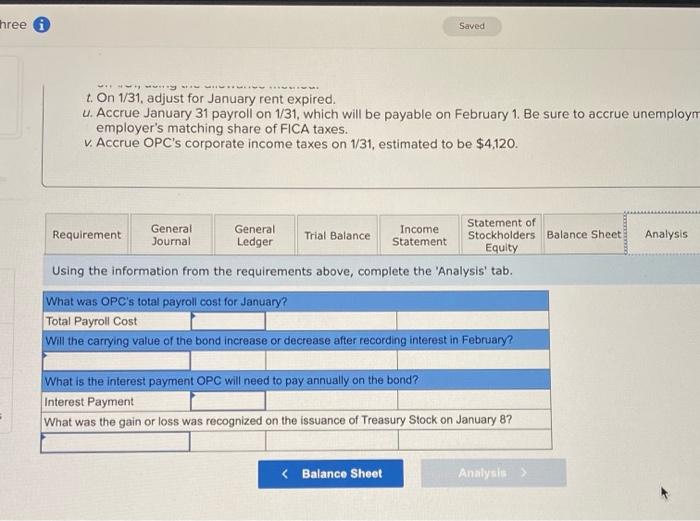

Saved He [The following information applies to the questions displayed below.] One Product Corporation (OPC) incorporated at the beginning of last year. The balances on its post-closing trial balance prepared on December 31, at the end of its first year of operations, were: Cash 20,130 Accounts Receivable 8,230 Allowance for Doubtful Accounts 935 Inventory 12.240 Prepaid Rent 1,700 Equipment 31,000 Accumulated Depreciation 3,000 Accounts Payable 0 Sales Tax Payable 500 PICA Payable 600 Withheld Income Taxes Payable 500 Salaries and Wages Payable 1,600 Unemployment Tax Payable 300 Deferred Revenue 4,500 Interest Payable 506 Notes Payable (long-term) 22,500 Common Stock 14,600 Additional Paid-In Capital, Common 19,449 Retained Earnings 8,310 Treasury Stock 4,000 The following information is relevant to the first month of operations in the following year: OPC sells its inventory at $150 per unit, plus sales tax of 6 percent. OPC's January 1 inventory balance consists of 180 units at a total cost of $12, 240. OPC's policy is to use the FIFO method, recorded using a perpetual inventory system The $1700 in Prepaid Rent relates to a payment made in December for January rent this year. The equipment was purchased on July 1 of last year. It has a residual value of $1,000 and an expected life of five years. It is being depreciated using the straight-line method. . Employee wages are $4.000 per month. Employees are paid on the 16th for the first half of the month and on the first day of the following month for the second half of each month. Withholdings each pay period include $250 of income taxes and $150 of FICA taxes. These withholdings and the employer's matching contribution are paid monthly on the second day of the following month. In addition, unemployment taxes of $50 are accrued each pay period, and will be paid on March 31, Deferred Revenue is for 30 units ordered and paid for in advance by two customers in late December. One order of --- OPC sells its inventory at $150 per unit, plus sales tax of 6 percent. OPC's January 1 inventory balance consists of 180 units at a total cost of $12,240. OPC's policy is to use the FIFO method, recorded using a perpetual Inventory system The $1,700 in Prepaid Rent relates to a payment made in December for January rent this year. The equipment was purchased on July 1 of last year. It has a residual value of $1,000 and an expected life of five years. It is being depreciated using the straight-line method. Employee wages are $4.000 per month. Employees are paid on the 16th for the first half of the month and on the first day of the following month for the second half of each month. Withholdings each pay period include $250 of income taxes and $150 of FICA taxes. These withholdings and the employer's matching contribution are paid monthly on the second day of the following month. In addition, unemployment taxes of $50 are accrued each pay period, and will be paid on March 31. Deferred Revenue is for 30 units ordered and paid for in advance by two customers in late December. One order of 25 units is to be filled in January, and the other will be filled in February Notes Payable arises from a three-year, 9 percent bank loan received on October 1 last year. The par value on the common stock is $2 per share. Treasury Stock arises from the reacquisition of 500 shares at a cost of $8 per share. January Transactions a. On 1/01, OPC paid employees' salaries and wages that were previously accrued on December 31, b. A truck is purchased on 1/02 for $10,000 cash. It is estimated this vehicle will be used for 50,000 miles, after which it will have no residual value. c. Payroll withholdings and employer contributions for December are remitted on 1/03 d. OPC declares a $0.50 cash dividend on each share of common stock on 104, to be paid on 1/10. e. A $975 customer account is written off as uncollectible on 105. On 106, recorded sales of 175 units of inventory on account. Sales tax is charged but not yet collected or remitted to the state. g. Sales taxes of $500 that had been collected and recorded in December are paid to the state on 1/07 h. On 1/08, OPC issued 300 shares of treasury stock for $2,400. Collections from customers on account, totaling $13,043, are recorded on 1/09 J. On 1/10, OPC distributes the $0.50 cash dividend declared on January 4 The company's stock price is currently $5 per share. K OPC purchases on account and receives 70 units of inventory on 111 for $4,480 1. The equipment purchased last year for $31,000 is sold on 1/15 for $30,000 cash. Record depreciation for the first half of January prior to recording the equipment disposal. im Dall for lanan 1-15 is recorded and paid on 1/16 Re sure to conte unemployment taxes and the emplover's a. On 1/01, OPC paid employees' salaries and wages that were previously accrued on December 31 b. A truck is purchased on 1/02 for $10,000 cash. It is estimated this vehicle will be used for 50,000 miles, after which it will have no residual value. c. Payroll withholdings and employer contributions for December are remitted on 1/03. d. OPC declares a $0.50 cash dividend on each share of common stock on 104, to be paid on 1/10. e. A $975 customer account is written off as uncollectible on 1/05. f. On 1/06, recorded sales of 175 units of inventory on account. Sales tax is charged but not yet collected or remitted to the state. g. Sales taxes of $500 that had been collected and recorded in December are paid to the state on 1/07. h. On 1/08, OPC issued 300 shares of treasury stock for $2,400. 1. Collections from customers on account, totaling $13,043, are recorded on 1/09. 1. On 1/10, OPC distributes the $0.50 cash dividend declared on January 4. The company's stock price is currently $5 per share. K. OPC purchases on account and receives 70 units of inventory on 1/11 for $4,480. . The equipment purchased last year for $31,000 is sold on 1/15 for $30,000 cash. Record depreciation for the first half of January prior to recording the equipment disposal. m. Payroll for January 1-15 is recorded and paid on 1/16. Be sure to accrue unemployment taxes and the employer's matching share of FICA taxes. n. Having sold the equipment, OPC pays off the note payable in full on 117. The amount paid is $23.099, which includes interest accrued in December and an additional $93 interest through January 17, o. On 127, OPC records sales of 30 units of inventory on account Sales tax is charged but not yet collected or remitted. p. A portion of the advance order from December (25 units) is delivered on 1/29. No sales tax is collected on this transaction because the customer is a US governmental organization that is exempt from sales tax. q. To obtain funds for purchasing new equipment, OPC issued bonds on 1/30 with a total face value of $95,000, stated interest rate of 5 percent , annual compounding, and six-year maturity date. OPC received $85,944 from the bond issuance, which implies a market interest rate of 7 percent On 131. OPC records units-of-production depreciation on the vehicle (truck), which was driven 2,000 miles this month. S. OPC estimates that 2% of the ending accounts receivable balance will be uncollectible. Adjust the applicable accounts on 1/31, using the allowance method. t. On 1/31, adjust for January rent expired. u.Accrue January 31 payroll on 131, which will be payable on February 1. Be sure to accrue unemployment taxes and the employer's matching share of FICA taxes. v. Accrue OPC's corporate income taxes on 1/31, estimated to be $4,120. Equity Prepare all January journal entries and adjusting entries for items (a)-(V). Review the 'General Ledger and Tabs to see the effect of the transactions on the account balances. (If no entry is required for a transaction entry required" in the first account field.) View transaction list Journal entry worksheet CG Prav 2 of 2 HH! :: Next LIWI, OujuLIUI JOHUQIY CHL CAPII cu. u. Accrue January 31 payroll on 1/31, which will be payable on February 1. Be sure to accrue unemployment taxes ar employer's matching share of FICA taxes. v. Accrue OPC's corporate income taxes on 1/31, estimated to be $4,120. General General Requirement Statement of Income Journal Ledger Trial Balance Stockholders Balance Sheet Analysis Statement Equity The unadjusted, adjusted, or post-closing balances will appear for each account, based on your selection. You will need to determine and enter the beginning and ending balances Unadjusted ONE PRODUCT CORPORATION Statement of Stockholders' Equity For the Month Ended January 31 Additional Paid Retained Common Stock In Capital Earinings Treasury Stock Common Beginning $ 8,310 Stock Issuances Net Income 0 Dividends (3.400) Ending $ 4,910

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts