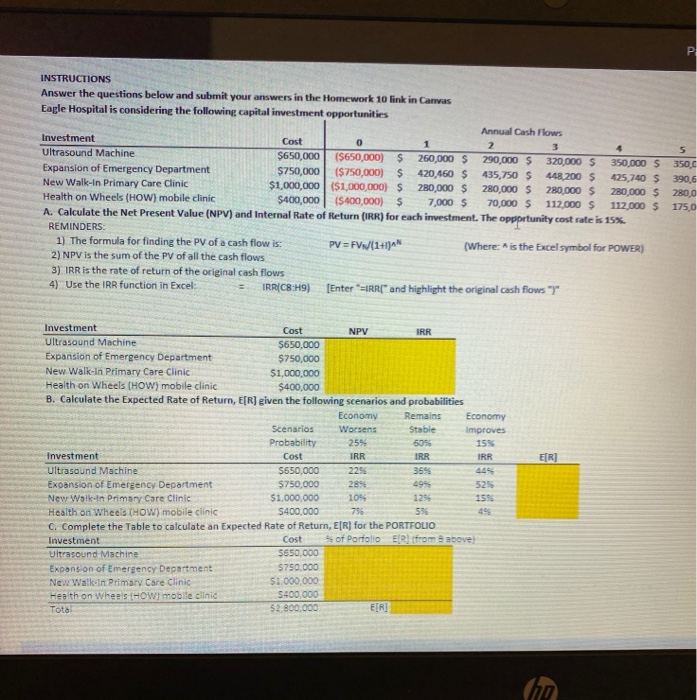

Question: here it is! INSTRUCTIONS Answer the questions below and submit your answers in the Homework 10 link in Canvas Eagle Hospital is considering the following

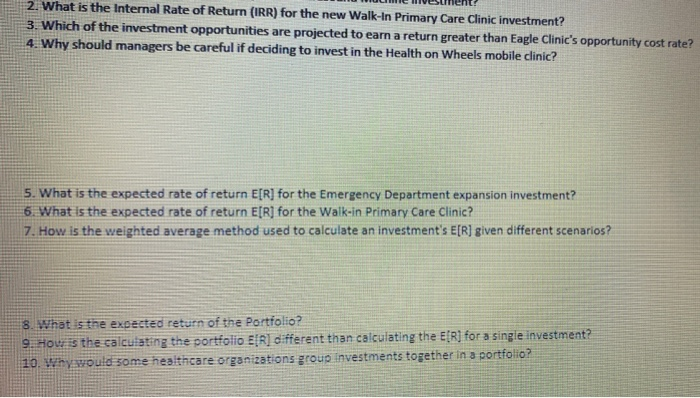

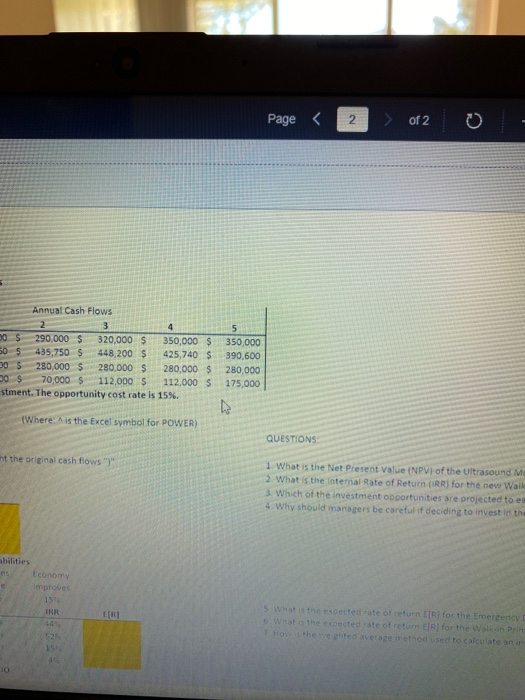

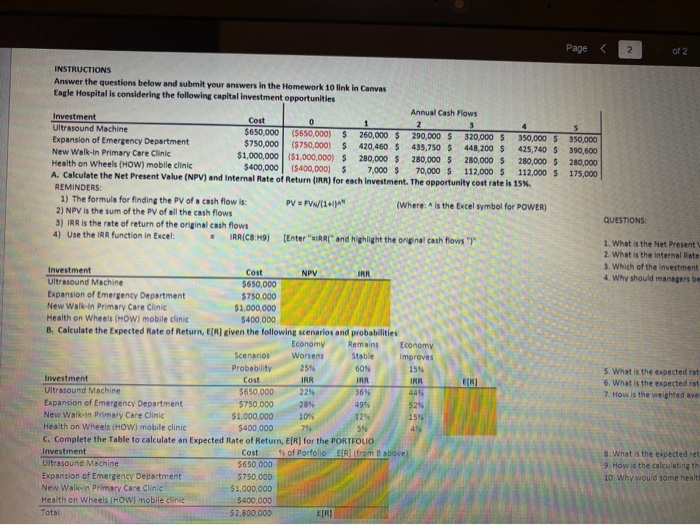

INSTRUCTIONS Answer the questions below and submit your answers in the Homework 10 link in Canvas Eagle Hospital is considering the following capital investment opportunities Annual Cash Flows Investment Cost Ultrasound Machine $650,000 ($650,000) $ 260,000 $ 290,000 $ 320,000 S 350,000 S Expansion of Emergency Department $750,000 $750,000) $ 420,460 $ 435,750 $ 448.200 S 425,740 $ New Walk-In Primary Care Clinic $1,000,000 ($1,000,000) $ 280,000 $ 280,000 $ 280,000 $ 230,000 $ Health on Wheels (HOW) mobile clinic $400,000 $400,000) $ 7,000 70,000 $ 112,000 $ 112,000 $ A. Calculate the Net Present Value (NPV) and Internal Rate of Return (IRR) for each investment. The opportunity cost rate is 15% REMINDERS: 1) The formula for finding the PV of a cash flow is: PV = FV (1) (Where is the Excelsymbol for POWER) 2) NPV is the sum of the PV of all the cash flows 3) IRR is the rate of return of the original cash flows 4) Use the IRR function in Excel IRRC:H9) [Enter"=IRR(" and highlight the original cash flows")" 350, 390,6 280,0 175,0 155 605 IRR Investment Cost Ultrasound Machine $650,000 Expansion of Emergency Department $750,000 New Walk-In Primary Care Clinic $1,000,000 Health on Wheels (HOW) mobile clinic $400,000 B. Calculate the expected Rate of Return, E[ R iven the following scenarios and probabilities Economy Remains Economy Scenarios Worsens Stable Improves Probability 259 Investment Cost IRR S650,000 Ultrasound Machine 229 359 449 $750,000 289 494 Expansion of Emergency Department New Walk-In Primary Care Clinic $1.000.000 10%- Health on Wheels HOW) mobile clinic S400,000 C. Complete the Table to calculate an Expected Rate of Return, E(R) for the PORTFOLIO Cost of Portfolio EIR) from Investment above Ultrasound Machine 5650,000 Expanson of Emergency Department $750,000 Ne Walk-In Primary Care Clinic 51.000.000 Heath on Wheels (Howmobile clinic $400.000 Total $2,800.000 0 IULIWE HIVEnent? 1 2. What is the Internal Rate of Return (IRR) for the new Walk-In Primary Care Clinic investment? 3. Which of the investment opportunities are projected to earn a return greater than Eagle Clinic's opportunity cost rate? 4. Why should managers be careful if deciding to invest in the Health on Wheels mobile clinic? 5. What is the expected rate of return E[R] for the Emergency Department expansion investment? 6. What is the expected rate of return E[R) for the Walk-in Primary Care Clinic? 7. How is the weighted average method used to calculate an investment's E[R] given different scenarios? 8. What is the expected return of the Portfolio? 9. How the calculating the portfolio EIR] different than calculating the E[R) for a single investment? 10. Why would some healthcare organizations group Investments together in a portfolio? Page of 2 0 Annual Cash Flows 3 0 $ 290,000 $ 320,000 $ 350,000 $ 50 S 435,750 S 448,200 $ 425,740 S 00 $ 280,000 $ 280,000 $ 280,000 $ DO $ 70,000 $ 112,000 $ 112,000 $ stment. The opportunity cost rate is 15%. 350,000 390,600 280,000 175,000 (Where is the Excel symbol for POWER) QUESTIONS ht the original cash flows) 1. What is the Net Present Value (NPV) of the Ultrasound Ma 2. What is the intemal Rate of Return (IRR) for the new Walle 3. Which of the investment opportunities are projected to ea 4. Why should managers be careful if deciding to invest in the Economy IRR 5 What the exected rate of return CR for the Emergency What is the expected rate of return for the Walk Drin Page 2 of 2 Cost INSTRUCTIONS Answer the questions below and submit your answers in the Homework 10 link in Canvas Eagle Hospital is considering the following capital investment opportunities Annual Cash Flows Investment Ultrasound Machine $650,000 $650.000) $ 260.000 $ 290,000 $ 320,000 $ 350,000 $ Expansion of Emergency Department $750,000 $750,000) $ 420,460 $ 435,750 S 448,200 $ 425,740 $ New Walk-In Primary Care Clinic $1,000,000 ($1,000,000) $ 280,000 $ 280,000 $ 280,000 $ 280,000 $ Health on Wheels (HOW) mobile clinic $400,000 $400,000) $ 7,000 $ 70,000 $ 112,000 $ 112,000 $ A. Calculate the Net Present Value (NPV) and internal Rate of Return (IRR) for each Investment. The opportunity cost rate is 19 REMINDERS 1) The formula for finding the PV of cash flow is PV = FWD (Where is the Excel symbol for POWER 2) NPV is the sum of the PV of all the cash flows 3) IRR is the rate of return of the original cash flows 4) Use the IRR function in Excel - RRC8H9) [Enter "RR(" and highlight the origna 350.000 390,600 280,000 175,000 QUESTIONS 1. What is the Net Present 2. What is the internal Rate 3. Which of the Investment 4. Why should managers be Cost 255 5. What is the expectedra 6. What is the expectedra 7. How is the weighted ave Investment Ultrasound Machine $650.000 Expansion of Emergency Department $750,000 New Walk-in Primary Care Clinic $1,000,000 Health on Wheels (HOW) mobile clinic $400.000 B. Calculate the expected Rate of Return, [R] given the following scenarios and probabilities Economy Remains Econom Scenarios Worsens Stable Improve Probability Investment Cost Ultrasound Machine 5650.000 Expansion of Emergency Department $750,000 284 New Walk in Primary Care Clinic $1,000,000 Health on Wheels (HOW) mobile clinic $400,000 C. Complete the Table to calculate an Expected Rate of Return, EIR) for the PORTFOLIO Investment Cost of Porfolio E from above) Ultrasound Machine $650.000 Expansion of Emergency Department $750,000 New Walk in Primary Care Clinic 51.000.000 Health on Wheels (HOW mobile clinit $400,000 Total 2.800.000 8. What is the expected te 9. How is the calculating ti 10 Why would come heal INSTRUCTIONS Answer the questions below and submit your answers in the Homework 10 link in Canvas Eagle Hospital is considering the following capital investment opportunities Annual Cash Flows Investment Cost Ultrasound Machine $650,000 ($650,000) $ 260,000 $ 290,000 $ 320,000 S 350,000 S Expansion of Emergency Department $750,000 $750,000) $ 420,460 $ 435,750 $ 448.200 S 425,740 $ New Walk-In Primary Care Clinic $1,000,000 ($1,000,000) $ 280,000 $ 280,000 $ 280,000 $ 230,000 $ Health on Wheels (HOW) mobile clinic $400,000 $400,000) $ 7,000 70,000 $ 112,000 $ 112,000 $ A. Calculate the Net Present Value (NPV) and Internal Rate of Return (IRR) for each investment. The opportunity cost rate is 15% REMINDERS: 1) The formula for finding the PV of a cash flow is: PV = FV (1) (Where is the Excelsymbol for POWER) 2) NPV is the sum of the PV of all the cash flows 3) IRR is the rate of return of the original cash flows 4) Use the IRR function in Excel IRRC:H9) [Enter"=IRR(" and highlight the original cash flows")" 350, 390,6 280,0 175,0 155 605 IRR Investment Cost Ultrasound Machine $650,000 Expansion of Emergency Department $750,000 New Walk-In Primary Care Clinic $1,000,000 Health on Wheels (HOW) mobile clinic $400,000 B. Calculate the expected Rate of Return, E[ R iven the following scenarios and probabilities Economy Remains Economy Scenarios Worsens Stable Improves Probability 259 Investment Cost IRR S650,000 Ultrasound Machine 229 359 449 $750,000 289 494 Expansion of Emergency Department New Walk-In Primary Care Clinic $1.000.000 10%- Health on Wheels HOW) mobile clinic S400,000 C. Complete the Table to calculate an Expected Rate of Return, E(R) for the PORTFOLIO Cost of Portfolio EIR) from Investment above Ultrasound Machine 5650,000 Expanson of Emergency Department $750,000 Ne Walk-In Primary Care Clinic 51.000.000 Heath on Wheels (Howmobile clinic $400.000 Total $2,800.000 0 IULIWE HIVEnent? 1 2. What is the Internal Rate of Return (IRR) for the new Walk-In Primary Care Clinic investment? 3. Which of the investment opportunities are projected to earn a return greater than Eagle Clinic's opportunity cost rate? 4. Why should managers be careful if deciding to invest in the Health on Wheels mobile clinic? 5. What is the expected rate of return E[R] for the Emergency Department expansion investment? 6. What is the expected rate of return E[R) for the Walk-in Primary Care Clinic? 7. How is the weighted average method used to calculate an investment's E[R] given different scenarios? 8. What is the expected return of the Portfolio? 9. How the calculating the portfolio EIR] different than calculating the E[R) for a single investment? 10. Why would some healthcare organizations group Investments together in a portfolio? Page of 2 0 Annual Cash Flows 3 0 $ 290,000 $ 320,000 $ 350,000 $ 50 S 435,750 S 448,200 $ 425,740 S 00 $ 280,000 $ 280,000 $ 280,000 $ DO $ 70,000 $ 112,000 $ 112,000 $ stment. The opportunity cost rate is 15%. 350,000 390,600 280,000 175,000 (Where is the Excel symbol for POWER) QUESTIONS ht the original cash flows) 1. What is the Net Present Value (NPV) of the Ultrasound Ma 2. What is the intemal Rate of Return (IRR) for the new Walle 3. Which of the investment opportunities are projected to ea 4. Why should managers be careful if deciding to invest in the Economy IRR 5 What the exected rate of return CR for the Emergency What is the expected rate of return for the Walk Drin Page 2 of 2 Cost INSTRUCTIONS Answer the questions below and submit your answers in the Homework 10 link in Canvas Eagle Hospital is considering the following capital investment opportunities Annual Cash Flows Investment Ultrasound Machine $650,000 $650.000) $ 260.000 $ 290,000 $ 320,000 $ 350,000 $ Expansion of Emergency Department $750,000 $750,000) $ 420,460 $ 435,750 S 448,200 $ 425,740 $ New Walk-In Primary Care Clinic $1,000,000 ($1,000,000) $ 280,000 $ 280,000 $ 280,000 $ 280,000 $ Health on Wheels (HOW) mobile clinic $400,000 $400,000) $ 7,000 $ 70,000 $ 112,000 $ 112,000 $ A. Calculate the Net Present Value (NPV) and internal Rate of Return (IRR) for each Investment. The opportunity cost rate is 19 REMINDERS 1) The formula for finding the PV of cash flow is PV = FWD (Where is the Excel symbol for POWER 2) NPV is the sum of the PV of all the cash flows 3) IRR is the rate of return of the original cash flows 4) Use the IRR function in Excel - RRC8H9) [Enter "RR(" and highlight the origna 350.000 390,600 280,000 175,000 QUESTIONS 1. What is the Net Present 2. What is the internal Rate 3. Which of the Investment 4. Why should managers be Cost 255 5. What is the expectedra 6. What is the expectedra 7. How is the weighted ave Investment Ultrasound Machine $650.000 Expansion of Emergency Department $750,000 New Walk-in Primary Care Clinic $1,000,000 Health on Wheels (HOW) mobile clinic $400.000 B. Calculate the expected Rate of Return, [R] given the following scenarios and probabilities Economy Remains Econom Scenarios Worsens Stable Improve Probability Investment Cost Ultrasound Machine 5650.000 Expansion of Emergency Department $750,000 284 New Walk in Primary Care Clinic $1,000,000 Health on Wheels (HOW) mobile clinic $400,000 C. Complete the Table to calculate an Expected Rate of Return, EIR) for the PORTFOLIO Investment Cost of Porfolio E from above) Ultrasound Machine $650.000 Expansion of Emergency Department $750,000 New Walk in Primary Care Clinic 51.000.000 Health on Wheels (HOW mobile clinit $400,000 Total 2.800.000 8. What is the expected te 9. How is the calculating ti 10 Why would come heal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts