Question: please answer questions 1-10. INSTRUCTIONS Answer the question below and when your ass Laple Health co n g the following capital in the or Expansion

![Wheels Dow] mobile in A Calculate the Net Pre SES 000 SS3](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f943fde842a_90166f943fd49651.jpg)

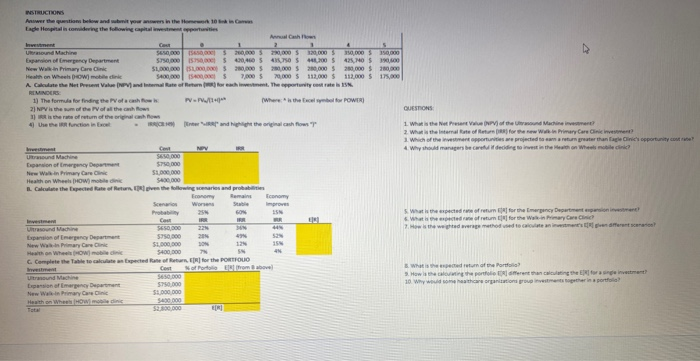

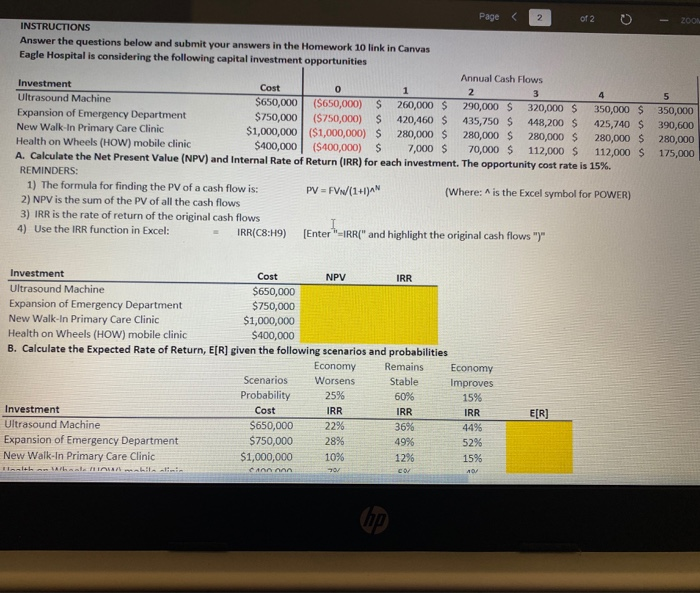

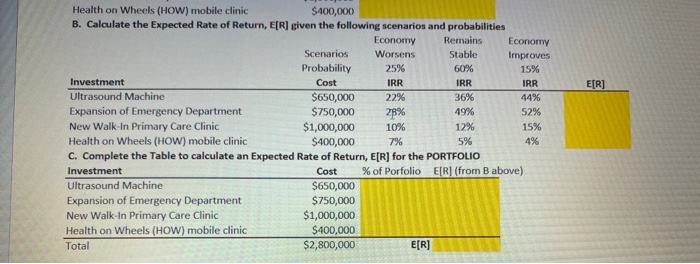

INSTRUCTIONS Answer the question below and when your ass Laple Health co n g the following capital in the or Expansion of Emergency Department New W in Primary Care Gini Heath on Wheels Dow] mobile in A Calculate the Net Pre SES 000 SS3 000 ,000 50,000 400,450 S 450 S 400 S 425, MOS 1900 SSS S SS 2012 S 500 S 00S 0S 199920510 m ate of Return o n the rest PVP Where is the well for POWER 1) The formula for finding the Poch 2 NPV is the mother of all the town ther of return of the orgalows 4 Uhe the function in Ewout - and the original cash flows 7 1. What is the Net Prat V NPV of the sound Machine in 2. What the internal Rate of Reture for www Primary Care Clinic Investment 1 Which of the investment opportunities projected to turn greater than aglines opp 4 Why should managers beca deciding tot in the watch on Wheels mobilen Expansion of Emergency Depan New W in Primary Care Health on Wheelsowie I Calculate the precedute of Return the wingers and probabi n t What is the expected of return for r e What we ofretum for the W How we wethod to view a y Care e r L es Departo New W a y Care Clinic Heath on W owmobi Complete the Expected t o the PORTFOLIO e 3. What is th 3. How t 10. Why w of the Portfolio r ore organization group in o h e turn the inport investment ? Lugn y Department Heath on Wheelow. med - 200 Page 2 of 2 0 INSTRUCTIONS Answer the questions below and submit your answers in the Homework 10 link in Canvas Eagle Hospital is considering the following capital investment opportunities Annual Cash Flows Investment Cost Ultrasound Machine $650,000 ($650,000) $ 260,000 $ 290,000 $ 320,000 $ 350,000 $ Expansion of Emergency Department $750,000 ($750,000) $ 420,460 $ 435,750 S 448,200 $ 425,740 $ New Walk-In Primary Care Clinic $1,000,000 ($1,000,000) $ 280,000 $ 280,000 $ 280,000 $ 280,000 $ Health on Wheels (HOW) mobile clinic $400,000 $400,000) $ 7,000 $ 70,000 $ 112,000 $ 112,000 $ A. Calculate the Net Present Value (NPV) and Internal Rate of Return (IRR) for each investment. The opportunity cost rate is 15%. REMINDERS: 1) The formula for finding the PV of a cash flow is: PV - FV/(1+1)^N (Where: is the Excel symbol for POWER) 2) NPV is the sum of the PV of all the cash flows 3) IRR is the rate of return of the original cash flows 4) Use the IRR function in Excel: - IRR(C8:H9) [Enter-IRR(" and highlight the original cash flows ")" 350,000 390,600 280,000 175,000 Investment Cost NPV IRR Ultrasound Machine $650,000 Expansion of Emergency Department $750,000 New Walk-In Primary Care Clinic $1,000,000 Health on Wheels (HOW) mobile clinic $400,000 B. Calculate the Expected Rate of Return, E[R] given the following scenarios and probabilities Economy Remains Economy Scenarios Worsens Stable Improves Probability 25% 60% 15% Investment Cost IRR IRR Ultrasound Machine $650,000 2296 36% 44% Expansion of Emergency Department $750,000 28% 49% 52% New Walk-In Primary Care Clinic $1,000,000 10% 12% 15% IRR IRR Health on Wheels (HOW) mobile clinic $400,000 B. Calculate the Expected Rate of Return, E[R] given the following scenarios and probabilities Economy Remains Economy Scenarios Worsens Stable Improves Probability 25% 60% 15% Investment Cost IRR IRR Ultrasound Machine $650,000 22% 36% 44% Expansion of Emergency Department $750,000 28% 49% 52% New Walk-In Primary Care Clinic $1,000,000 10% 12% 15% Health on Wheels (HOW) mobile clinic $400,000 7% 4% C. Complete the Table to calculate an Expected Rate of Return, E(R) for the PORTFOLIO Investment Cost % of Porfolio E[R] (from B above) Ultrasound Machine $650,000 Expansion of Emergency Department $750,000 New Walk-In Primary Care Clinic $1,000,000 Health on Wheels (HOW) mobile clinic $400,000 Total $2,800,000 5% E [R] QUESTIONS: 1. What is the Net Present Value (NPV) of the Ultrasound Machine investment? 2. What is the Internal Rate of Return (IRR) for the new Walk In Primary Care Clinic investment? 3. Which of the investment opportunities are projected to earn a return greater than Eagle Clinic's opportunity cost rate? 4. Why should managers be careful if deciding to invest in the Health on Wheels mobile clinic? 5. What is the expected rate of return E[R] for the Emergency Department expansion investment? 6. What is the expected rate of return E[R) for the Walk-in Primary Care Clinic? 7. How is the weighted average method used to calculate an investment's E[R] given different scenarios? 8. What is the expected return of the Portfolio? 9. How is the calculating the portfolio E[R] different than calculating the E[R) for a single investment? 10. Why would some healthcare organizations group investments together in a portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts