Question: Here they ask for all three income statements, changes in SE, Balance sheet: unadjusted, adjusted, Post-closing This goes to line 28. Thank you for your

Here they ask for all three income statements, changes in SE, Balance sheet: unadjusted, adjusted, Post-closing

This goes to line 28.

Thank you for your help.

I have retaken all photos. Sorry for the poor quality the first time.

Trial balance, income statement, Changes in SE & balance sheet all require inadjusted, adjust, and post closing

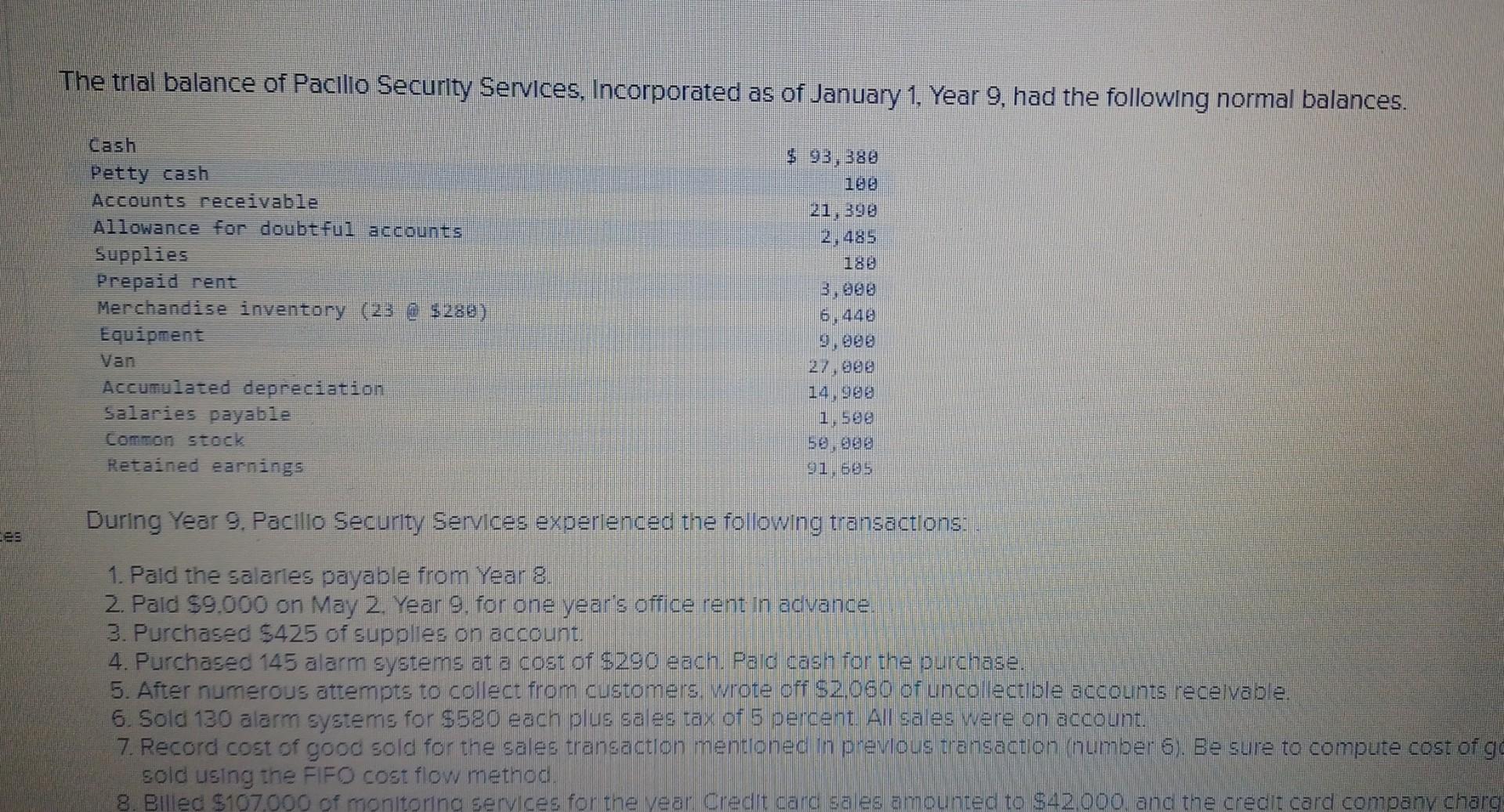

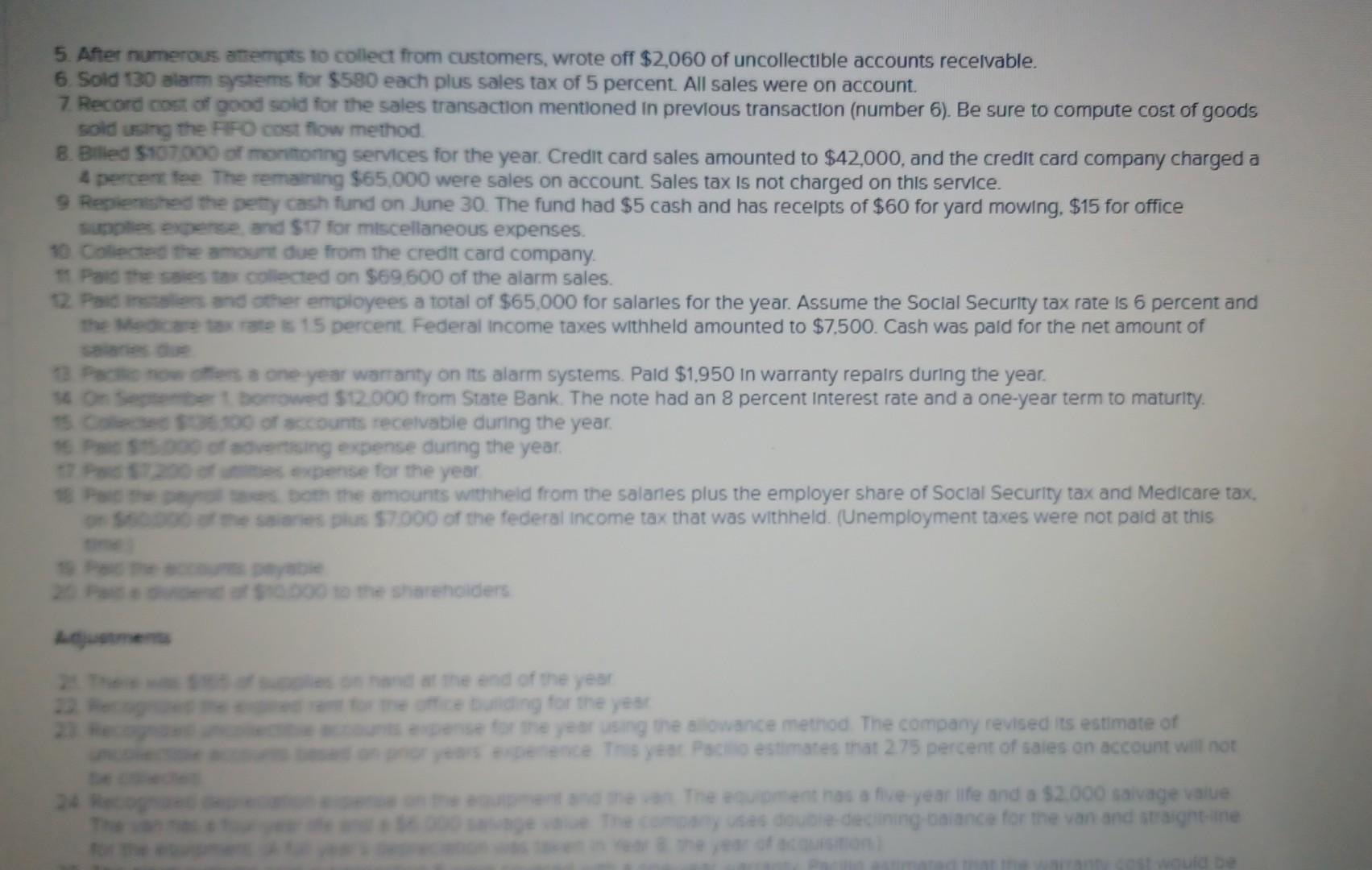

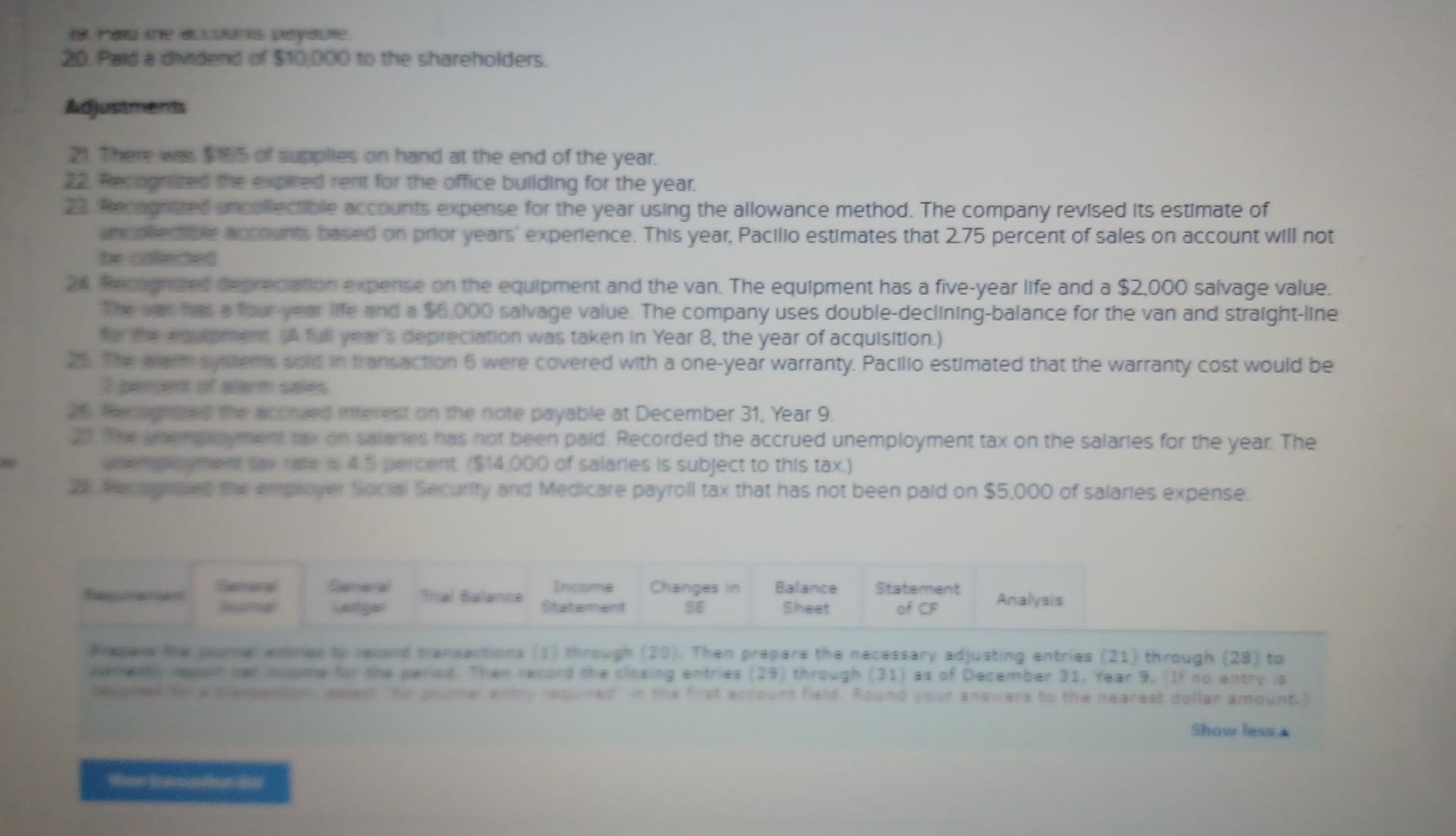

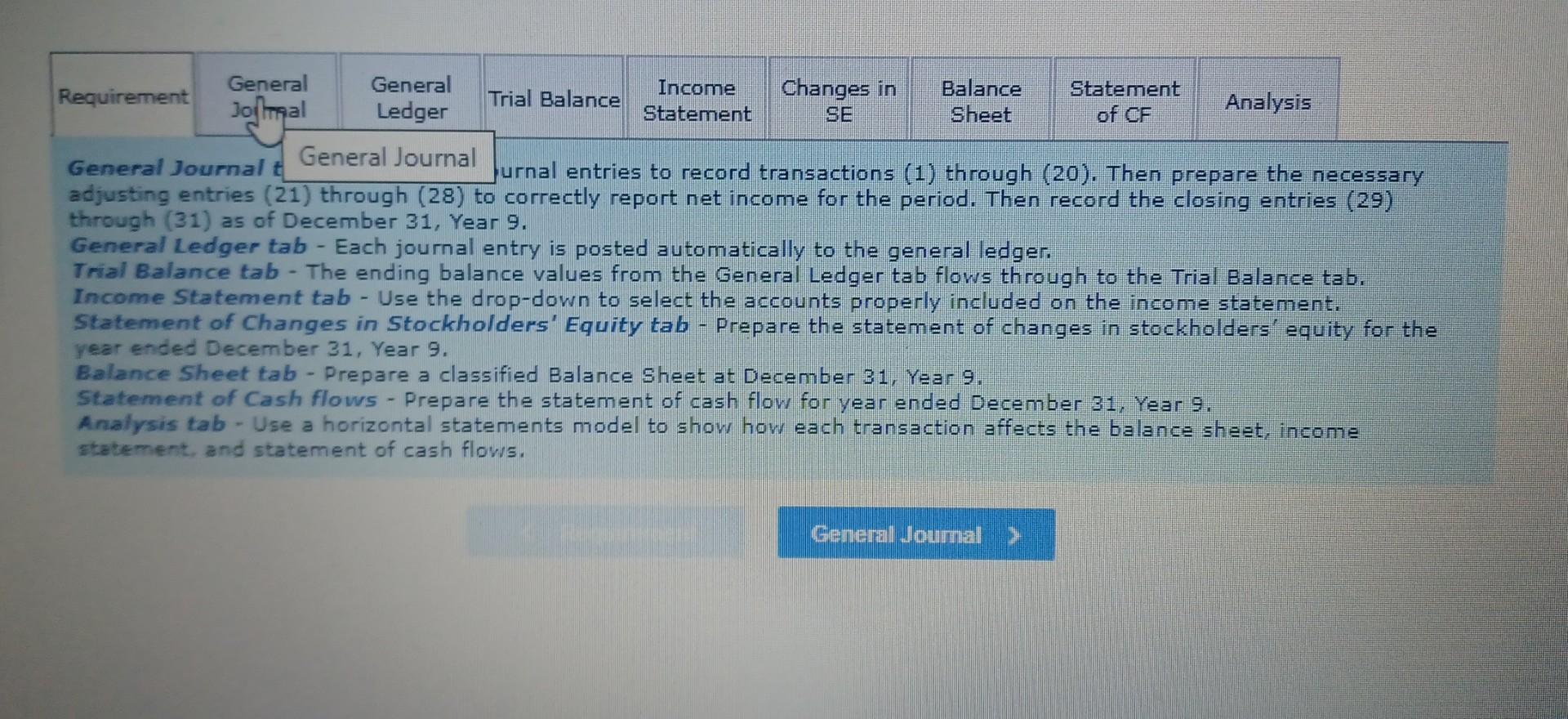

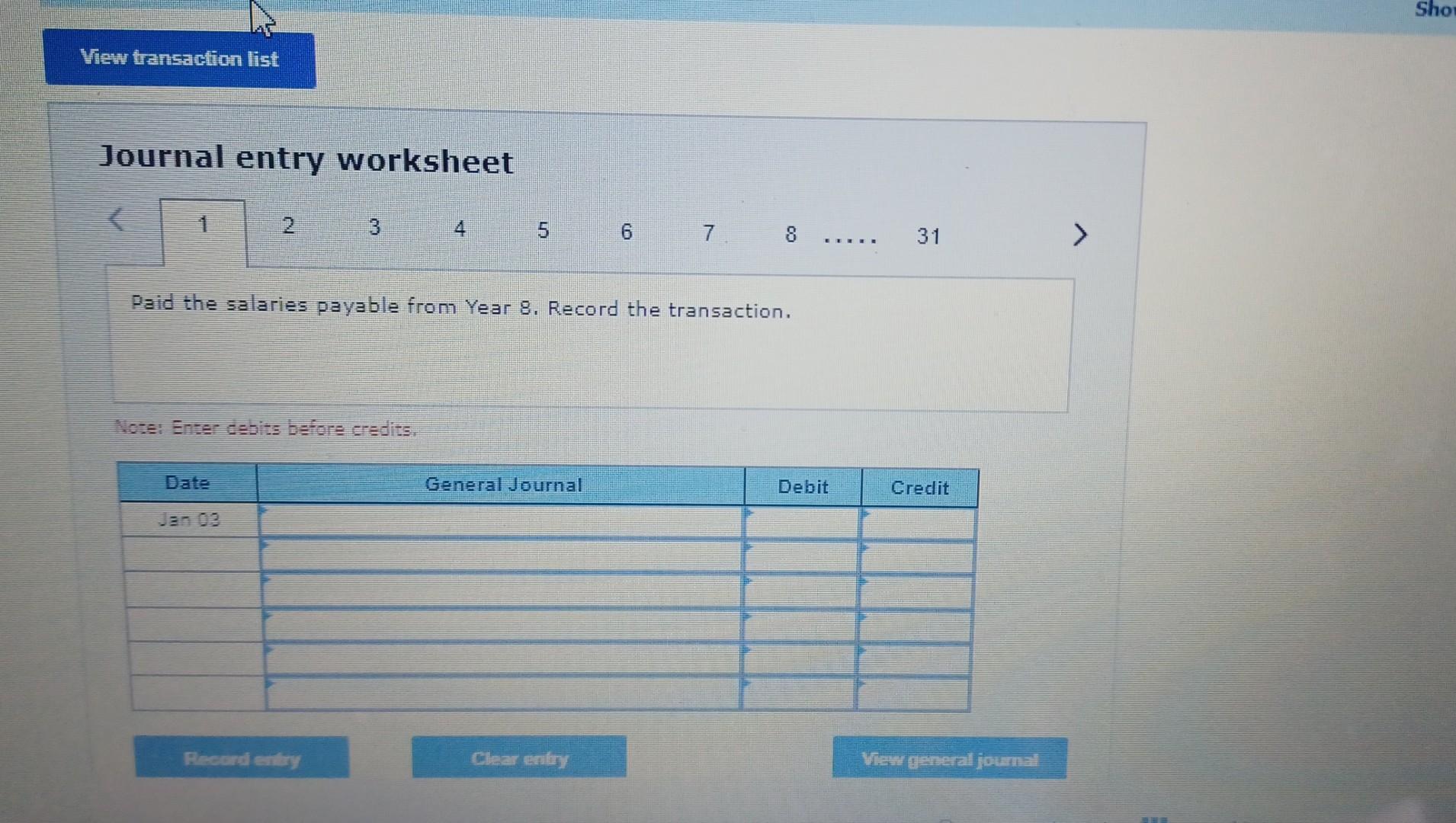

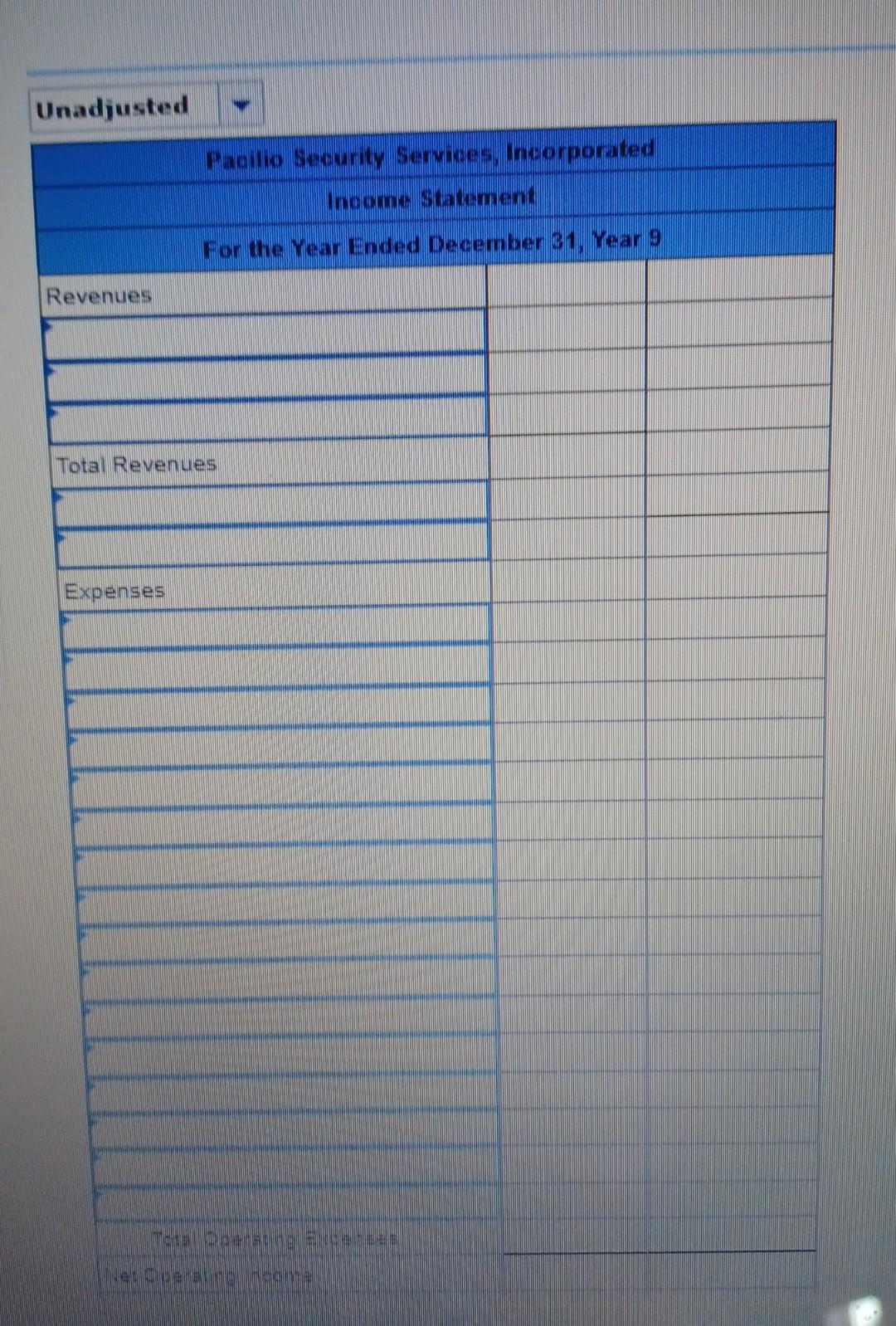

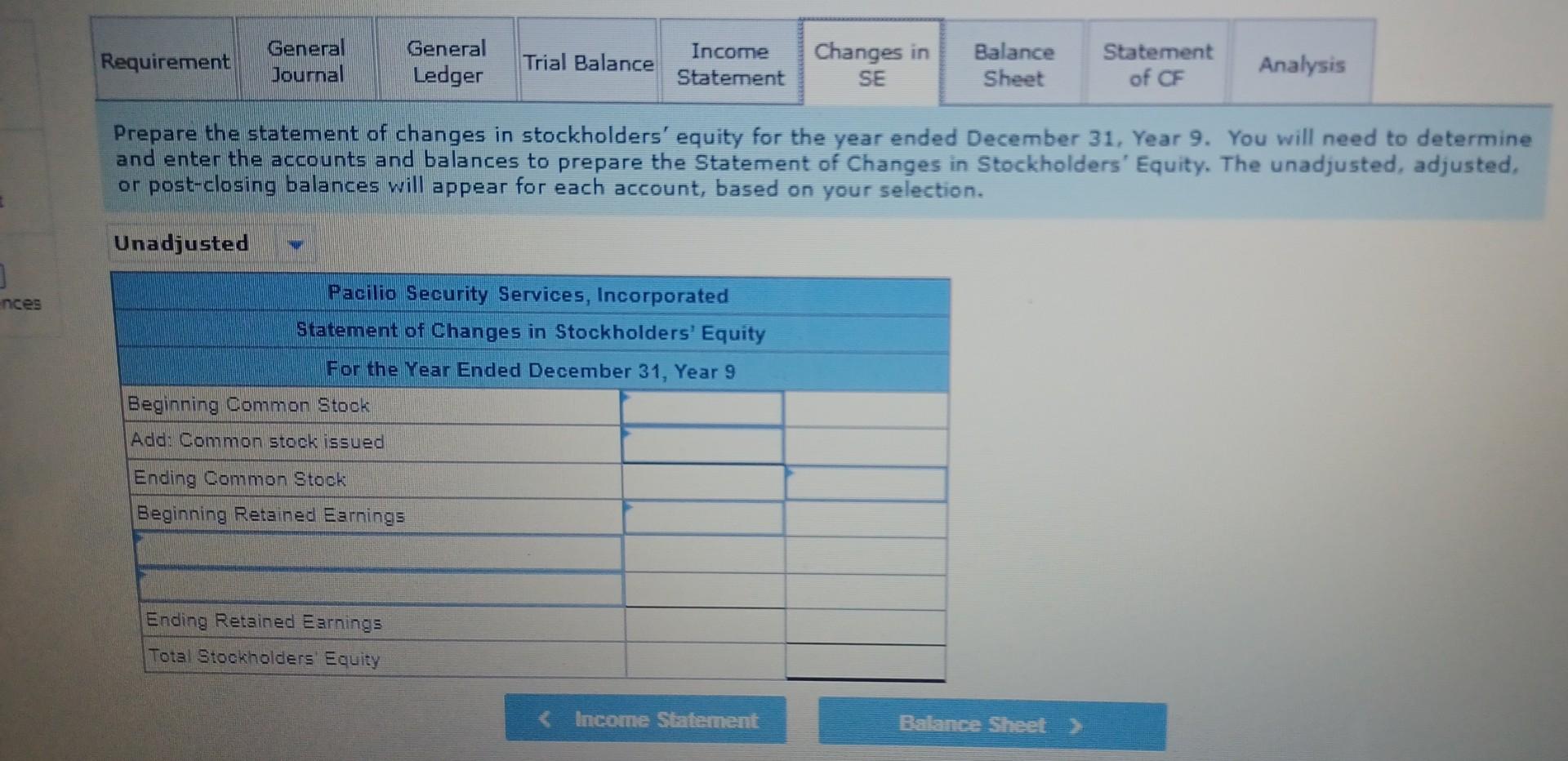

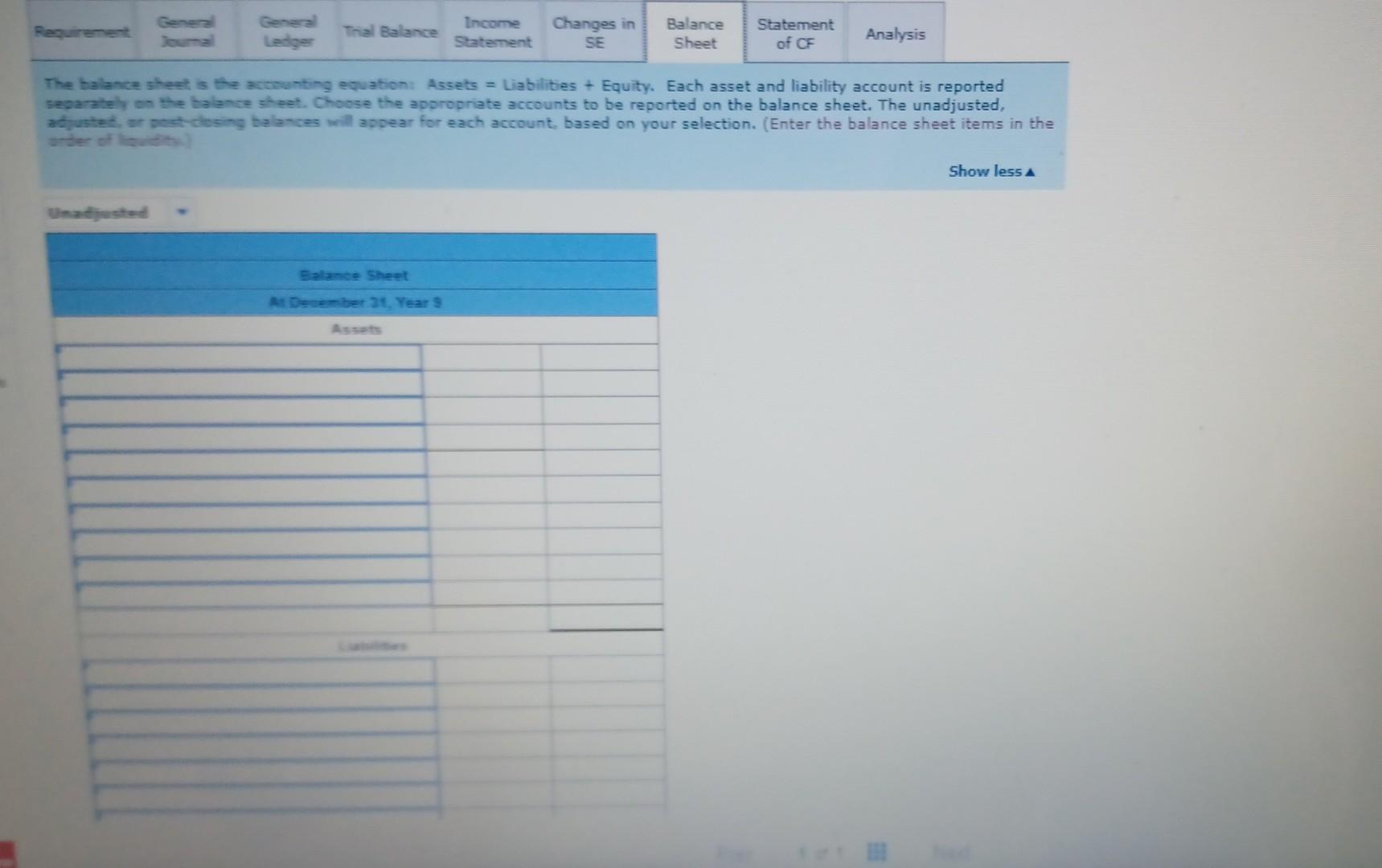

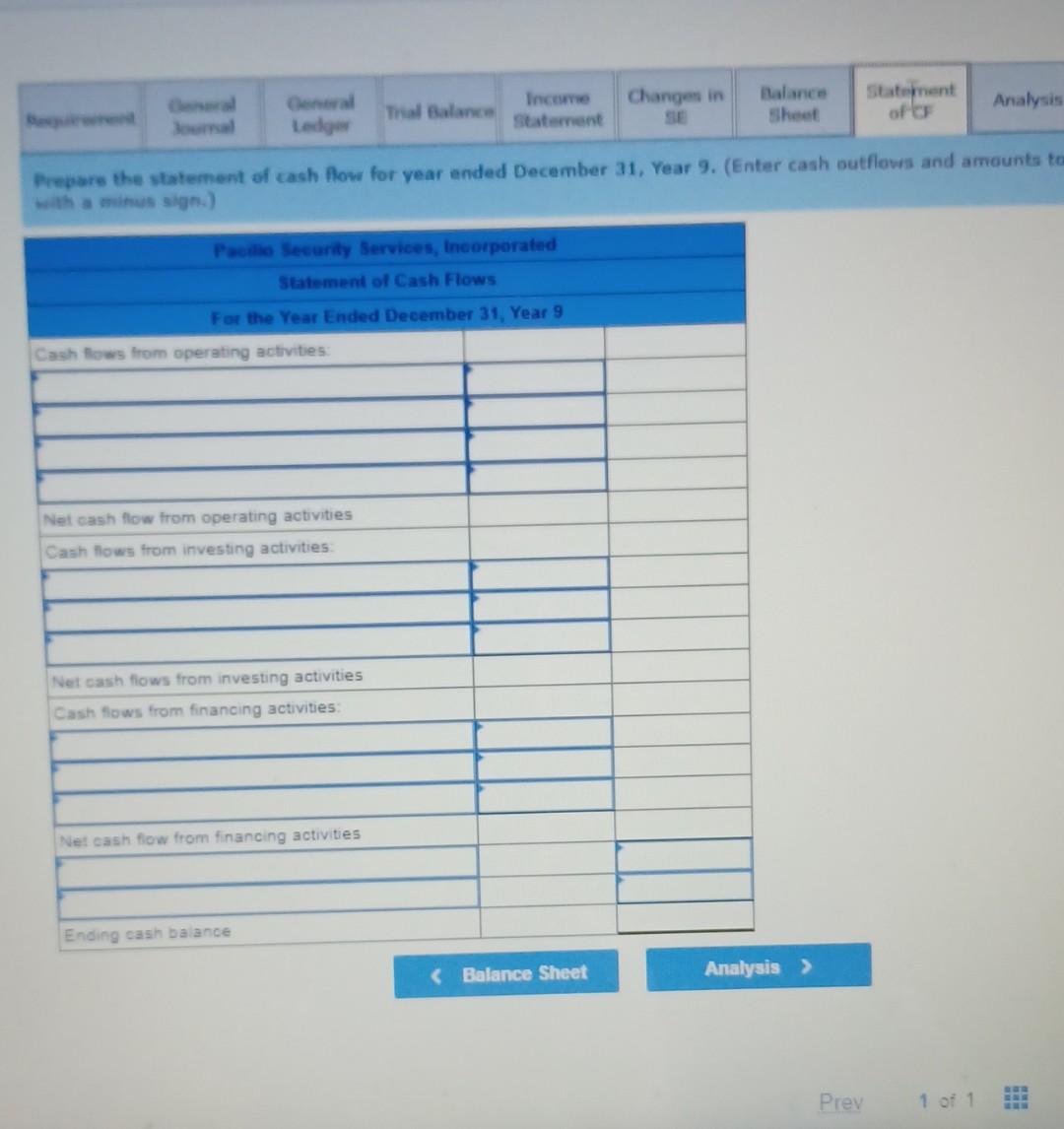

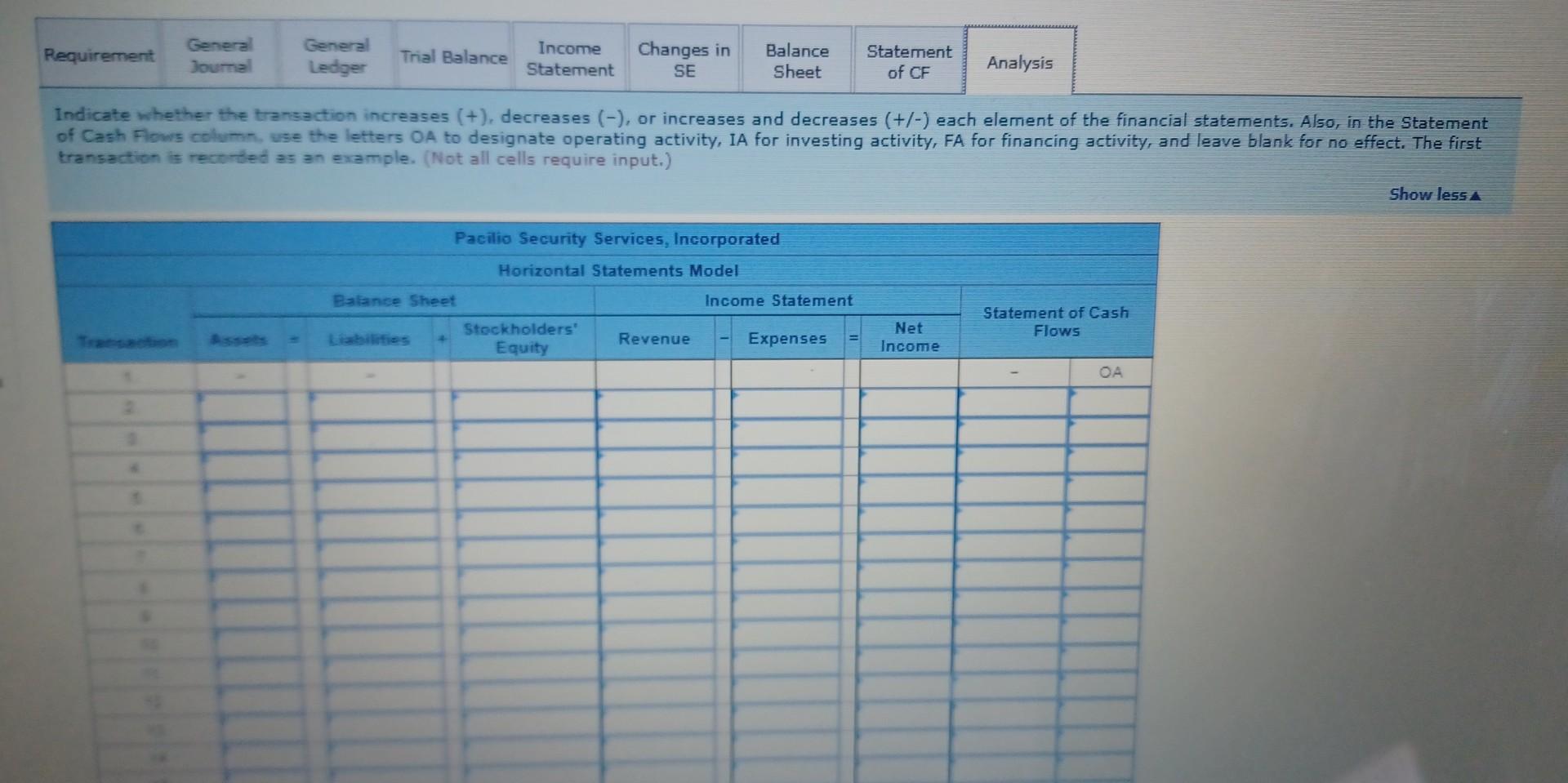

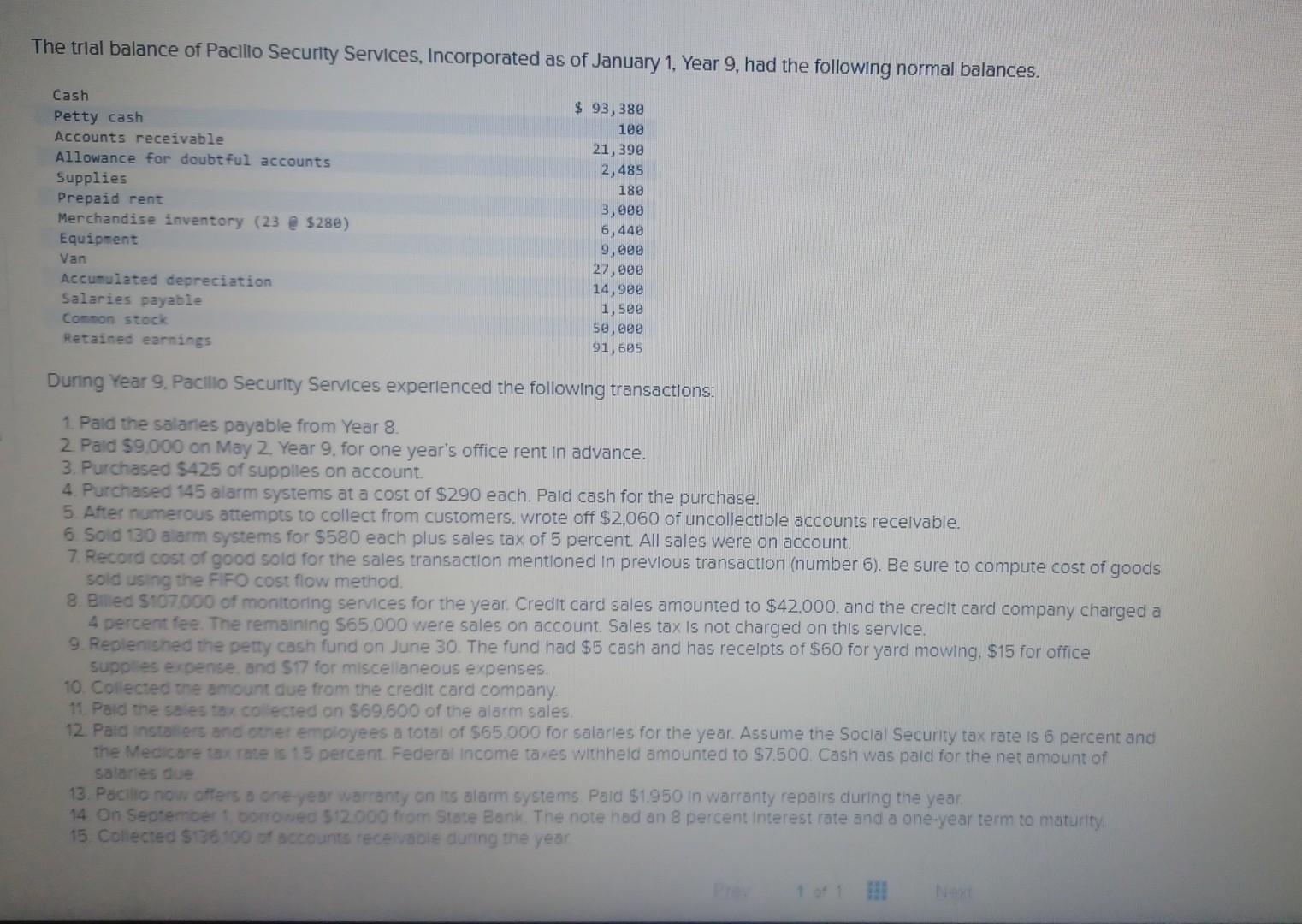

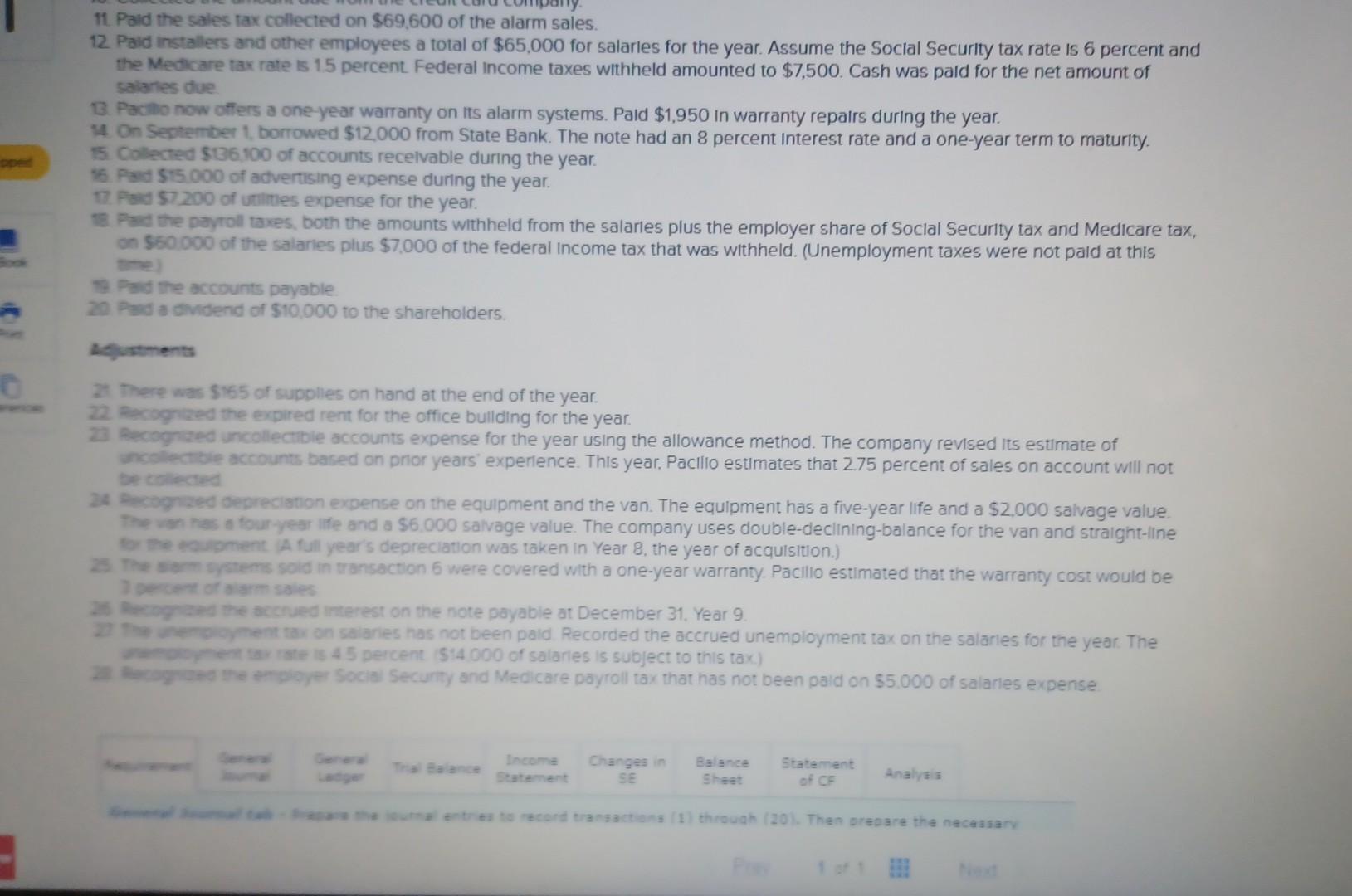

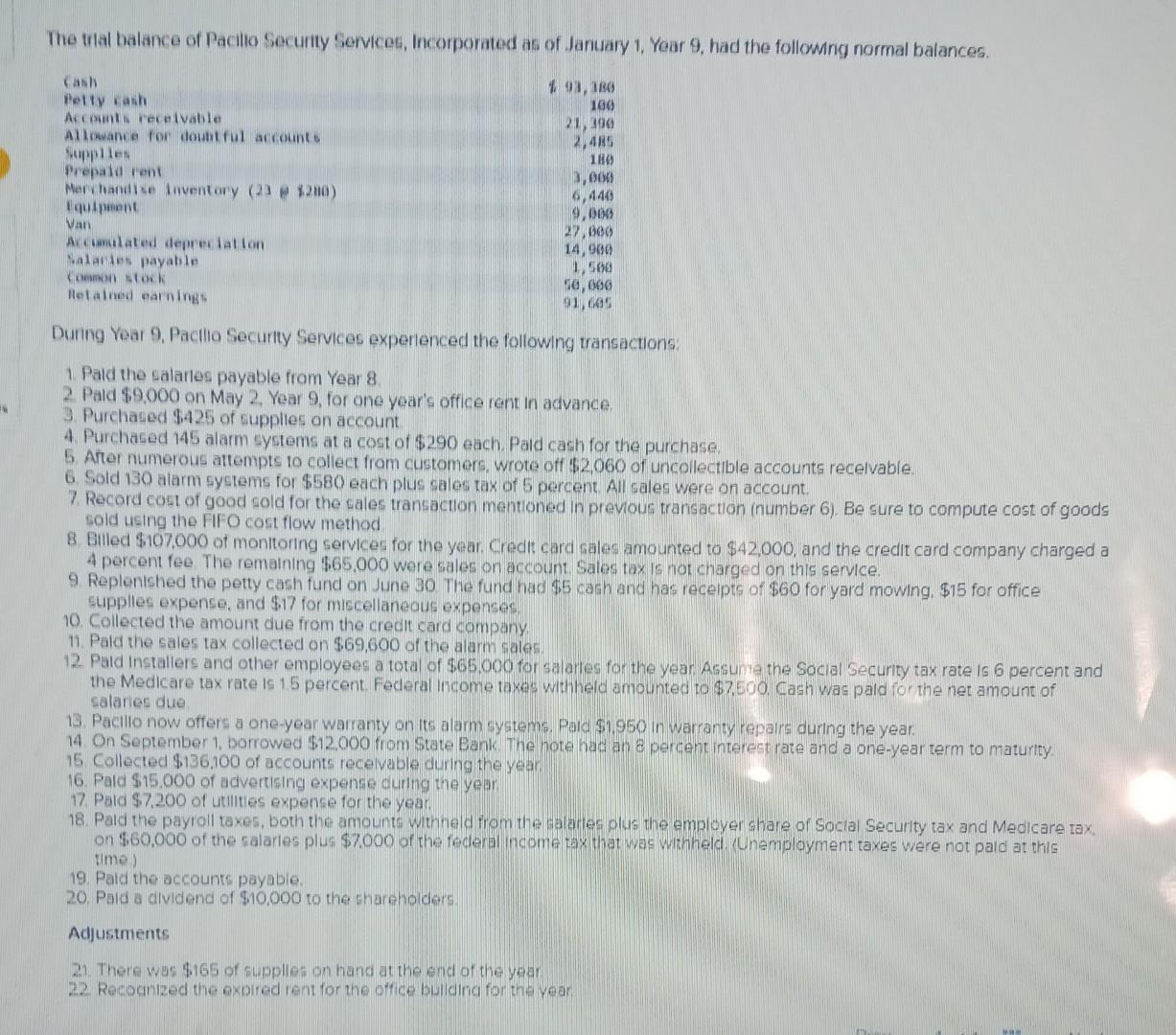

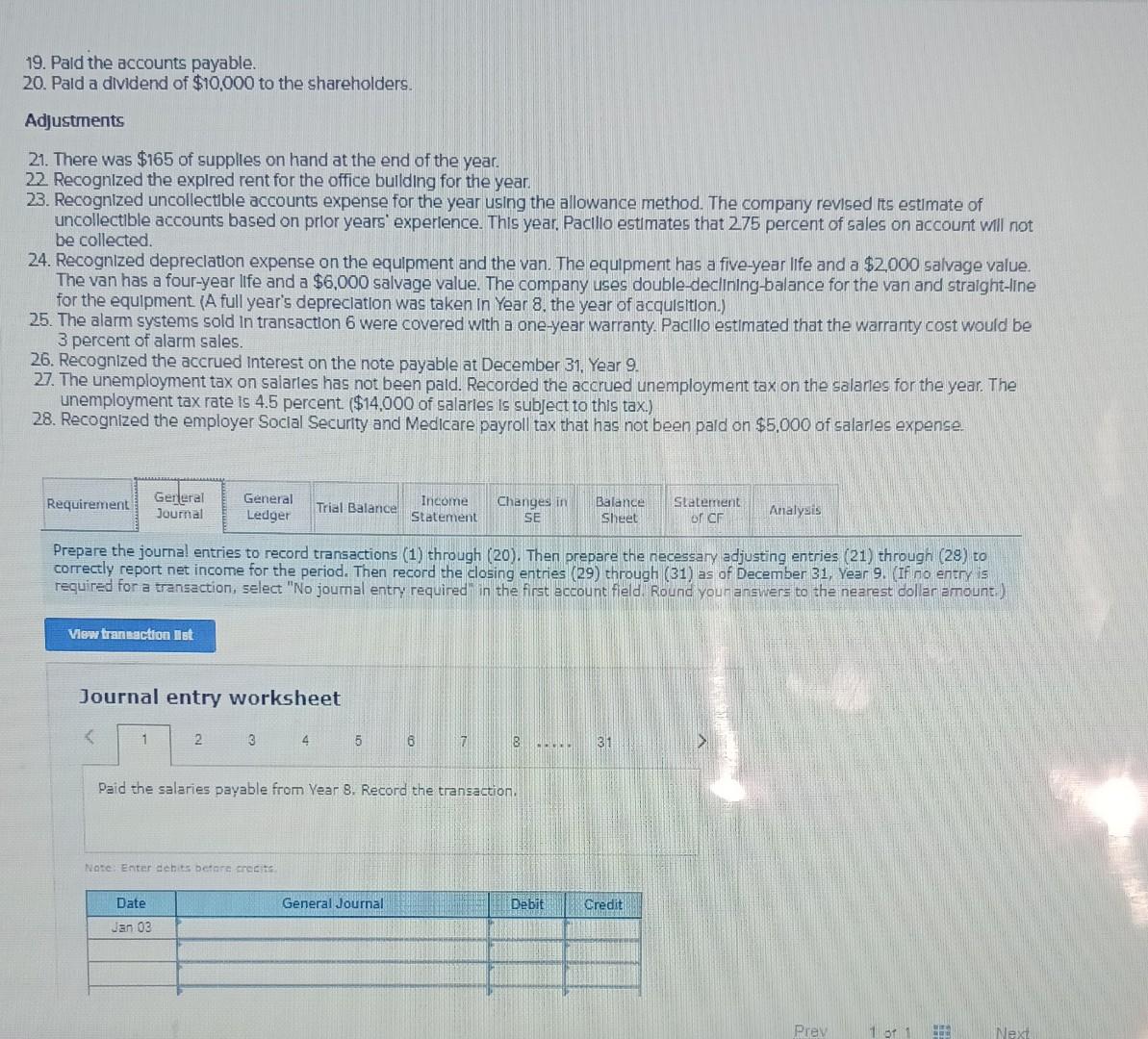

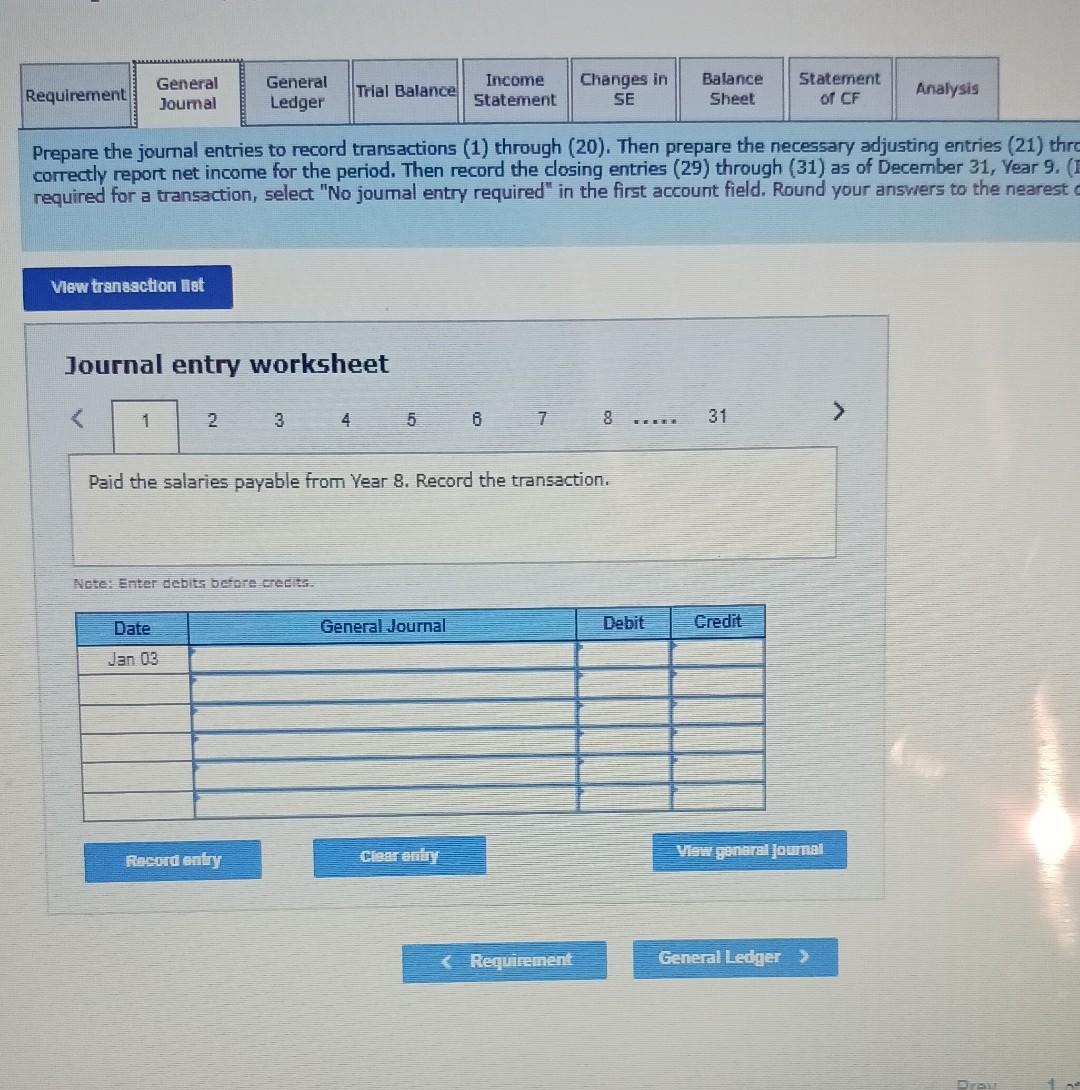

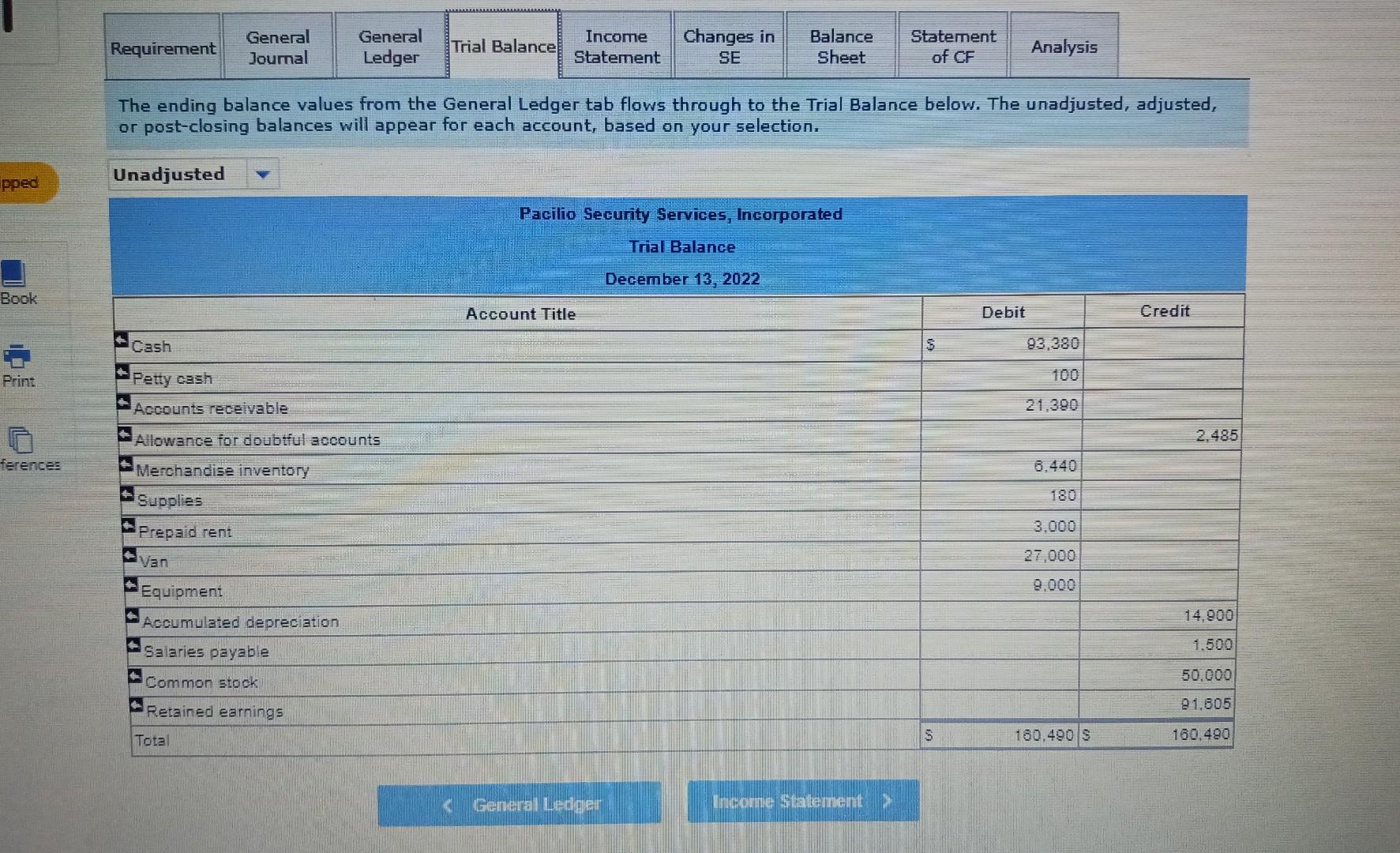

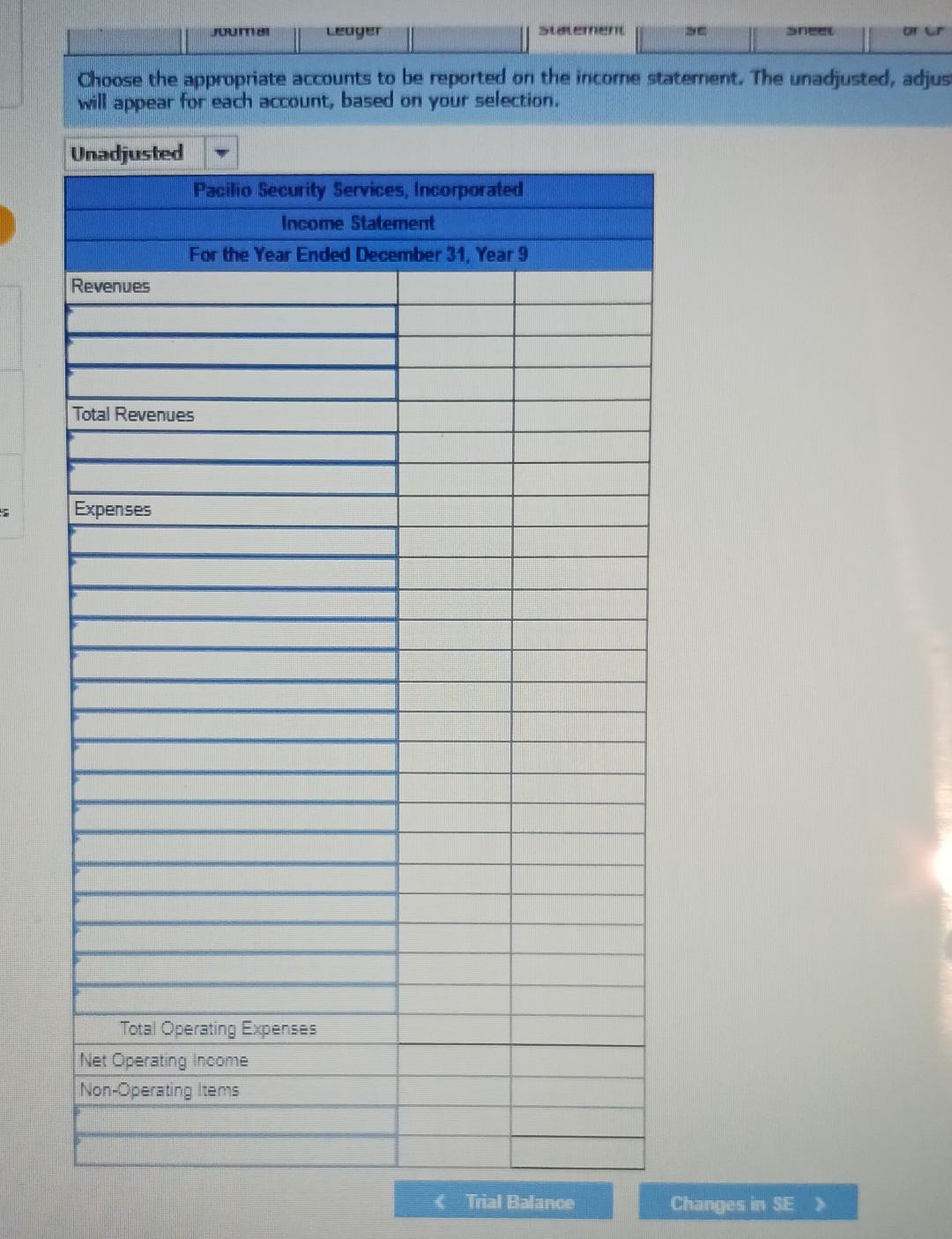

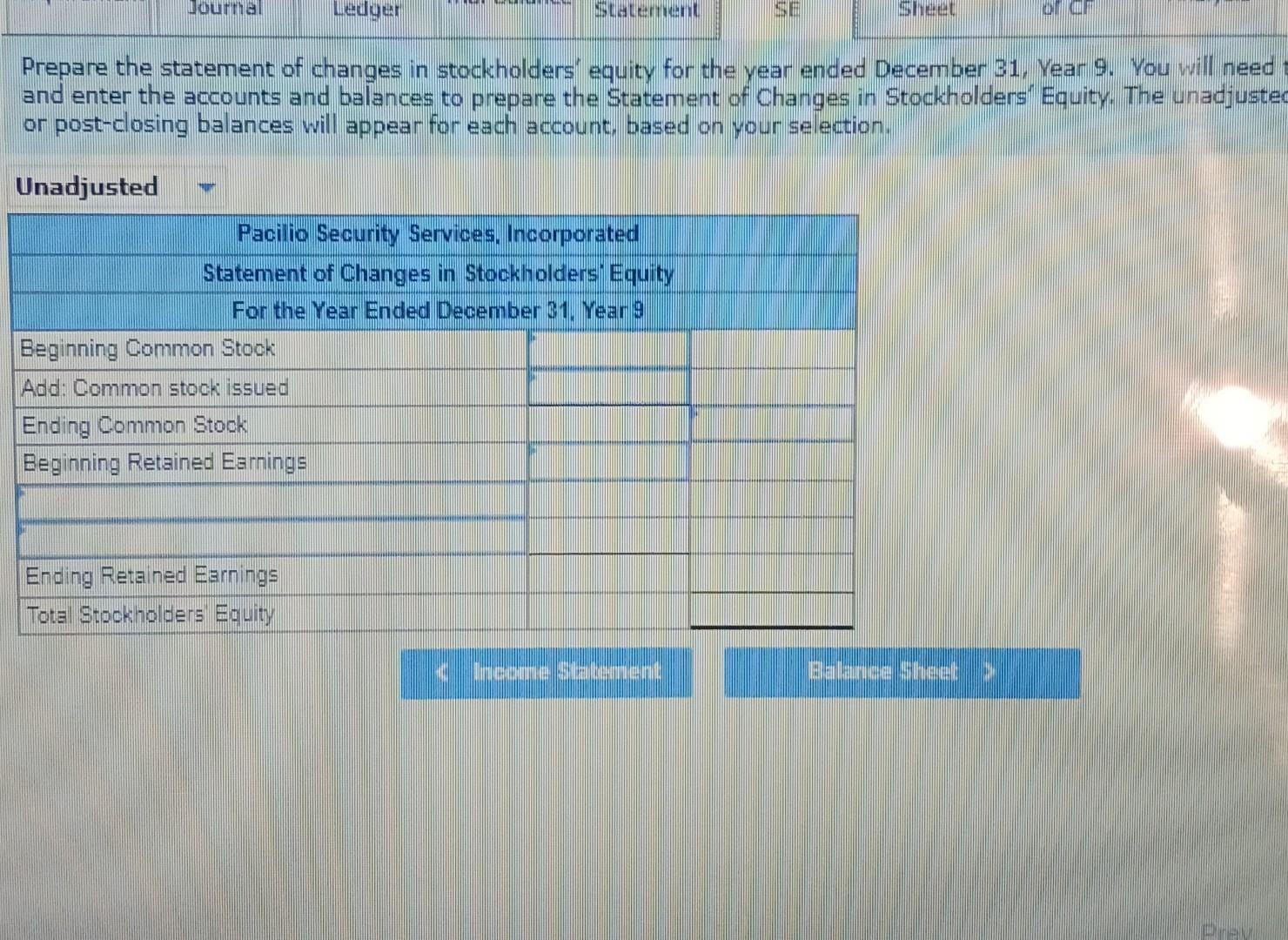

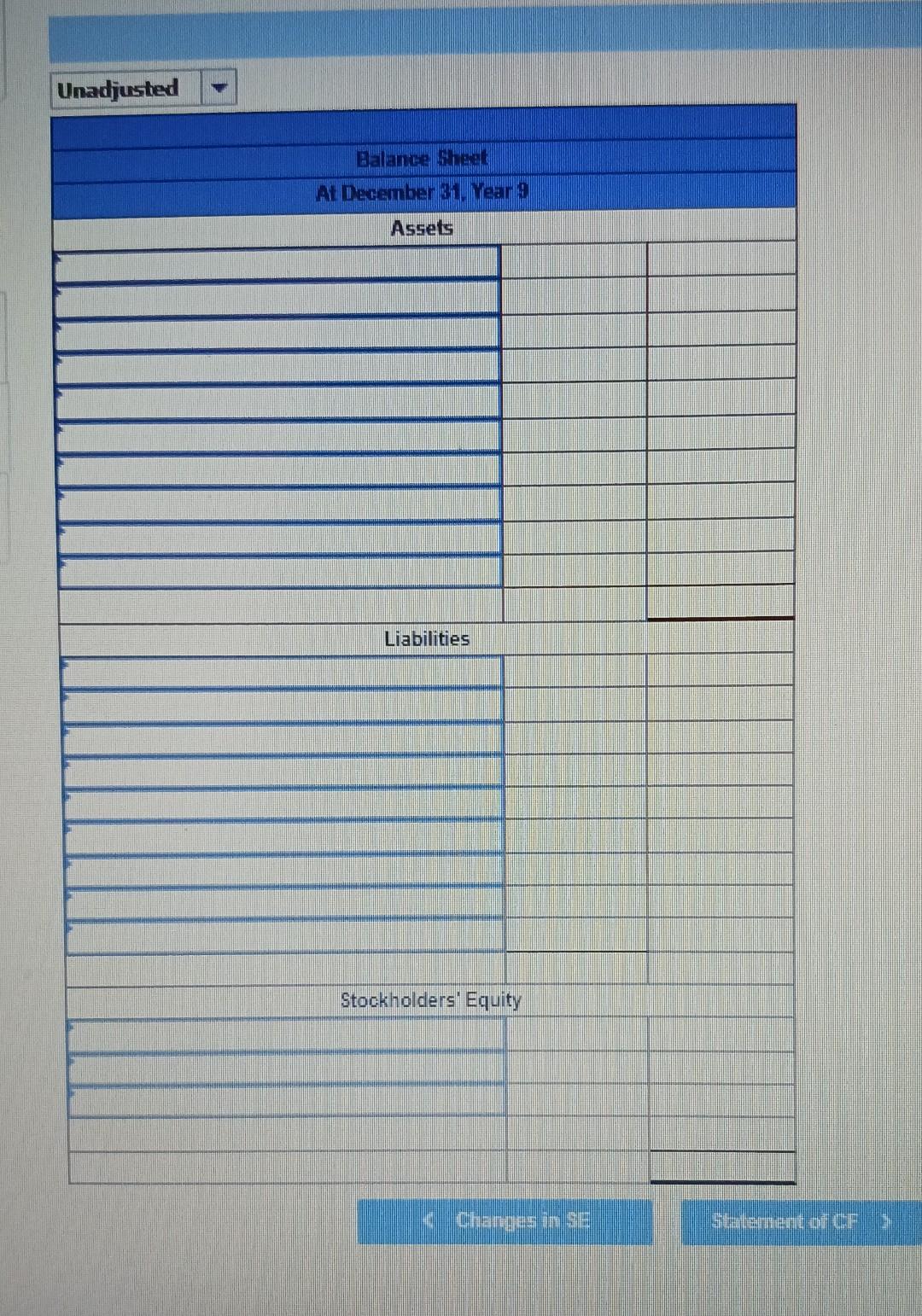

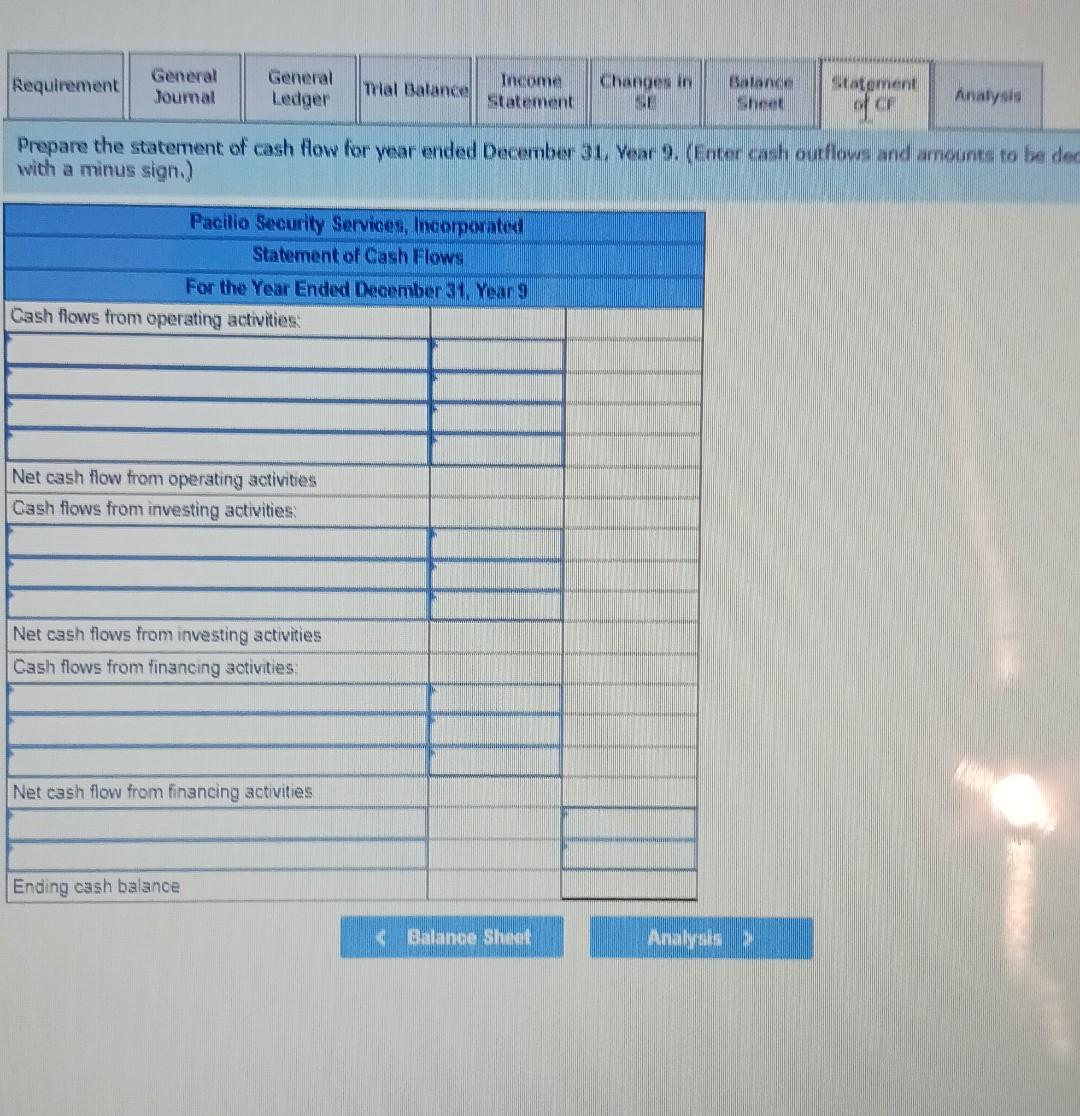

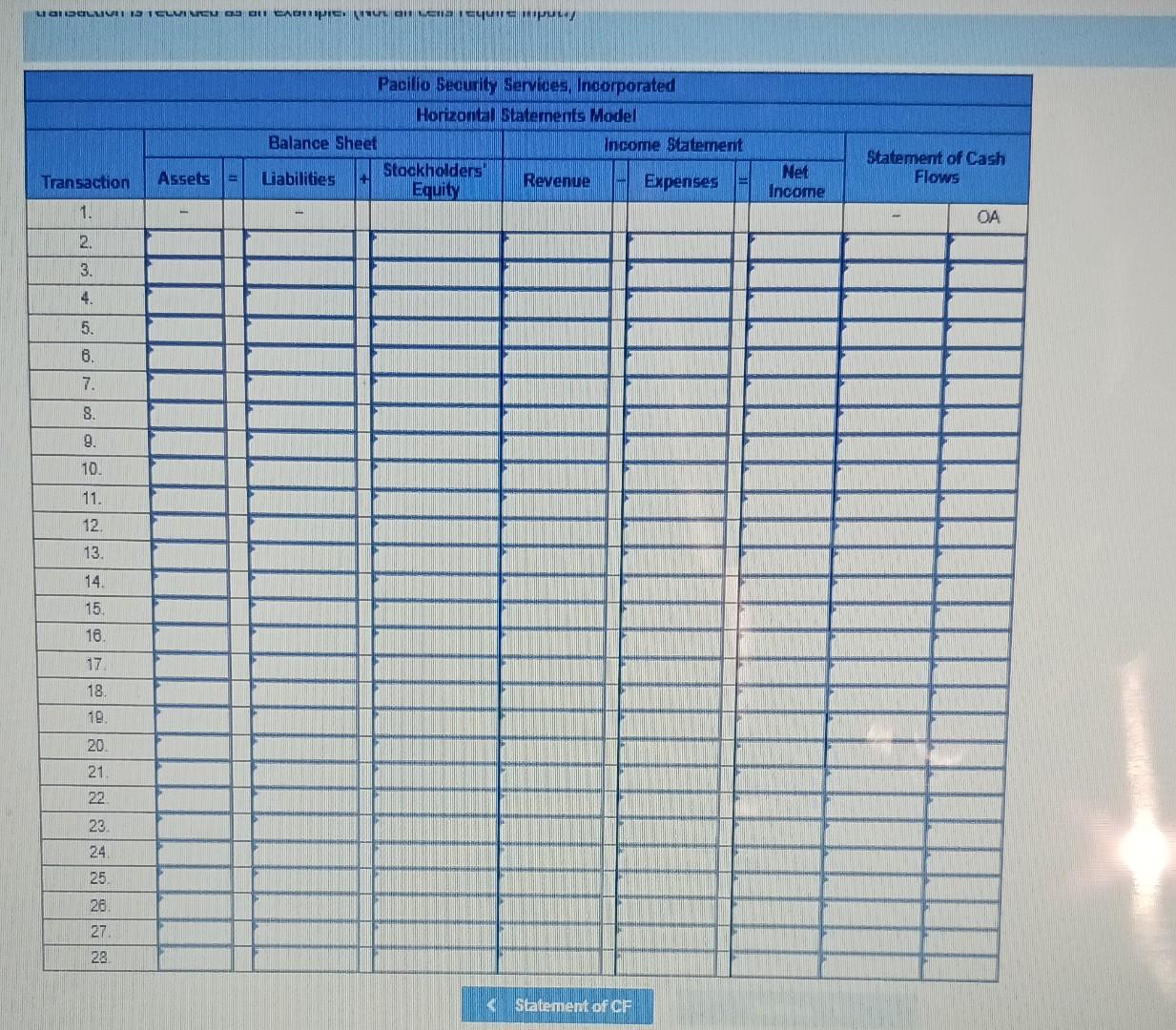

The trlal balance of Pacilio Security Services, Incorporated as of January 1 , Year 9 , had the following normal balances. During Year 9 . Pacilio Security Services experlenced the following transactions: 1. Paid the salarles payable from Year 8. 2. Paid $9.000 on May 2, Year 9 , for one year's office rent in advance. 3. Purchased $425 of supplles on account. 4. Purchased 145 alarm systems at a cost of $290 each. Paid cash for the purchase 5. After numerous attempts to collect from customers, wrote off $2,060 of uncollectlble accounts recelvable. 6. Sold 130 alarm systems for $580 each plus sales tax of 5 percent. All sales were on account. 7. Record cost of good sold for the sales transaction mentioned in previous transaction (number 6 ). Be sure to compute cost of s sold using the FIFO cost flow method. 8. Billed $107.000 of monitoring services for the vear Credit card $ ales amounted to $42.000, and the credit card companv charm 5. After numerous amempts to collect from customers, wrote off $2,060 of uncollectlble accounts recelvable. 6. Sold 130 alam gystems for $580 each plus sales tax of 5 percent. All sales were on account. 7. Record cost of good sold for the sales transaction mentioned in previous transaction (number 6 ). Be sure to compute cost of goods sold using the PFOO cost flow method. 8. Blled $107000 of montronng services for the year. Credit card sales amounted to $42,000, and the credit card company charged a 4 percere fae The remaining $65,000 were sales on account. Sales tax is not charged on this service. 9 Renienshed the pety cash fund on June 30 . The fund had $5 cash and has recelpts of $60 for yard mowing, $15 for office suppter experse and $17 for miscellaneous expenses. 10. Collected the amourt due from the credit card company. 21. Pais the saies tas collected on $69.600 of the alarm sales. 12 Pait iremisens and other employees a total of $65,000 for salarles for the year. Assume the Soclal Security tax rate is 6 percent and the Mosacare tas rate is 15 percent. Federal income taxes withheld amounted to $7,500. Cash was pald for the net amount of saishes dive 13 Packis now cotees a one year warranty on its alarm systems. Paid $1,950 in warranty repairs during the year. 14 on Sestemtser 1 bonrowed $12.000 from State Bank. The note had an 8 percent Interest rate and a one-year term to maturity. T5 Cowecases first 190 of accounts recelvable during the year. to Pant stising of advertsing expense duning the year. i7 Pais 17200 of utitaes expense for the year 20 Paic the pernat taves both the amounts withheld from the salarles plus the employer share of Soclal Security tax and Medicare tax, Lefustments 20 Past is chestaned of 510ingo to the shareholders. Adjustments Z2. iop General Journal the furnal entries to record transactions (1) through (20). Then prepare the necessary adjusting entries (21) through (28) to correctly report net income for the period. Then record the closing entries (29) through (31) as of December 31 , Year 9. General Ledger tab - Each journal entry is posted automatically to the general ledger. Trial Balance tab - The ending balance values from the General Ledger tab flows through to the Trial Balance tab. Income Statement tab - Use the drop-down to select the accounts properly included on the income statement. Statement of Changes in Stockholders' Equity tab - Prepare the statement of changes in stockholders' equity for the year ended December 31 , Year 9. Balance Sheet tab - Prepare a classified Balance Sheet at December 31 , Year 9 Statement of Cash flows - Prepare the statement of cash flow for year ended December 31, Year 9 , Analysis tab - Use a horizontal statements model to show how each transaction affects the balance sheet, income statement, and statement of cash flows. Journal entry worksheet 2345678 Paid the salaries payable from Year 8 . Record the transaction. Note: Enter debits before credits. Unadjusted Pacilio seeurity Sempes, lneorporated Inoome statement For the Year Ended December 31, Year 9 Revenues Total Revenues Expenses Prepare the statement of changes in stockholders' equity for the year ended December 31 , Year 9. You will need to determine and enter the accounts and balances to prepare the Statement of Changes in Stockholders' Equity. The unadjusted, adjusted, or post-closing balances will appear for each account, based on your selection. Unadjusted The halance sheel is the accounting equation: Assets = Liabilities + Equity. Each asset and liability account is reported separgity an the halanie shaet. Choose the appropriate accounts to be reported on the balance sheet. The unadjusted, Prepare the wtatement of cash flow for year anded December 31, Year 9. (Enter cash butflewis and amounts to with a minus sign.) transaction is rect thed as an example. (Not all cells require input.) The trial balance of Pacillo Security Services, Incorporated as of January 1, Year 9, had the following normal balances. During Year 9. Pacilio Security Services experlenced the following transactions: 1. Paid the salanes payable from Year 8 . 2. Paid $9,000 on May 2. Year 9 , for one year's office rent in advance. 3. Purchased $425 of supplles on account. 4. Purchased 145 alarm systems at a cost of $290 each. Paid cash for the purchase. 5. After numerous attempts to collect from customers, wrote off $2,060 of uncollectible accounts recelvable. 6 Soid 130 aiarm systems for $580 each plus sales tax of 5 percent. All sales were on account. 7. Record cost of good sold for the sales transaction mentioned in previous transaction (number 6 ). Be sure to compute cost of goods sold using the FIFO cost flow method. 8. Elied $107.000 of monitoring semices for the year. Credit card sales amounted to $42.000, and the credit card company charged a 4 percent fee. The remaining $65,000 were sales on account. Sales tax is not charged on this service. 9. Replenished the petty cash fund on June 30 . The fund had $5 cash and has recelpts of $60 for yard mowing. $15 for office supp is expense. and $17 for miscellaneous expenses. 10. Collected the amount due from the credit card company. 11. Paid the saies tax col ected on $69.600 of the alarm sales. 12. Paid instai ers and otret emplioyees a total of $65.000 for salarles for the year. Assume the Soclal Security tax rate is 6 percent and the Mecicare tax rate is 15 percent. Federal income taxes withheld amounted to $7.500. Cash was paid for the net amount of saiartes due 13. Pacilio now offers a cre-yesr warranty on its alarm systems Pald $1.950 in warranty repairs during the year. 14. On September t borrowed 512.000 from State Bank. The note had an 8 percent interest rate and a one-year term to maturity. 15. Collected $136190 of accounts rece vable during the year 11. Paid the sales tax collected on $69,600 of the alarm sales. 12. Paid installers and other employees a total of $65,000 for salarles for the year. Assume the Social Security tax rate is 6 percent and the Medicare tax rate is 15 percent. Federal Income taxes withheld amounted to $7,500. Cash was paid for the net amount of salanes due 13. Pactio now offers a one year warranty on its alarm systems. Paid $1,950 In warranty repalrs during the year. 14 On Sextember 1, borrowed \$12,000 from State Bank. The note had an 8 percent interest rate and a one-year term to maturity. t5. Collected $136,100 of accounts recelvable during the year. 16. Fad 515,000 of advertising expense during the year. 17. Fads 57200 of utimes expense for the year. 12. Pad the paytoll taxes, both the amounts withheld from the salarles plus the employer share of Soclal Security tax and Medicare tax, on $50,000 of the salaries plus $7,000 of the federal Income tax that was withheld. (Unemployment taxes were not paid at this Farel the accounts payable. 20 Fad the accounts payable cidend of $10,000 to the shareholders. atywents 2t. There was 5155 of supplles on hand at the end of the year. 22 axcogrized the expired rent for the office bullding for the year. 2 axcogrited uncollecible accounts expense for the year using the allowance method. The company revised its estimate of ancaiectibie accounts based on prior years' experlence. This year. Pacilio estimates that 2.75 percent of sales on account will not be collected 24 zesognzed oeprecistion expense on the equipment and the van. The equipment has a five-year life and a $2,000 salvage value. Tre with ras a four-year ilfe and a $6.000 salvage value. The company uses double-declining-balance for the van and straight-line tar the eavisment A full year's depreciation was taken in Year 8 , the year of acquisition.) 25 Ttee sest systems soid in transaction 6 were covered with a one-year warranty. Pacillo estimated that the warranty cost would be 7 percent of aiarm saies 235 Resvontaed the accrued interest on the note payable at December 31 , Year 9 The trial balance of Pacilio Socurity Services, Incorporated as of January 1. Yoar 9 , had the followng normal balances. During Year 9. Pacillo Securtty Servicos experlenced the following transactions: 1. Pald the salarles payable from Year 8. 2. Paid $9,000 on May 2. Year 9 , for one year's office rent in advance. 3. Purchaced $425 of supples an account 4. Purchased 145 alarm systems at a cost of $290 each. Pald cash for the purchase. 5. After numerous attempts to collect from customers, wrote off $2,060 of uncollectible accounts recelvable. 6 . Sold 130 alarm systems for $580 each plus sales tax of 5 percent. All sales were on account. 7. Record cost of good sold for the cales transaction mentioned in previous transaction (number 6). Be sure to compute cost of goods sold using the FIFO cost flow method 8. Billed $107,000 of monitoring services for the year. Credit card sales amounted to $42,000, and the credit card company charged a 4 percent fee. The remalning 465,000 were sales on account. Sales tax 15 not charged on this service. 9. Replenished the petty cash fund on June 30 . The fund had $5 cash and has recelpts of $60 for yard mowing. \$15 for office supplles expense, and $17 for miscellaneous expenses. 10. Collected the amount due from the crecit card company 11. Pald the sales tax collected on $69,600 of the alarm siales. 12. Paid Installers and other employees a total of $65,000 for salartes for the year. Assume the Social Security tax rate is 6 percent and the Medicare tax rate is 1.5 percent. Federal income taves withheic amounted to $7.500. Cash was pald for the net amount of salaries due 13. Pacillo now offers a one-year warranty on its alarm systems. Pard $1,950 in warranty repalrs during the year. 14. On September 1. borrowed \$12.000 from State Bank. The hote hac an 8 percent interest rate and a one-year term to maturity. 15. Collected $136,100 of accounts recelvable during the year. 16. Pald $15,000 of advertising expense ciuring the year 17. Pald $7,200 of utillties expense for the year. 18. Pald the payroll taxes, both the amounts withne di from the salartes plus the employer share of Social Security tax and Medicare tax, on $60,000 of the salartes plus $7.000 of the fecleral income tax that was withheld. (Unemployment taxes were not paid at this time) 19. Paid the accounts payabie. 20. Paid a dividend of $10,000 to the shareholders Adjustments 21. There was $165 of supplles on hand at the end of the year 22 Recoanized the expired rent for the office bullaina for the year 19. Paid the accounts payable. 20. Pald a dividend of $10,000 to the shareholders. Adjustments 21. There was $165 of supplies on hand at the end of the year. 22 Recognized the explred rent for the office bullding for the year. 23. Recognized uncollectible accounts expense for the year using the allowance method. The company revised its estimate of uncollectible accounts based on prior years' experlence. This year. Pacllo estimates that 275 percent of sales on account will not be collected. 24. Recognized depreclation expense on the equipment and the van. The equipment has a five-year life and a $2,000 salvage value. The van has a four-year life and a $6,000 salvage value. The company uses double-declining-balance for the van and straight-line for the equipment. (A full year's depreclation was taken in Year 8 , the year of acquisition.) 25. The alarm systems sold in transaction 6 were covered with a one-year warranty. Pacillo estimated that the warranty cost would be 3 percent of alarm sales. 26. Recognized the accrued interest on the note payable at December 31, Year 9. 27. The unemployment tax on salarles has not been pald. Recorded the accrued unemployment tax on the salarles for the year. The unemployment tax rate is 4.5 percent. (\$14,000 of salarles is subject to this tax.) 28. Recognized the employer Soclal Security and Medicare payroll tax that has not been paid on $5,000 of salarles expense. Prepare the journal entries to record transactions (1) through (20). Then prepare the necessary adjusting entries (21) through (28) to correctly report net income for the period. Then record the closing entries (29) through (31) as of December 31 , Year 9 . (If no entry is required for a transaction, select "No joumal entry required" in the first account fleld. Round your answers to the nearest doller amount.) Journal entry worksheet Paid the salaries payable from Vear 8 . Record the transaction. Prepare the journal entries to record transactions (1) through (20). Then prepare the necessary adjusting entries ( 21 ) thr correctly report net income for the period. Then record the closing entries (29) through (31) as of December 31, Year 9 . ( required for a transaction, select "No joumal entry required" in the first account field. Round your answers to the nearest Journal entry worksheet Paid the salaries payable from Vear 8 . Record the transaction. Nete: Enter debits before credits. The ending balance values from the General Ledger tab flows through to the Trial Balance below. The unadjusted, adjusted, or post-closing balances will appear for each account, based on your selection. Choose the appropriate accounts to be reported on the income statement. The unadjusted, adjus will appear for each account, based on your selection. Prepare the statement of changes in stockholders' equity for the year ended December 31, Year 9. Vou will need and enter the accounts and balances to prepare the Statement of Changes in Stockholders' Equity. The unadjuste or post-closing balances will appear for each account, based on your selection. Unadjusted Prepare the statement of cash flow for year ended December 31, Vear 9. (Fnter cash outflows and amounts to be with a minus sign.) 4. Statement of CF The trlal balance of Pacilio Security Services, Incorporated as of January 1 , Year 9 , had the following normal balances. During Year 9 . Pacilio Security Services experlenced the following transactions: 1. Paid the salarles payable from Year 8. 2. Paid $9.000 on May 2, Year 9 , for one year's office rent in advance. 3. Purchased $425 of supplles on account. 4. Purchased 145 alarm systems at a cost of $290 each. Paid cash for the purchase 5. After numerous attempts to collect from customers, wrote off $2,060 of uncollectlble accounts recelvable. 6. Sold 130 alarm systems for $580 each plus sales tax of 5 percent. All sales were on account. 7. Record cost of good sold for the sales transaction mentioned in previous transaction (number 6 ). Be sure to compute cost of s sold using the FIFO cost flow method. 8. Billed $107.000 of monitoring services for the vear Credit card $ ales amounted to $42.000, and the credit card companv charm 5. After numerous amempts to collect from customers, wrote off $2,060 of uncollectlble accounts recelvable. 6. Sold 130 alam gystems for $580 each plus sales tax of 5 percent. All sales were on account. 7. Record cost of good sold for the sales transaction mentioned in previous transaction (number 6 ). Be sure to compute cost of goods sold using the PFOO cost flow method. 8. Blled $107000 of montronng services for the year. Credit card sales amounted to $42,000, and the credit card company charged a 4 percere fae The remaining $65,000 were sales on account. Sales tax is not charged on this service. 9 Renienshed the pety cash fund on June 30 . The fund had $5 cash and has recelpts of $60 for yard mowing, $15 for office suppter experse and $17 for miscellaneous expenses. 10. Collected the amourt due from the credit card company. 21. Pais the saies tas collected on $69.600 of the alarm sales. 12 Pait iremisens and other employees a total of $65,000 for salarles for the year. Assume the Soclal Security tax rate is 6 percent and the Mosacare tas rate is 15 percent. Federal income taxes withheld amounted to $7,500. Cash was pald for the net amount of saishes dive 13 Packis now cotees a one year warranty on its alarm systems. Paid $1,950 in warranty repairs during the year. 14 on Sestemtser 1 bonrowed $12.000 from State Bank. The note had an 8 percent Interest rate and a one-year term to maturity. T5 Cowecases first 190 of accounts recelvable during the year. to Pant stising of advertsing expense duning the year. i7 Pais 17200 of utitaes expense for the year 20 Paic the pernat taves both the amounts withheld from the salarles plus the employer share of Soclal Security tax and Medicare tax, Lefustments 20 Past is chestaned of 510ingo to the shareholders. Adjustments Z2. iop General Journal the furnal entries to record transactions (1) through (20). Then prepare the necessary adjusting entries (21) through (28) to correctly report net income for the period. Then record the closing entries (29) through (31) as of December 31 , Year 9. General Ledger tab - Each journal entry is posted automatically to the general ledger. Trial Balance tab - The ending balance values from the General Ledger tab flows through to the Trial Balance tab. Income Statement tab - Use the drop-down to select the accounts properly included on the income statement. Statement of Changes in Stockholders' Equity tab - Prepare the statement of changes in stockholders' equity for the year ended December 31 , Year 9. Balance Sheet tab - Prepare a classified Balance Sheet at December 31 , Year 9 Statement of Cash flows - Prepare the statement of cash flow for year ended December 31, Year 9 , Analysis tab - Use a horizontal statements model to show how each transaction affects the balance sheet, income statement, and statement of cash flows. Journal entry worksheet 2345678 Paid the salaries payable from Year 8 . Record the transaction. Note: Enter debits before credits. Unadjusted Pacilio seeurity Sempes, lneorporated Inoome statement For the Year Ended December 31, Year 9 Revenues Total Revenues Expenses Prepare the statement of changes in stockholders' equity for the year ended December 31 , Year 9. You will need to determine and enter the accounts and balances to prepare the Statement of Changes in Stockholders' Equity. The unadjusted, adjusted, or post-closing balances will appear for each account, based on your selection. Unadjusted The halance sheel is the accounting equation: Assets = Liabilities + Equity. Each asset and liability account is reported separgity an the halanie shaet. Choose the appropriate accounts to be reported on the balance sheet. The unadjusted, Prepare the wtatement of cash flow for year anded December 31, Year 9. (Enter cash butflewis and amounts to with a minus sign.) transaction is rect thed as an example. (Not all cells require input.) The trial balance of Pacillo Security Services, Incorporated as of January 1, Year 9, had the following normal balances. During Year 9. Pacilio Security Services experlenced the following transactions: 1. Paid the salanes payable from Year 8 . 2. Paid $9,000 on May 2. Year 9 , for one year's office rent in advance. 3. Purchased $425 of supplles on account. 4. Purchased 145 alarm systems at a cost of $290 each. Paid cash for the purchase. 5. After numerous attempts to collect from customers, wrote off $2,060 of uncollectible accounts recelvable. 6 Soid 130 aiarm systems for $580 each plus sales tax of 5 percent. All sales were on account. 7. Record cost of good sold for the sales transaction mentioned in previous transaction (number 6 ). Be sure to compute cost of goods sold using the FIFO cost flow method. 8. Elied $107.000 of monitoring semices for the year. Credit card sales amounted to $42.000, and the credit card company charged a 4 percent fee. The remaining $65,000 were sales on account. Sales tax is not charged on this service. 9. Replenished the petty cash fund on June 30 . The fund had $5 cash and has recelpts of $60 for yard mowing. $15 for office supp is expense. and $17 for miscellaneous expenses. 10. Collected the amount due from the credit card company. 11. Paid the saies tax col ected on $69.600 of the alarm sales. 12. Paid instai ers and otret emplioyees a total of $65.000 for salarles for the year. Assume the Soclal Security tax rate is 6 percent and the Mecicare tax rate is 15 percent. Federal income taxes withheld amounted to $7.500. Cash was paid for the net amount of saiartes due 13. Pacilio now offers a cre-yesr warranty on its alarm systems Pald $1.950 in warranty repairs during the year. 14. On September t borrowed 512.000 from State Bank. The note had an 8 percent interest rate and a one-year term to maturity. 15. Collected $136190 of accounts rece vable during the year 11. Paid the sales tax collected on $69,600 of the alarm sales. 12. Paid installers and other employees a total of $65,000 for salarles for the year. Assume the Social Security tax rate is 6 percent and the Medicare tax rate is 15 percent. Federal Income taxes withheld amounted to $7,500. Cash was paid for the net amount of salanes due 13. Pactio now offers a one year warranty on its alarm systems. Paid $1,950 In warranty repalrs during the year. 14 On Sextember 1, borrowed \$12,000 from State Bank. The note had an 8 percent interest rate and a one-year term to maturity. t5. Collected $136,100 of accounts recelvable during the year. 16. Fad 515,000 of advertising expense during the year. 17. Fads 57200 of utimes expense for the year. 12. Pad the paytoll taxes, both the amounts withheld from the salarles plus the employer share of Soclal Security tax and Medicare tax, on $50,000 of the salaries plus $7,000 of the federal Income tax that was withheld. (Unemployment taxes were not paid at this Farel the accounts payable. 20 Fad the accounts payable cidend of $10,000 to the shareholders. atywents 2t. There was 5155 of supplles on hand at the end of the year. 22 axcogrized the expired rent for the office bullding for the year. 2 axcogrited uncollecible accounts expense for the year using the allowance method. The company revised its estimate of ancaiectibie accounts based on prior years' experlence. This year. Pacilio estimates that 2.75 percent of sales on account will not be collected 24 zesognzed oeprecistion expense on the equipment and the van. The equipment has a five-year life and a $2,000 salvage value. Tre with ras a four-year ilfe and a $6.000 salvage value. The company uses double-declining-balance for the van and straight-line tar the eavisment A full year's depreciation was taken in Year 8 , the year of acquisition.) 25 Ttee sest systems soid in transaction 6 were covered with a one-year warranty. Pacillo estimated that the warranty cost would be 7 percent of aiarm saies 235 Resvontaed the accrued interest on the note payable at December 31 , Year 9 The trial balance of Pacilio Socurity Services, Incorporated as of January 1. Yoar 9 , had the followng normal balances. During Year 9. Pacillo Securtty Servicos experlenced the following transactions: 1. Pald the salarles payable from Year 8. 2. Paid $9,000 on May 2. Year 9 , for one year's office rent in advance. 3. Purchaced $425 of supples an account 4. Purchased 145 alarm systems at a cost of $290 each. Pald cash for the purchase. 5. After numerous attempts to collect from customers, wrote off $2,060 of uncollectible accounts recelvable. 6 . Sold 130 alarm systems for $580 each plus sales tax of 5 percent. All sales were on account. 7. Record cost of good sold for the cales transaction mentioned in previous transaction (number 6). Be sure to compute cost of goods sold using the FIFO cost flow method 8. Billed $107,000 of monitoring services for the year. Credit card sales amounted to $42,000, and the credit card company charged a 4 percent fee. The remalning 465,000 were sales on account. Sales tax 15 not charged on this service. 9. Replenished the petty cash fund on June 30 . The fund had $5 cash and has recelpts of $60 for yard mowing. \$15 for office supplles expense, and $17 for miscellaneous expenses. 10. Collected the amount due from the crecit card company 11. Pald the sales tax collected on $69,600 of the alarm siales. 12. Paid Installers and other employees a total of $65,000 for salartes for the year. Assume the Social Security tax rate is 6 percent and the Medicare tax rate is 1.5 percent. Federal income taves withheic amounted to $7.500. Cash was pald for the net amount of salaries due 13. Pacillo now offers a one-year warranty on its alarm systems. Pard $1,950 in warranty repalrs during the year. 14. On September 1. borrowed \$12.000 from State Bank. The hote hac an 8 percent interest rate and a one-year term to maturity. 15. Collected $136,100 of accounts recelvable during the year. 16. Pald $15,000 of advertising expense ciuring the year 17. Pald $7,200 of utillties expense for the year. 18. Pald the payroll taxes, both the amounts withne di from the salartes plus the employer share of Social Security tax and Medicare tax, on $60,000 of the salartes plus $7.000 of the fecleral income tax that was withheld. (Unemployment taxes were not paid at this time) 19. Paid the accounts payabie. 20. Paid a dividend of $10,000 to the shareholders Adjustments 21. There was $165 of supplles on hand at the end of the year 22 Recoanized the expired rent for the office bullaina for the year 19. Paid the accounts payable. 20. Pald a dividend of $10,000 to the shareholders. Adjustments 21. There was $165 of supplies on hand at the end of the year. 22 Recognized the explred rent for the office bullding for the year. 23. Recognized uncollectible accounts expense for the year using the allowance method. The company revised its estimate of uncollectible accounts based on prior years' experlence. This year. Pacllo estimates that 275 percent of sales on account will not be collected. 24. Recognized depreclation expense on the equipment and the van. The equipment has a five-year life and a $2,000 salvage value. The van has a four-year life and a $6,000 salvage value. The company uses double-declining-balance for the van and straight-line for the equipment. (A full year's depreclation was taken in Year 8 , the year of acquisition.) 25. The alarm systems sold in transaction 6 were covered with a one-year warranty. Pacillo estimated that the warranty cost would be 3 percent of alarm sales. 26. Recognized the accrued interest on the note payable at December 31, Year 9. 27. The unemployment tax on salarles has not been pald. Recorded the accrued unemployment tax on the salarles for the year. The unemployment tax rate is 4.5 percent. (\$14,000 of salarles is subject to this tax.) 28. Recognized the employer Soclal Security and Medicare payroll tax that has not been paid on $5,000 of salarles expense. Prepare the journal entries to record transactions (1) through (20). Then prepare the necessary adjusting entries (21) through (28) to correctly report net income for the period. Then record the closing entries (29) through (31) as of December 31 , Year 9 . (If no entry is required for a transaction, select "No joumal entry required" in the first account fleld. Round your answers to the nearest doller amount.) Journal entry worksheet Paid the salaries payable from Vear 8 . Record the transaction. Prepare the journal entries to record transactions (1) through (20). Then prepare the necessary adjusting entries ( 21 ) thr correctly report net income for the period. Then record the closing entries (29) through (31) as of December 31, Year 9 . ( required for a transaction, select "No joumal entry required" in the first account field. Round your answers to the nearest Journal entry worksheet Paid the salaries payable from Vear 8 . Record the transaction. Nete: Enter debits before credits. The ending balance values from the General Ledger tab flows through to the Trial Balance below. The unadjusted, adjusted, or post-closing balances will appear for each account, based on your selection. Choose the appropriate accounts to be reported on the income statement. The unadjusted, adjus will appear for each account, based on your selection. Prepare the statement of changes in stockholders' equity for the year ended December 31, Year 9. Vou will need and enter the accounts and balances to prepare the Statement of Changes in Stockholders' Equity. The unadjuste or post-closing balances will appear for each account, based on your selection. Unadjusted Prepare the statement of cash flow for year ended December 31, Vear 9. (Fnter cash outflows and amounts to be with a minus sign.) 4. Statement of CF

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts