Question: please help! I need the changes of SE, Balance sheet, Statement of CF, and Analysis filled in The trial balance of Pacilio Security Services, Incorporated

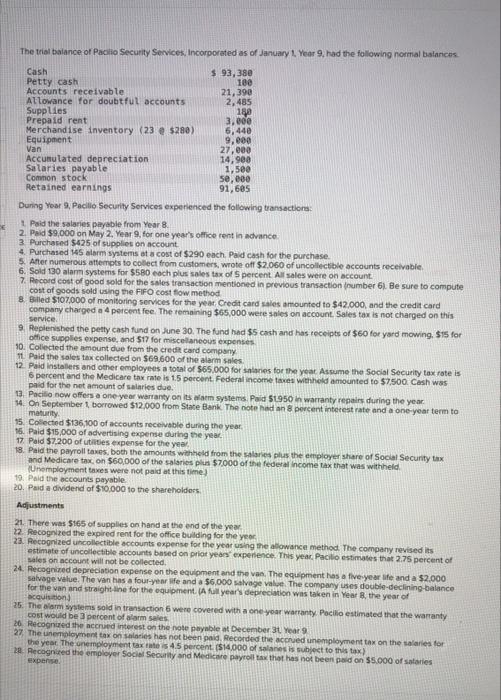

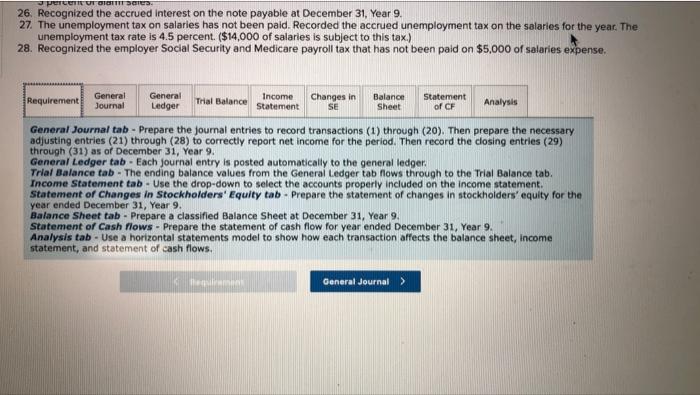

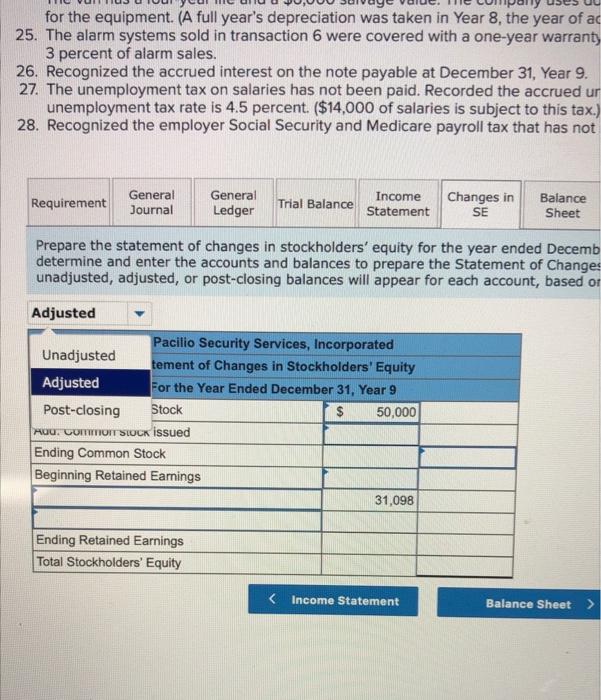

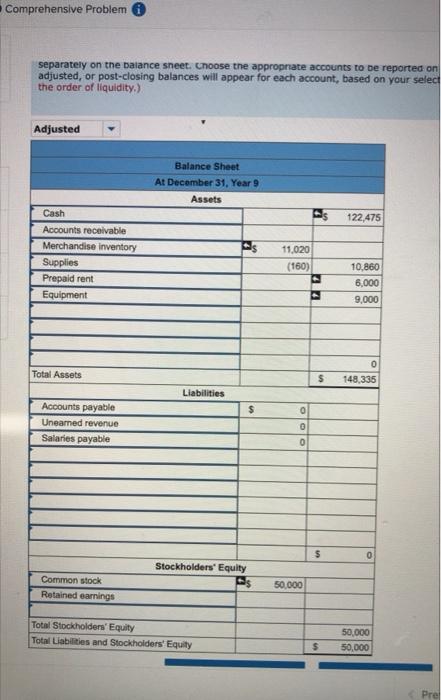

The trial balance of Pacilio Security Services, Incorporated as of January 1 Year 9, had the following normal balances Cash $ 93,380 Petty cash 100 Accounts receivable 21,390 Allowance for doubtful accounts 2,485 Supplies 180 Prepaid rent 3.000 Merchandise Inventory (23e $280) 6,440 Equipment 9,000 Van 27,000 Accumulated depreciation 14,900 Salaries payable 1,500 Common stock se,000 Retained earnings 91,605 During Year Padillo Security Services experienced the following transactions 1 Paid the salaries payable from Year 8 2. Paid $9,000 on May 2. Year 9. for one year's office rent in advance. 3 Purchased $425 of supplies on account 4. Purchased 145 alarm systems at a cost of $290 each. Paid cash for the purchase. 5. After numerous attempts to collect from customers, wrote off $2,060 of uncollectible accounts receivable 6. Sold 130 alarm systems for $580 each plus sales tax of 5 percent All sales were on account 7. Record cost of good sold for the sales transaction mentioned in previous transaction number 61. Be sure to compute cost of goods sold using the FIFO cost flow method 8 Billed $107.000 of monitoring services for the year Credit card sales amounted to $42.000, and the credit card company charged a 4 percent fee. The remaining $65,000 were sales on account Sales tax is not charged on this Service 9. Replenished the petty cash fund on June 30. The fund had $5 cath and has receipts of $60 fot yard mowing. $15 for office supplies expense, and 517 for miscellaneous expenses 10. Collected the amount due from the credit card company * Paid the sales tax collected on $69.600 of the alarm sales 12. Paid installers and other employees a total of $65.000 for salaries for the year. Assume the Social Security tax rate is 6 percent and the Medicare tax rate is 1.5 percent Federal income taxes withheld amounted to $7.500 Cash was paid for the net amount of salaries due 13. Pacilio now offers a one year warranty on its warm systems, Paid S1950 in warranty repairs during the year 14. On September 1 borrowed $12.000 from State Bank The note had an 8 percent interest rate and a one-year term to maturity 15. Collected $136,100 of accounts receivable during the year 15. Paid $15,000 of advertising expense during the year. 17 Paid $7.200 of utilities expense for the year 18. Paid the payroll taxes, both the amounts withheld from the salaries plus the employer share of Social Security tax and Medicare tax on $60,000 of the salaries plus $7.000 of the federal income tax that was withheld Unemployment taxes were not paid at this time) 19. Paid the accounts payable 20. Paid a dividend of $10,000 to the shareholders Adjustments 21. There was $165 of supplies on hand at the end of the year 22. Recognized the expired rent for the office building for the year 23. Recognized uncollectible accounts expense for the year using the allowance method. The company revised its estimate of uncollectible accounts based on prior years' experience. This year. Pacilio estimates that 2.75 percent of sales on account will not be collected 24. Recognized depreciation expense on the equipment and the van. The equipment has a five year wife and a $2.000 salvage value. The van has a four-year fe and a $6.000 salvage value. The company uses double-declining balance for the van and straight line for the equipment. (A full year's depreciation was taken in Year the year of acquisition) 25. The larm systems sold in transaction 6 were covered with a one year warranty. Pocillo estimated that the warranty cost would be 3 percent of alarm sales 26 Recognized the accrued interest on the note payable at December 31 Year 9 27. The unemployment tax on salaries has not been paid, Recorded the accrued unemployment tax on the salaries for the year. The unemployment taxates 45 percent. ($14.000 of sales is subject to this tax) 20. Recognized the employer Social Security and Medicare payroll that has not been paid on $5.000 of stories expense PETLETU OBTT Saes 26 Recognized the accrued interest on the note payable at December 31, Year 9. 27. The unemployment tax on salaries has not been paid. Recorded the accrued unemployment tax on the salaries for the year. The unemployment tax rate is 4.5 percent. ($14,000 of salaries is subject to this tax.) 28. Recognized the employer Social Security and Medicare payroll tax that has not been paid on $5,000 of salaries expense. Requirement General Journal General Ledger Trial Balance Income Statement Changes in Balance Sheet Statement of CF Analysis General Journal tab. Prepare the journal entries to record transactions (1) through (20). Then prepare the necessary adjusting entries (21) through (28) to correctly report net income for the period. Then record the closing entries (29) through (31) as of December 31, Year 9. General Ledger tab - Each journal entry is posted automatically to the general ledger Trial Balance tab - The ending balance values from the General Ledger tab flows through to the Trial Balance tab. Income Statement tab. Use the drop-down to select the accounts properly included on the income statement. Statement of Changes in Stockholders' Equity tab - Prepare the statement of changes in stockholders' equity for the year ended December 31, Year 9. Balance Sheet tab - Prepare a classified Balance Sheet at December 31, Year 9. Statement of Cash flows - Prepare the statement of cash flow for year ended December 31, Year 9. Analysis tab - Use a horizontal statements model to show how each transaction affects the balance sheet, Income statement, and statement of cash flows. General Journal > for the equipment. (A full year's depreciation was taken in Year 8, the year of ac 25. The alarm systems sold in transaction 6 were covered with a one-year warranty 3 percent of alarm sales. 26. Recognized the accrued interest on the note payable at December 31, Year 9. 27. The unemployment tax on salaries has not been paid. Recorded the accrued ur unemployment tax rate is 4.5 percent. ($14,000 of salaries is subject to this tax.) 28. Recognized the employer Social Security and Medicare payroll tax that has not Requirement General Journal General Ledger Trial Balance Income Statement Changes in SE Balance Sheet Prepare the statement of changes in stockholders' equity for the year ended Decemb determine and enter the accounts and balances to prepare the Statement of Changes unadjusted, adjusted, or post-closing balances will appear for each account, based on Adjusted Pacilio Security Services, Incorporated Unadjusted tement of Changes in Stockholders' Equity Adjusted For the Year Ended December 31, Year 9 Post-closing Stock $ 50,000 AQU. Common Stock issued Ending Common Stock Beginning Retained Earnings 31,098 Ending Retained Earnings Total Stockholders' Equity Income Statement Balance Sheet Comprehensive Problem separately on the balance sheet. Choose the appropriate accounts to be reported on adjusted, or post-closing balances will appear for each account, based on your select the order of liquidity.) Adjusted Balance Sheet At December 31, Year 9 Assets 122,475 Cash Accounts receivable Merchandise Inventory Supplies Prepaid rent Equipment 11,020 (160) 10,860 6,000 9,000 Total Assets $ 148,335 Liabilities $ Accounts payable Uneamed revenue Salaries payable 0 0 $ 0 Stockholders' Equity Common stock Retained earnings 50.000 Total Stockholders' Equity Total Liabilities and Stockholders' Equity 50,000 50,000 $ unemployment tax rate is 4.5 percent. ($14,000 of salaries is subject to this 28. Recognized the employer Social Security and Medicare payroll tax that ha Requirement General Journal General Ledger Trial Balance Income Statement Changes in SE Ball Sh Prepare the statement of cash flow for year ended December 31, Year 9. (Ente with a minus sign.) Pacilio Security Services, Incorporated Statement of Cash Flows For the Year Ended December 31, Year 9 Cash flows from operating activities: $ 0 Net cash flow from operating activities Cash flows from investing activities: Net cash flows from investing activities Cash flows from financing activities: Net cash flow from financing activities 0 Ending cash balance $ 1 Indicate whether the transaction increderea ), or increases and decreases (+/-) each element of the financial statements Nos, in the statement of Cash Flows column, use the letters of to designate operating activity. IA for testing activity. IA for hinancing activity and leave blank for no effect. The first transaction is recorded as an example. (Not all could require input) Show 10 Pacifi fecurity Services Incorporated Horizontal Bulements Model Balance Sheet Inco Salement Asset - Liabilities Stockholders Equity evene Expenses Sement of Cash Net Income Transaction 1 2 QUA A 4 5 7 B 10 12 IS 14 15 16 17 18 TO 30 21 22 23 24 26 26

Step by Step Solution

There are 3 Steps involved in it

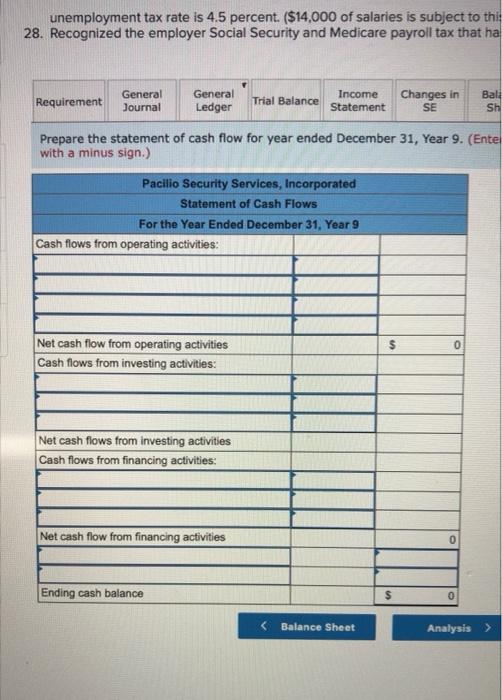

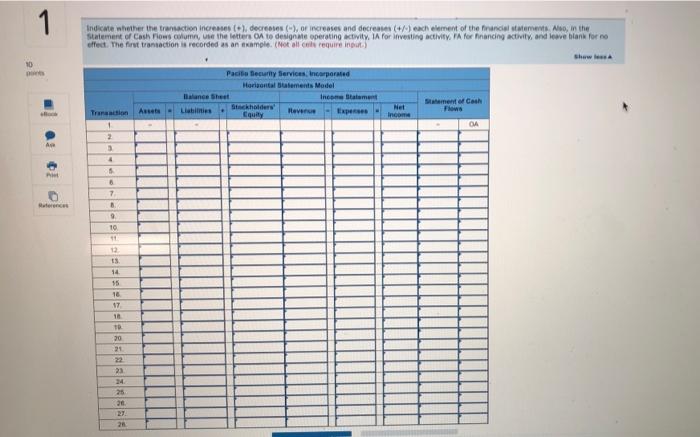

Get step-by-step solutions from verified subject matter experts