Question: Heres a case study which is from my accounting class. I have no idea to build ip the excel sheet by using this instructions. Help

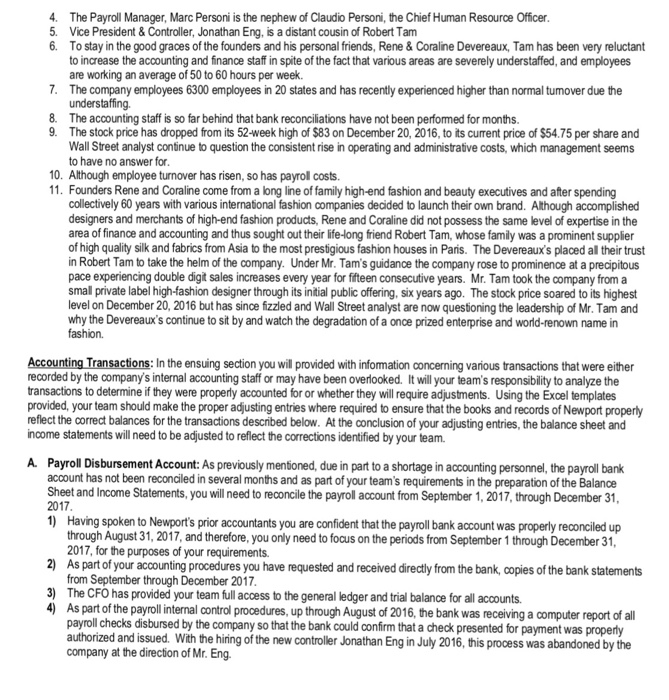

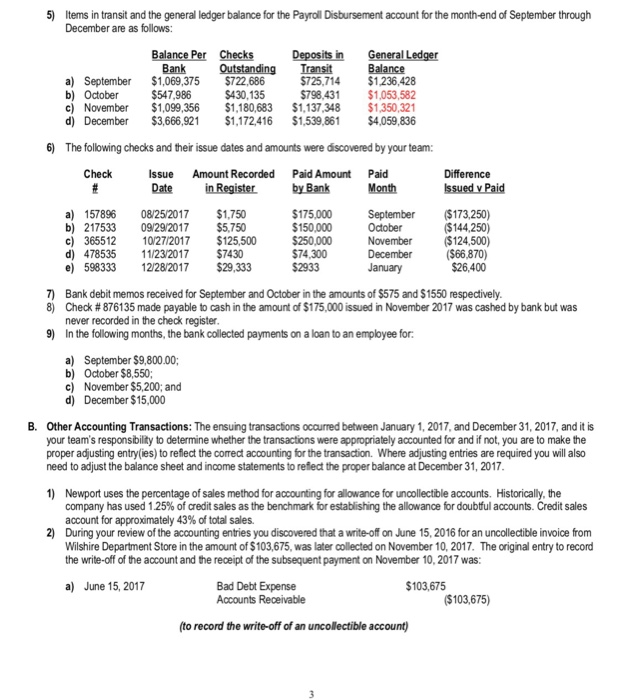

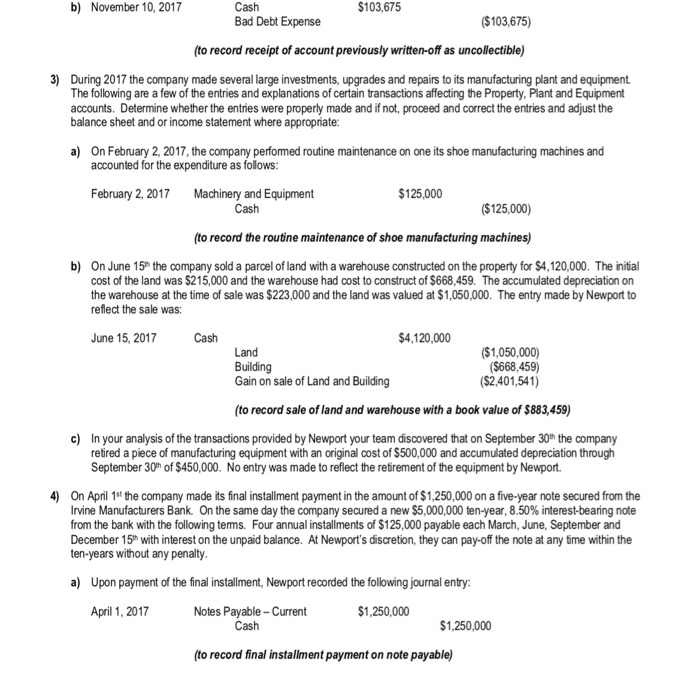

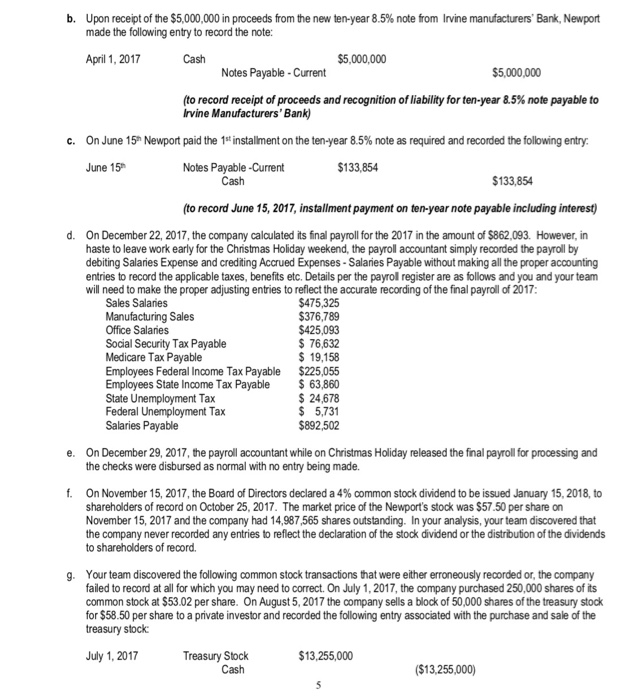

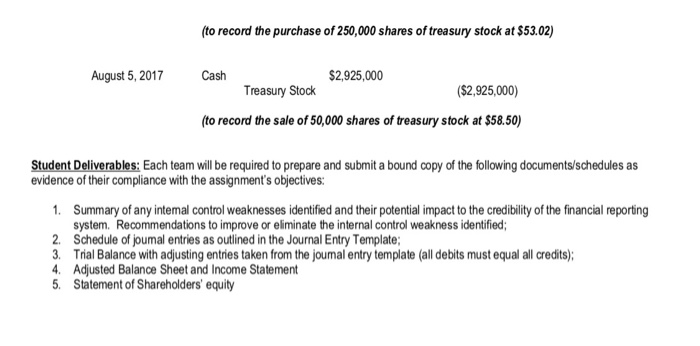

The Signature Assignment is based on the concepts reviewed and discussed in Chapters 8 through 11 and Chapter 13 of the text book. The assignment will require the students to apply the concepts taught in the aforementioned chapters in a practical exercise esting the students' understanding and application of basic accounting concepts, including but not limited to identifying potental areas of risk in the intemal control process of a fictitious company, identifying errors and or, omissions in recording transactions and making the proper adjusting or correcting entry all of which will culminate in the preparaton of a balance sheet and income statement Company History: Newport Fashions, Inc.("Newport) is an up and coming international high-end fashion designer, manufacturer and retailer with annual sales approaching $736 million, and although publicly traded, the majority of the stock is held by its founders Rene & Coraline Devereaux and some long-term employees. The stock is listed on the NASDAQ under the symbol NF and has traded over he last 52 weeks between $53 and $83 per share. The stock closed at $54.75 per share at December 31, 2017 While the company has historically been very profitable, the founders have taken a more hands-of approach to management and oversight of the company and consequently, has placed a significant amount of trust in the day-to-day running of the company to ther ife-long friend who serves as President and Chief Executive Officer, Mr. Robert Tam. Mr. Tam is perceived as being very loyal and competent over his 20-year tenure with the company and is well respected by both the employees and founders. However, Mr. Tam has been very reluctant to increase Newport's professional and office staff to keep pace with the precipitous growth realized over the last five years and has been criticized for maintaining an environment of nepotism and cronyism as evidenced by the numerous family and friends holding top positons within the company. As a result, the company has experenced various intemal control issues and weaknesses that were overlooked by its former accounting fim and consequently, through a long interview process, your firm has been selected to replace Newport's former accounting team. The company is dlosing its books for the year-ended December 31, 2017 and has retained your team to handle the preparation of its Balanoe Sheet and Income Statement. Additionally, the company is requesting as part of your services to perform a review of their intemal controls to identify any potential weaknesses that could impact the integrity of its financial data and jeopardize its financial resources and reputation. As part of your team's responsibility to Newport and based on the facts provided heretofore, you are to identify any potential weaknesses in the company's internal control processes and make the appropriate recommendations to mitigate such risks. Additionally, you are to review the various transacions as provided to ensure that they are appropriately categorized and recorded in the general ledger, review the December 31, 2017, bank reconailiation for accuracy and make adjustments were required. Prepare the closing Balance Sheet, Statement of Shareholder's Equity and Income Statement as of December 31, 2017. As part of your assignment you have been instructed to work directly with the Chief Financial Officer CFOr), Franoise Dion who is also Mr. Tams sister-in-law. As part of your request for information, the company has provided you with an organization chart that ilustrates the ines of reporting for company personnel. About Newport 1. In spite of former consultants and external accountants' recommendations, the company continues to maintain questionable reporting lines of responsibility and has done nothing to curb the obvious policy of nepotsm and cronyism. As previously mentioned, Robert Tam is a life-long friend of Rene and Coraline Devereaux and is also married to a cousin of Coraline Devereaux. The CFO, Ms. Dion is Robert Tam's sister-in-law 2. The Chief Operations Officer, Jean-Claude Devereaux is the eldest son of Rene and Coraline Devereaux. 3. The Chief information Officer, Nelly Kim is the sister of Robert Tam. 4. The Payroll Manager, Marc Personi is the nephew of Claudio Personi, the Chief Human Resource Officer 5. Vice President &Controller, Jonathan Eng, is a distant cousin of Robert Tam 6. To stay in the good graces of the founders and his personal friends, Rene &Coraline Devereaux, Tam has been very reluctant to increase the accounting and finance staff in spite of the fact that various areas are severely understaffed, and employees are working an average of 50 to 60 hours per week. The company employees 6300 employees in 20 states and has recently experienced higher than normal tumover due the understafing. 7. 8. The accounting staff is so far behind that bank reconciliations have not been perfomed for months. 9. The stock price has dropped from its 52-week high of $83 on December 20, 2016, to its current price of $54.75 per share and Wall Street analyst continue to question the consistent rise in operating and administrative costs, which management seems to have no answer for 10. Although employee turnover has risen, so has payroll costs. 11. Founders Rene and Coraline come from a long line of family high-end fashion and beauty executives and after spending collectively 60 years with various international fashion companies decided to launch their own brand. Although ac mplished designers and merchants of high-end fashion products, Rene and Coraline did not possess the same level of expertise in the area of finance and accounting and thus sought out their life-long friend Robert Tam, whose family was a prominent supplier of high quality silk and fabrics from Asia to the most prestigious fashion houses in Paris. The Devereaux's placed all their trust in Robert Tam to take the helm of the company. Under Mr. Tam's guidance the company rose to prominence at a precipitous pace experiencing double digt sales increases every year for fifteen consecutive years. Mr. Tam took the company from a small private label high-fashion designer through its initial public offering, six years ago. The stock price soared to its highest level on December 20, 2016 but has since fizzled and Wall Street analyst are now questioning the leadership of Mr. Tam and why the Devereaux's continue to sit by and watch the degradation of a once prized enterprise and world-renown name in fashion. Accounting Transactions: In the ensuing section you will provided with information concerning various transactions that were either recorded by the company's internal accounting staff or may have been overlooked. It will your team's responsibility to analyze the ransactions to determine if they were properly accounted for or whether they will require adjustments. Using the Excel templates provided, your team should make the proper adjusting entries where required to ensure that the books and records of Newport properly eflect the correct balances for the transactions descibed below. At the conclusion of your adjusting entries, the balance sheet and income statements will need to be adjusted to reflect the corrections identified by your team Payroll Disbursement Account: As previously mentioned, due in part to a shortage in accounting personnel, the payroll bank account has not been reconciled in several months and as part of your team's requirements in the preparation of the Balance Sheet and Income Statements, you will need to reconcile the payroll account from September 1, 2017, through December 31, A. 2017 1 Having spoken to Newport's prior accountants you are confident that the payroll bank account was properly reconciled up through August 31, 2017, and therefore, you only need to focus on the periods from September 1 through December 31, 2017, for the purposes of your requirements As partof your accounting procedures you have requested and received directly from the bank, copies of the bank statements from September through December 2017 2) 3) The CFO has provided your team full access to the general ledger and trial balance for all accounts. 4) As part of the payroll nternal control procedures, up through August of 2016, the bank was receiving a computer report f all payrollchecks disbursed by the company so that the bank could confrm that authorized and issued. With the hiring of the new controller Jonathan Eng in July 2016, this process was abandoned by the company at the direction of Mr. Eng. check presented for payment was properly 5) Items in transit and the general ledger balance for the Payroll Disbursement account for the month-end of September through December are as follows: Balance Per Checks Bank Outstanding Transit Balance a) September $1,069,375 $722,686 b) October $547,986 c) November $1,099,356 $1,180,683 $1,137,348 $1350,321 d) December $3,666,921 1,172,416 $1,539,861 $4,059,836 725,714 $1236,428 798.431 $1,053,582 $430,135 6) The following checks and their issue dates and amounts were discovered by your team: Check Issue Amount Recorded Paid Amount Paid Date in Register. by Bank Month a) 157896 08/25/2017 1,750 b) 217533 0/29/2017 $5,750 c) 365512 10/27/2017 $125,500 d) 478535 11/23/2017 $7430 e) 598333 12/28/2017 $29,333 $175,000 $150,000 $250,000 $74,300 $2933 September($173,250) $144,250) ovember ($124,500) ($66,870) $26,400 7) 8) Bank debit memos received for September and October in the amounts of $575 and $1550 respectively Check # 876135 made payable to cash in te amount of $175,000 issued in November 2017 was cashed by bank but was never recorded in the check register 9) In the following months, the bank collected payments on a loan to an employee for a September $9,800.00; b) October $8,550; c) November $5,200; and d) December $15,000 B. Other Accounting Transactions: The ensuing transactions occurred between January 1, 2017, and December 31, 2017, and it is your team's responsibility to determine whether the transactions were appropriately accounted for and if not, you are to make the proper adjusting entry(ies) to reflect the correct accounting for the transaction. Where adjusting entries are required you will also need to adjust the balance sheet and income statements to refect the proper balance at December 31, 2017 1 Newport uses the percentage of sales method for accounting for allowance for uncollectible accounts. Historically, the company has used 1.25% of credit sales as the benchmark for establishing the allowance for doubtful accounts. Credit sales account for approximately 43% of total sales. 2 During your review of the accounting entries you discovered that a write-off on June 15, 2016 for an uncollectible invoice from Wilshire Department Store in the amount of $103,675, was later collected on November 10, 2017. The original entry to record the write-off of the account and the receipt of the subsequent payment on November 10, 2017 was: Bad Debt Expense Accounts Receivable a) June 15, 2017 $103,675 $103,675) to record the write-off of an uncollectible account) Cash Bad Debt Expense b) November 10, 2017 S103,675 ($103,675) to record receipt of account previously written-off as uncollectible) 3) During 2017 the company made several large investments, upgrades and repairs to its manufacturing plant and equipment. The following are a few of the entries and explanations of certain transactions affecting the Property, Plant and Equipment accounts. Determine whether the entries were properly made and if not, proceed and correct the entries and adjust the balance sheet and or income statement where appropriate: a) On February 2, 2017, the company perfomed routine maintenance on one its shoe manufacturing machines and accounted for the expenditure as follows February 2, 2017 Machinery and Equipment $125,000 Cash ($125,000) (to record the routine maintenance of shoe manufacturing machines) b) On June 15h the company sold a parcel of land with a warehouse constructed on the property for $4,120,000. The initial cost of the land was $215,000 and the warehouse had cost to construct of $668,459. The accumulated depreciation on the warehouse at the time of sale was $223,000 and the land was valued at $1,050,000. The entry made by Newport to reflect the sale was: June 15, 2017 Cash S4,120,000 Land Building Gain on sale of Land and Building $1,050,000) ($668,459) ($2,401,541) (to record sale of land and warehouse with a book value of $883,459) c) In your analysis of the transactions provided by Newport your team discovered that on September 30th the company retired a piece of manufacturing equipment with an original cost of $500,000 and accumulated depreciation through September 30h of $450,000. No entry was made to reflect the rerement of the equipment by Newport 4) On April 1st the company made its final installment payment in the amount of $1,250,000 on a five-year note secured from the Irvine Manufacturers Bank. On the same day the company secured a new $5,000,000 ten-year, 8.50% interest-bearing note from the bank with the following tems. Four annual installments of $125,000 payable each March, June, September and December 15h with interest on the unpaid balance. At Newport's discretion, they can pay-off the note at any time within the ten-years without any penalty a) Upon payment of the final installment, Newport recorded the following journal entry: Notes Payable-Current Cash April 1, 2017 $1,250,000 $1,250,000 (to record final installment payment on note payable) b. Upon receipt of the $5,000,000 in proceeds from the new ten-year 8.5% note from Irvine manufacturers. Bank, Newport made the following entry to record the note: April 1, 2017 $5,000,000 Notes Payable -Current $5,000,000 (to record receipt of proceeds and recognition of liability for ten-year 8.5% note payable to rvine Manufacturers'Bank) c. On June 15n Newport paid the 1st installment on the ten-year 8.5% note as required and recorded the following entry: June 15 $133,854 Notes Payable -Current Cash $133,854 (to record June 15, 2017, installment payment on ten-year note payable including interest) d. On December 22, 2017, the company calculated its final payroll for the 2017 in the amount of $862,093. However, in haste to leave work early for the Christmas Holiday weekend, the payroll accountant simply recorded the payroll by debiting Salaries Expense and crediting Accrued Expenses-Salares Payable without making all the proper accounting entries to record the applicable taxes, benefits etc. Details per the payrol register are as follows and you and your team will need to make the proper adjusting entries to reflect the accurate recording of the final payroll of 2017 Sales Salares Manufacturing Sales Office Salanies Social Security Tax Payable Medicare Tax Payable Employees Federal Income Tax Payable $225,055 Employees State Income Tax Payable 63,860 State Unemployment Tax Federal Unemployment Tax Salaries Payable $475,325 376,789 425,093 76,632 $ 19,158 24,678 5,731 $892,502 e. On December 29, 2017, the payroll accountant while on Christmas Holiday released the final payroll for processing and the checks were disbursed as normal with no entry being made. f. On November 15, 2017, the Board of Directors declared a 4% common stock dividend to be issued January 15, 2018, to shareholders of record on October 25, 2017. The market price of the Newport's stock was $57.50 per share on November 15, 2017 and the company had 14,987,565 shares outstanding. In your analysis, your team discovered that the company never recorded any entries to reflect the declaration of the stock dividend or the distribution of the dividends to shareholders of record. Your team discovered the following common stock transactions that were either erroneously recorded or, the company failed to record at all for which you may need to correct. On July 1,2017, the company purchased 250,000 shares of its common stock at $53.02 per share. On August 5, 2017 the company sells a block of 50,000 shares of the treasury stock for $58.50 per share to a private investor and recorded the following entry associated with the purchase and sale of the treasury stock g. July 1, 2017 Treasury Stock Cash 13,255,000 ($13,255,000) (to record the purchase of 250,000 shares of treasury stock at $53.02) August 5,2017 Cash $2,925,000 Treasury Stock ($2,925,000) (to record the sale of 50,000 shares of treasury stock at $58.50) Student Deliverables: Each team will be required to prepare and submit a bound copy of the following documents/schedules as evidence of their compliance with the assignment's objectives: 1. 2. 3. 4. 5. Summary of any intemal control weaknesses identified and their potential impact to the credibility of the financial reporting system. Recommendations to improve or eliminate the internal control weakness identified; Schedule of joumal entries as outlined in the Journal Entry Template; Trial Balance with adjusting entries taken from the joumal entry template (all debits must equal all credits); Adjusted Balance Sheet and Income Statement Statement of Shareholders' equity The Signature Assignment is based on the concepts reviewed and discussed in Chapters 8 through 11 and Chapter 13 of the text book. The assignment will require the students to apply the concepts taught in the aforementioned chapters in a practical exercise esting the students' understanding and application of basic accounting concepts, including but not limited to identifying potental areas of risk in the intemal control process of a fictitious company, identifying errors and or, omissions in recording transactions and making the proper adjusting or correcting entry all of which will culminate in the preparaton of a balance sheet and income statement Company History: Newport Fashions, Inc.("Newport) is an up and coming international high-end fashion designer, manufacturer and retailer with annual sales approaching $736 million, and although publicly traded, the majority of the stock is held by its founders Rene & Coraline Devereaux and some long-term employees. The stock is listed on the NASDAQ under the symbol NF and has traded over he last 52 weeks between $53 and $83 per share. The stock closed at $54.75 per share at December 31, 2017 While the company has historically been very profitable, the founders have taken a more hands-of approach to management and oversight of the company and consequently, has placed a significant amount of trust in the day-to-day running of the company to ther ife-long friend who serves as President and Chief Executive Officer, Mr. Robert Tam. Mr. Tam is perceived as being very loyal and competent over his 20-year tenure with the company and is well respected by both the employees and founders. However, Mr. Tam has been very reluctant to increase Newport's professional and office staff to keep pace with the precipitous growth realized over the last five years and has been criticized for maintaining an environment of nepotism and cronyism as evidenced by the numerous family and friends holding top positons within the company. As a result, the company has experenced various intemal control issues and weaknesses that were overlooked by its former accounting fim and consequently, through a long interview process, your firm has been selected to replace Newport's former accounting team. The company is dlosing its books for the year-ended December 31, 2017 and has retained your team to handle the preparation of its Balanoe Sheet and Income Statement. Additionally, the company is requesting as part of your services to perform a review of their intemal controls to identify any potential weaknesses that could impact the integrity of its financial data and jeopardize its financial resources and reputation. As part of your team's responsibility to Newport and based on the facts provided heretofore, you are to identify any potential weaknesses in the company's internal control processes and make the appropriate recommendations to mitigate such risks. Additionally, you are to review the various transacions as provided to ensure that they are appropriately categorized and recorded in the general ledger, review the December 31, 2017, bank reconailiation for accuracy and make adjustments were required. Prepare the closing Balance Sheet, Statement of Shareholder's Equity and Income Statement as of December 31, 2017. As part of your assignment you have been instructed to work directly with the Chief Financial Officer CFOr), Franoise Dion who is also Mr. Tams sister-in-law. As part of your request for information, the company has provided you with an organization chart that ilustrates the ines of reporting for company personnel. About Newport 1. In spite of former consultants and external accountants' recommendations, the company continues to maintain questionable reporting lines of responsibility and has done nothing to curb the obvious policy of nepotsm and cronyism. As previously mentioned, Robert Tam is a life-long friend of Rene and Coraline Devereaux and is also married to a cousin of Coraline Devereaux. The CFO, Ms. Dion is Robert Tam's sister-in-law 2. The Chief Operations Officer, Jean-Claude Devereaux is the eldest son of Rene and Coraline Devereaux. 3. The Chief information Officer, Nelly Kim is the sister of Robert Tam. 4. The Payroll Manager, Marc Personi is the nephew of Claudio Personi, the Chief Human Resource Officer 5. Vice President &Controller, Jonathan Eng, is a distant cousin of Robert Tam 6. To stay in the good graces of the founders and his personal friends, Rene &Coraline Devereaux, Tam has been very reluctant to increase the accounting and finance staff in spite of the fact that various areas are severely understaffed, and employees are working an average of 50 to 60 hours per week. The company employees 6300 employees in 20 states and has recently experienced higher than normal tumover due the understafing. 7. 8. The accounting staff is so far behind that bank reconciliations have not been perfomed for months. 9. The stock price has dropped from its 52-week high of $83 on December 20, 2016, to its current price of $54.75 per share and Wall Street analyst continue to question the consistent rise in operating and administrative costs, which management seems to have no answer for 10. Although employee turnover has risen, so has payroll costs. 11. Founders Rene and Coraline come from a long line of family high-end fashion and beauty executives and after spending collectively 60 years with various international fashion companies decided to launch their own brand. Although ac mplished designers and merchants of high-end fashion products, Rene and Coraline did not possess the same level of expertise in the area of finance and accounting and thus sought out their life-long friend Robert Tam, whose family was a prominent supplier of high quality silk and fabrics from Asia to the most prestigious fashion houses in Paris. The Devereaux's placed all their trust in Robert Tam to take the helm of the company. Under Mr. Tam's guidance the company rose to prominence at a precipitous pace experiencing double digt sales increases every year for fifteen consecutive years. Mr. Tam took the company from a small private label high-fashion designer through its initial public offering, six years ago. The stock price soared to its highest level on December 20, 2016 but has since fizzled and Wall Street analyst are now questioning the leadership of Mr. Tam and why the Devereaux's continue to sit by and watch the degradation of a once prized enterprise and world-renown name in fashion. Accounting Transactions: In the ensuing section you will provided with information concerning various transactions that were either recorded by the company's internal accounting staff or may have been overlooked. It will your team's responsibility to analyze the ransactions to determine if they were properly accounted for or whether they will require adjustments. Using the Excel templates provided, your team should make the proper adjusting entries where required to ensure that the books and records of Newport properly eflect the correct balances for the transactions descibed below. At the conclusion of your adjusting entries, the balance sheet and income statements will need to be adjusted to reflect the corrections identified by your team Payroll Disbursement Account: As previously mentioned, due in part to a shortage in accounting personnel, the payroll bank account has not been reconciled in several months and as part of your team's requirements in the preparation of the Balance Sheet and Income Statements, you will need to reconcile the payroll account from September 1, 2017, through December 31, A. 2017 1 Having spoken to Newport's prior accountants you are confident that the payroll bank account was properly reconciled up through August 31, 2017, and therefore, you only need to focus on the periods from September 1 through December 31, 2017, for the purposes of your requirements As partof your accounting procedures you have requested and received directly from the bank, copies of the bank statements from September through December 2017 2) 3) The CFO has provided your team full access to the general ledger and trial balance for all accounts. 4) As part of the payroll nternal control procedures, up through August of 2016, the bank was receiving a computer report f all payrollchecks disbursed by the company so that the bank could confrm that authorized and issued. With the hiring of the new controller Jonathan Eng in July 2016, this process was abandoned by the company at the direction of Mr. Eng. check presented for payment was properly 5) Items in transit and the general ledger balance for the Payroll Disbursement account for the month-end of September through December are as follows: Balance Per Checks Bank Outstanding Transit Balance a) September $1,069,375 $722,686 b) October $547,986 c) November $1,099,356 $1,180,683 $1,137,348 $1350,321 d) December $3,666,921 1,172,416 $1,539,861 $4,059,836 725,714 $1236,428 798.431 $1,053,582 $430,135 6) The following checks and their issue dates and amounts were discovered by your team: Check Issue Amount Recorded Paid Amount Paid Date in Register. by Bank Month a) 157896 08/25/2017 1,750 b) 217533 0/29/2017 $5,750 c) 365512 10/27/2017 $125,500 d) 478535 11/23/2017 $7430 e) 598333 12/28/2017 $29,333 $175,000 $150,000 $250,000 $74,300 $2933 September($173,250) $144,250) ovember ($124,500) ($66,870) $26,400 7) 8) Bank debit memos received for September and October in the amounts of $575 and $1550 respectively Check # 876135 made payable to cash in te amount of $175,000 issued in November 2017 was cashed by bank but was never recorded in the check register 9) In the following months, the bank collected payments on a loan to an employee for a September $9,800.00; b) October $8,550; c) November $5,200; and d) December $15,000 B. Other Accounting Transactions: The ensuing transactions occurred between January 1, 2017, and December 31, 2017, and it is your team's responsibility to determine whether the transactions were appropriately accounted for and if not, you are to make the proper adjusting entry(ies) to reflect the correct accounting for the transaction. Where adjusting entries are required you will also need to adjust the balance sheet and income statements to refect the proper balance at December 31, 2017 1 Newport uses the percentage of sales method for accounting for allowance for uncollectible accounts. Historically, the company has used 1.25% of credit sales as the benchmark for establishing the allowance for doubtful accounts. Credit sales account for approximately 43% of total sales. 2 During your review of the accounting entries you discovered that a write-off on June 15, 2016 for an uncollectible invoice from Wilshire Department Store in the amount of $103,675, was later collected on November 10, 2017. The original entry to record the write-off of the account and the receipt of the subsequent payment on November 10, 2017 was: Bad Debt Expense Accounts Receivable a) June 15, 2017 $103,675 $103,675) to record the write-off of an uncollectible account) Cash Bad Debt Expense b) November 10, 2017 S103,675 ($103,675) to record receipt of account previously written-off as uncollectible) 3) During 2017 the company made several large investments, upgrades and repairs to its manufacturing plant and equipment. The following are a few of the entries and explanations of certain transactions affecting the Property, Plant and Equipment accounts. Determine whether the entries were properly made and if not, proceed and correct the entries and adjust the balance sheet and or income statement where appropriate: a) On February 2, 2017, the company perfomed routine maintenance on one its shoe manufacturing machines and accounted for the expenditure as follows February 2, 2017 Machinery and Equipment $125,000 Cash ($125,000) (to record the routine maintenance of shoe manufacturing machines) b) On June 15h the company sold a parcel of land with a warehouse constructed on the property for $4,120,000. The initial cost of the land was $215,000 and the warehouse had cost to construct of $668,459. The accumulated depreciation on the warehouse at the time of sale was $223,000 and the land was valued at $1,050,000. The entry made by Newport to reflect the sale was: June 15, 2017 Cash S4,120,000 Land Building Gain on sale of Land and Building $1,050,000) ($668,459) ($2,401,541) (to record sale of land and warehouse with a book value of $883,459) c) In your analysis of the transactions provided by Newport your team discovered that on September 30th the company retired a piece of manufacturing equipment with an original cost of $500,000 and accumulated depreciation through September 30h of $450,000. No entry was made to reflect the rerement of the equipment by Newport 4) On April 1st the company made its final installment payment in the amount of $1,250,000 on a five-year note secured from the Irvine Manufacturers Bank. On the same day the company secured a new $5,000,000 ten-year, 8.50% interest-bearing note from the bank with the following tems. Four annual installments of $125,000 payable each March, June, September and December 15h with interest on the unpaid balance. At Newport's discretion, they can pay-off the note at any time within the ten-years without any penalty a) Upon payment of the final installment, Newport recorded the following journal entry: Notes Payable-Current Cash April 1, 2017 $1,250,000 $1,250,000 (to record final installment payment on note payable) b. Upon receipt of the $5,000,000 in proceeds from the new ten-year 8.5% note from Irvine manufacturers. Bank, Newport made the following entry to record the note: April 1, 2017 $5,000,000 Notes Payable -Current $5,000,000 (to record receipt of proceeds and recognition of liability for ten-year 8.5% note payable to rvine Manufacturers'Bank) c. On June 15n Newport paid the 1st installment on the ten-year 8.5% note as required and recorded the following entry: June 15 $133,854 Notes Payable -Current Cash $133,854 (to record June 15, 2017, installment payment on ten-year note payable including interest) d. On December 22, 2017, the company calculated its final payroll for the 2017 in the amount of $862,093. However, in haste to leave work early for the Christmas Holiday weekend, the payroll accountant simply recorded the payroll by debiting Salaries Expense and crediting Accrued Expenses-Salares Payable without making all the proper accounting entries to record the applicable taxes, benefits etc. Details per the payrol register are as follows and you and your team will need to make the proper adjusting entries to reflect the accurate recording of the final payroll of 2017 Sales Salares Manufacturing Sales Office Salanies Social Security Tax Payable Medicare Tax Payable Employees Federal Income Tax Payable $225,055 Employees State Income Tax Payable 63,860 State Unemployment Tax Federal Unemployment Tax Salaries Payable $475,325 376,789 425,093 76,632 $ 19,158 24,678 5,731 $892,502 e. On December 29, 2017, the payroll accountant while on Christmas Holiday released the final payroll for processing and the checks were disbursed as normal with no entry being made. f. On November 15, 2017, the Board of Directors declared a 4% common stock dividend to be issued January 15, 2018, to shareholders of record on October 25, 2017. The market price of the Newport's stock was $57.50 per share on November 15, 2017 and the company had 14,987,565 shares outstanding. In your analysis, your team discovered that the company never recorded any entries to reflect the declaration of the stock dividend or the distribution of the dividends to shareholders of record. Your team discovered the following common stock transactions that were either erroneously recorded or, the company failed to record at all for which you may need to correct. On July 1,2017, the company purchased 250,000 shares of its common stock at $53.02 per share. On August 5, 2017 the company sells a block of 50,000 shares of the treasury stock for $58.50 per share to a private investor and recorded the following entry associated with the purchase and sale of the treasury stock g. July 1, 2017 Treasury Stock Cash 13,255,000 ($13,255,000) (to record the purchase of 250,000 shares of treasury stock at $53.02) August 5,2017 Cash $2,925,000 Treasury Stock ($2,925,000) (to record the sale of 50,000 shares of treasury stock at $58.50) Student Deliverables: Each team will be required to prepare and submit a bound copy of the following documents/schedules as evidence of their compliance with the assignment's objectives: 1. 2. 3. 4. 5. Summary of any intemal control weaknesses identified and their potential impact to the credibility of the financial reporting system. Recommendations to improve or eliminate the internal control weakness identified; Schedule of joumal entries as outlined in the Journal Entry Template; Trial Balance with adjusting entries taken from the joumal entry template (all debits must equal all credits); Adjusted Balance Sheet and Income Statement Statement of Shareholders' equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts