Question: heres the #2 info 3. Using the data given for North End Oil in problem 2, compute the depreciation for 2014 under each of the

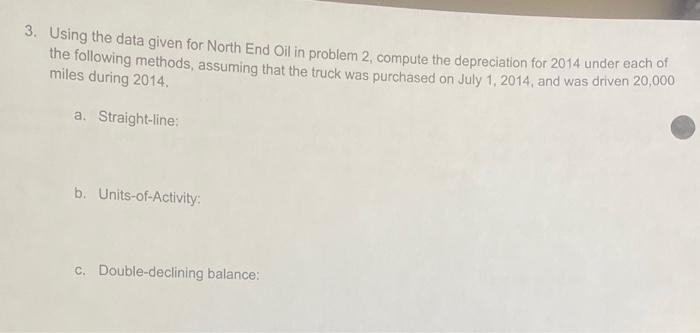

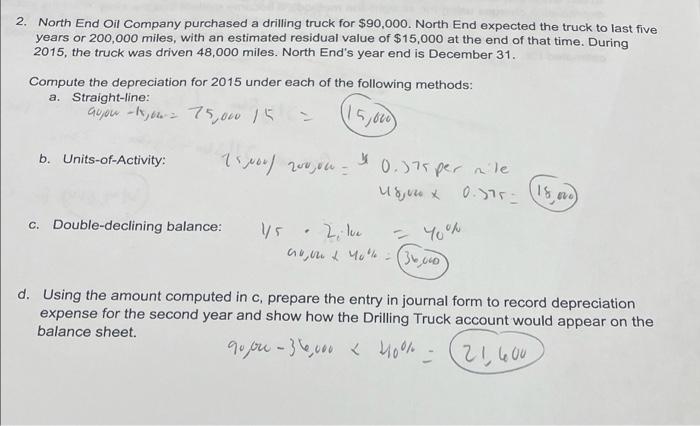

3. Using the data given for North End Oil in problem 2, compute the depreciation for 2014 under each of the following methods, assuming that the truck was purchased on July 1, 2014, and was driven 20,000 miles during 2014 a. Straight-line b. Units-of-Activity: C. Double-declining balance: 2. North End Oil Company purchased a drilling truck for $90,000. North End expected the truck to last five years or 200,000 miles, with an estimated residual value of $15,000 at the end of that time. During 2015, the truck was driven 48,000 miles. North End's year end is December 31. Compute the depreciation for 2015 under each of the following methods: a. Straight-line: aujou -1,642 75,000 15 (15,00) b. Units-of-Activity: = / 16 0.75 per le udgurux 0.75 - 18.00 You C. Double-declining balance: 15 2, he cout 40% = (36,000 d. Using the amount computed in c, prepare the entry in journal form to record depreciation expense for the second year and show how the Drilling Truck account would appear on the balance sheet. 90 ou - 36,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts