Question: Hey! Could you solve this problem? I don't want an excel calculation. I'd be so glad if you interpreted it step by step. Thanks in

Hey! Could you solve this problem? I don't want an excel calculation. I'd be so glad if you interpreted it step by step. Thanks in advance.

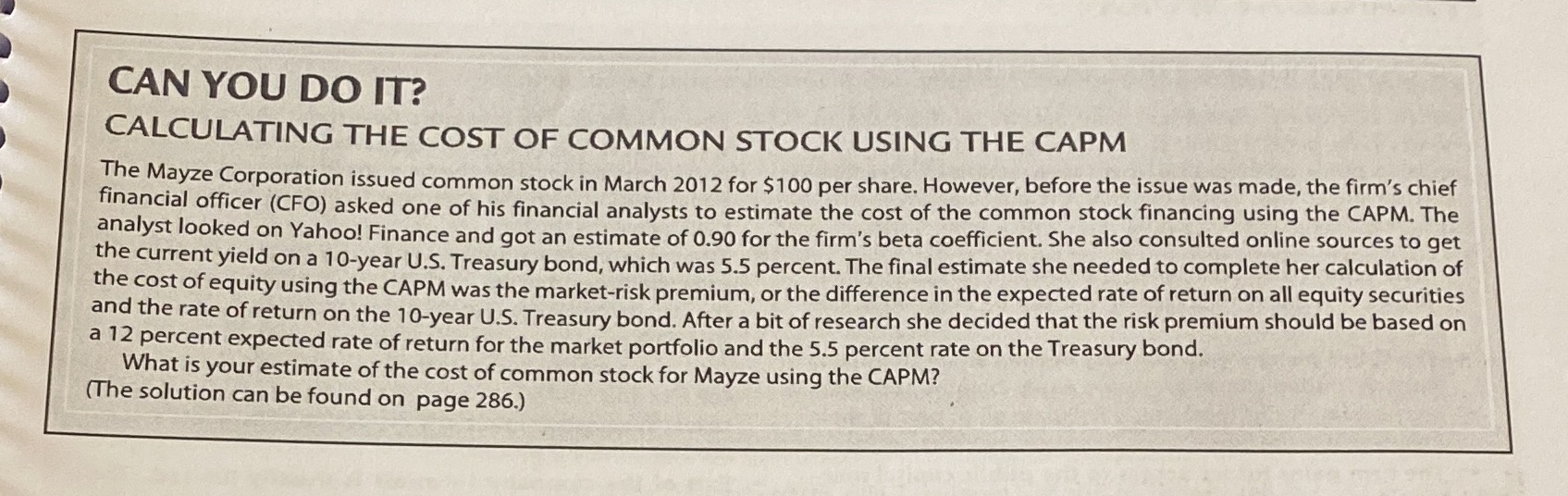

CAN YOU DO IT? CALCULATING THE COST OF COMMON STOCK USING THE CAPM The Mayze Corporation issued common stock in March 2012 for $100 per share. However, before the issue was made, the firm's chief financial officer (CFO) asked one of his financial analysts to estimate the cost of the common stock financing using the CAPM. The analyst looked on Yahoo! Finance and got an estimate of 0.90 for the firm's beta coefficient. She also consulted online sources to get the current yield on a 10-year U.S. Treasury bond, which was 5.5 percent. The final estimate she needed to complete her calculation of the cost of equity using the CAPM was the market-risk premium, or the difference in the expected rate of return on all equity securities and the rate of return on the 10-year U.S. Treasury bond. After a bit of research she decided that the risk premium should be based on a 12 percent expected rate of return for the market portfolio and the 5.5 percent rate on the Treasury bond. What is your estimate of the cost of common stock for Mayze using the CAPM? (The solution can be found on page 286.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts