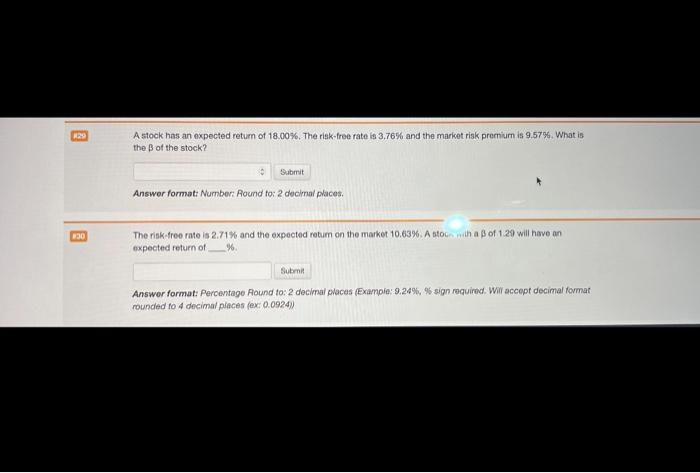

Question: hey guys, can someone help me do these two questions please. A stock has an oxpected return of 18.00%. The riak-free fate is 3.76% and

hey guys, can someone help me do these two questions please.

A stock has an oxpected return of 18.00%. The riak-free fate is 3.76% and the maricet risk premium is 9.57 ? the B of the stock? Answor format: Numbor: Aound fo: 2 decimal places. The risk-tree rate is 2.71% and the expected retum on the market 10.63%. A btocn inih a of 1.29 will have an expected return of 6. Answer format: Percentage Aound to: 2 decimal evaces fExampie: 9.24%, 9 s sign required. Will accept docimal format rounded to 4 decimal places (ex: 0.0924y)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock