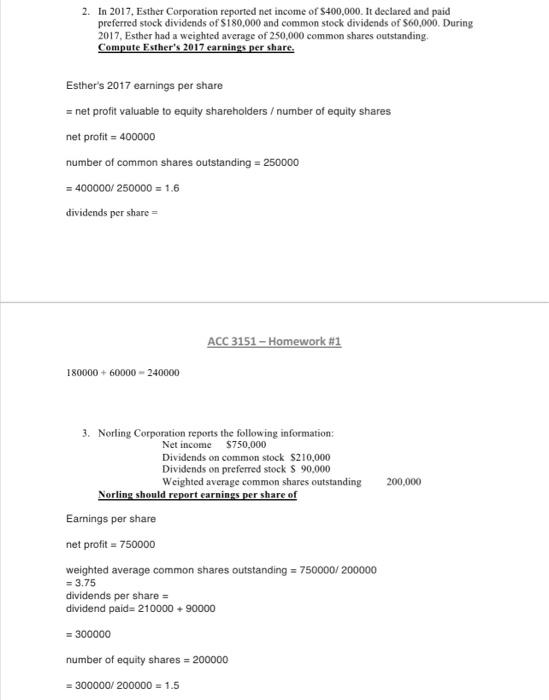

Question: hey . I answered them wrong. . would you please fix it ! i got a a feedback was saying ( Don't forget to subtract

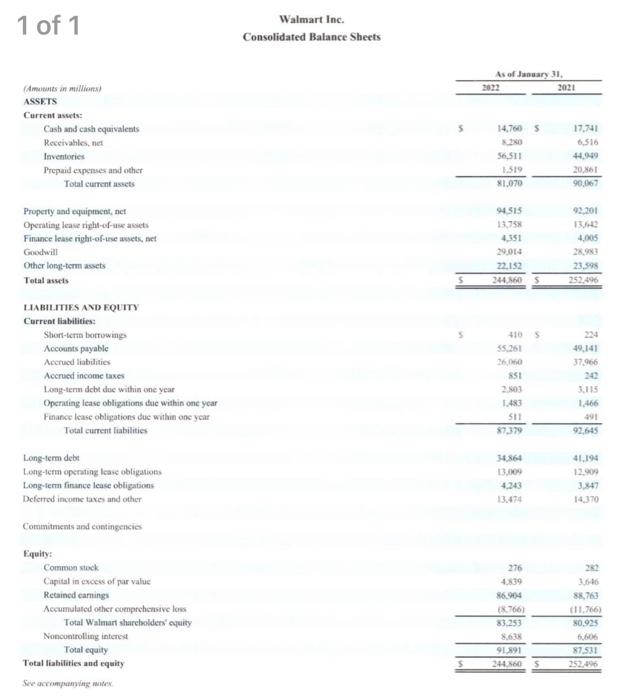

2. In 2017, Esther Corporation reported net income of $400,000. It declared and paid preferred stock dividends of $180,000 and common stock dividends of $60,000. During 2017, Esther had a weighted average of 250,000 common shares outstanding. Compute F.sther's 2017 earnings per share. Esther's 2017 earnings per share = net profit valuable to equity shareholders / number of equity shares net profit =400000 number of common shares outstanding =250000 =400000/250000=1.6 dividends per share = ACC 3151 - Homework H1 180000+60000=240000 3. Norling Corporation reports the following information: Net income $750,000 Dividends on common stock $210,000 Dividends on preferred stock S90.000 Weighted average common shares outstanding 200,000 Norling should report earnings per share of Earnings per share net profit =750000 weighted average common shares outstanding =750000/200000 =3.75 dividends per share = dividend paid =210000+90000 =300000 number of equity shares =200000 =300000/200000=1.5 1 of 1 Walmart Inc. Consolidated Balance Sheets (Amuiwests in mallions) ASSEIS Current assets: Cash and cash equivalents Receivahlos, net Inventories Prepaid expereser and other Total curnent assets 2021AsofJanaary31, Property and equipment, net Operatiag leave right-of-ase assets Finance lease right-of-rse awsets, act Goodwill Other long-term assets Tetal assets T.IABILITIES AND EQUITY Current fiabilities: Short-kers borrowings Accousts payable Accrucd liabidities Accrued income taxes Loag-ternn debt due within one year Openating lease obligations due within one year Fenance lease obligations due within one year Total current liabilities \begin{tabular}{rrr} 5.14,760 & 5 & 17,741 \\ 8.210 & & 6,516 \\ 56,511 & 44,940 \\ 1519 & & 20,861 \\ \cline { 2 - 3 } & 81,970 & 90,067 \end{tabular} Long-tem debt Long-tera operating lease obligations Long-term finance lease obligations Deferrod incone taves and other \begin{tabular}{rr} 94,515 & 02,201 \\ 13,758 & 13,,642 \\ 4,351 & 4,006 \\ 29,014 & 25,903 \\ 522,152 & 244,460 \\ \hline \end{tabular} Cotanitments and contingencies Equity: Common susck Capital in excess of par value Recained carnings Aecumalated other eomprehcrisive low Total Walnart sharebolderx' equity Noncontrolling interest Total equity Total liahilities and equity Seve acrompurring mater

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts