Hey, I just need help answering D. Pls help.

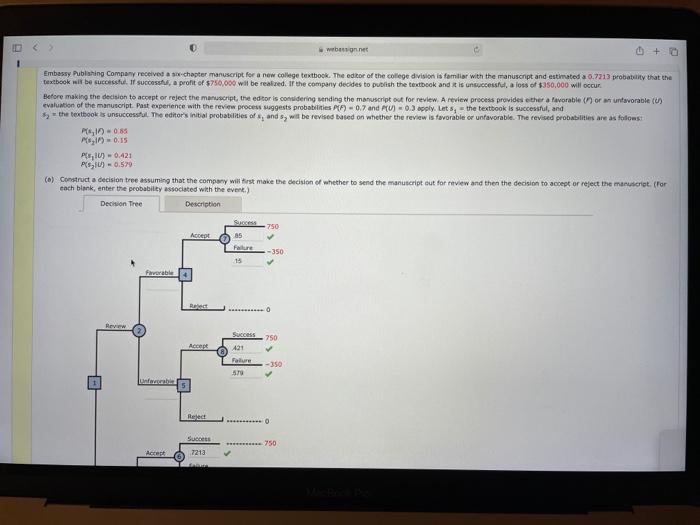

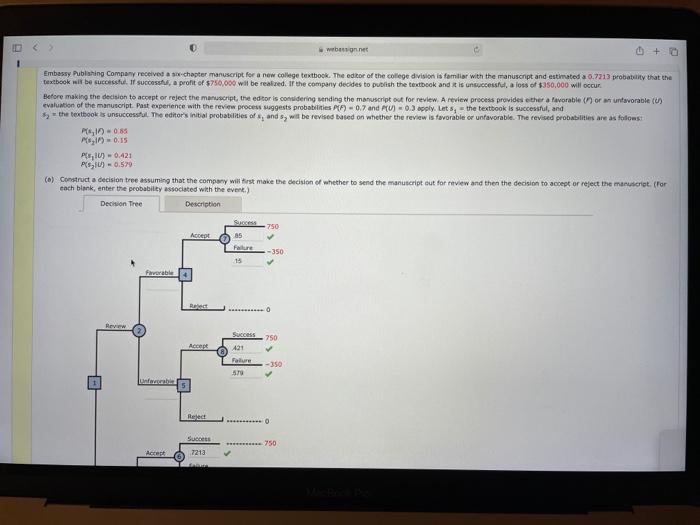

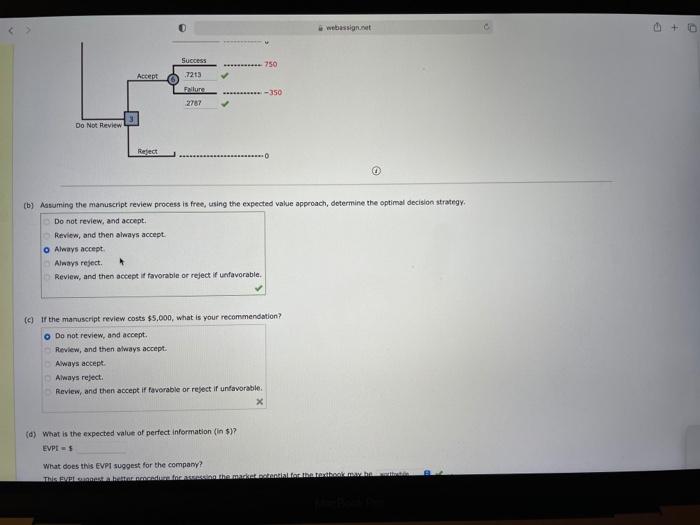

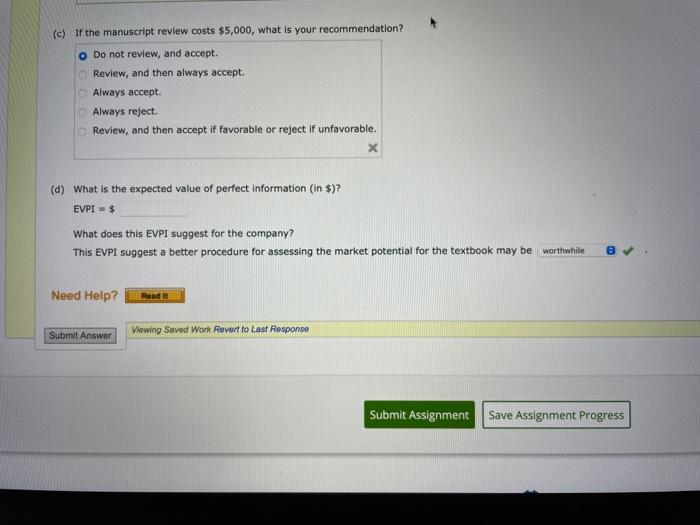

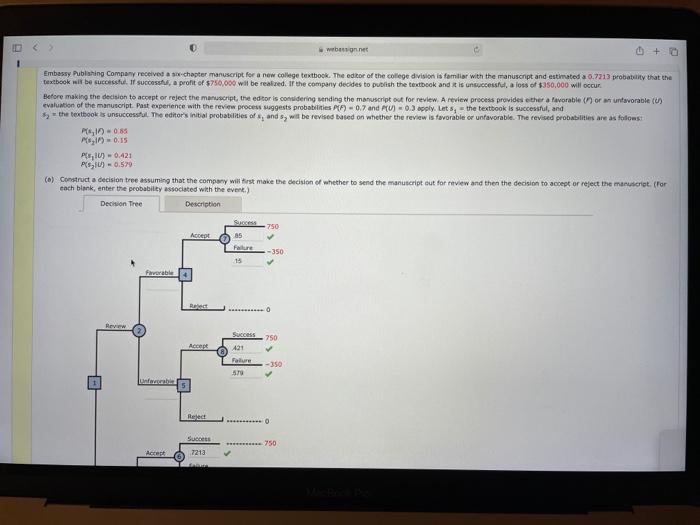

webersonne + Embassy Publishing Company received a chapter manuscript for a new college textbook. The editor of the college division is familiar with the manuscript and estimated 0.721) probability that the textbook will be success. If such a profit of $750,000 will be realized. If the company decides to publish the textbook and it is unsuccessful, a loss of $350,000 will occur Before making the decision to accept or reject the manuscript, the editor is considering sending the manuscript out for review. A review process provides ether a favorable or unfavorable (4) evaluation of the manuscript. Past experience with the review procesuggests probabilities - 0.7 and U) -0.3 oply. Lets, the textbook is successful and 5 the textbook is unsuccessful. The editor's initial probabilities of , and will be revised based on whether the review is favorable or unfavorable. The revised probabilities are as fotos! Pin 0.15 PS) 0421 PSV) - 0.570 ($) Construct a decision tree assuming that the company will first make the decision of whether to send the manuscript out for review and then the decision to accept or reject the manuscrit. (For cach blank, enter the probability associated with the event.) Decision Tree Description 750 Accept 85 Failure -350 15 Favorable 750 Accept Success 421 Failure -350 Reed Success 750 Acept 7213 webssigt 0 + Success 7213 750 -350 Flure 2787 Do Not Review (b) Assuming the manuscript review process is free, using the expected value approach, determine the optimal decision strategy Do not review, and accept Review, and then always accept Always accept Always reject. Review, and then accept of favorable or rejectif unfavorable. (If the manuscript review costs $5,000, what is your recommendation? Do not review, and accept Review, and then always accept. Always accept Always reject. Review, and then accept if favorable or reject if unfavorable X (d) What is the expected value of perfect information (in $)? EVPES What does this EVPI suggest for the company? cedentemente no hem (c) If the manuscript review costs $5,000, what is your recommendation? O Do not review, and accept. Review, and then always accept Always accept Always reject. Review, and then accept if favorable or reject if unfavorable. X (d) What is the expected value of perfect information (in $)? EVPI = $ What does this EVPI suggest for the company? This EVPI suggest a better procedure for assessing the market potential for the textbook may be worthwhile Need Help? Raad Submit Answer Viewing Saved Work Revert to Last Response Submit Assignment Save Assignment Progress webersonne + Embassy Publishing Company received a chapter manuscript for a new college textbook. The editor of the college division is familiar with the manuscript and estimated 0.721) probability that the textbook will be success. If such a profit of $750,000 will be realized. If the company decides to publish the textbook and it is unsuccessful, a loss of $350,000 will occur Before making the decision to accept or reject the manuscript, the editor is considering sending the manuscript out for review. A review process provides ether a favorable or unfavorable (4) evaluation of the manuscript. Past experience with the review procesuggests probabilities - 0.7 and U) -0.3 oply. Lets, the textbook is successful and 5 the textbook is unsuccessful. The editor's initial probabilities of , and will be revised based on whether the review is favorable or unfavorable. The revised probabilities are as fotos! Pin 0.15 PS) 0421 PSV) - 0.570 ($) Construct a decision tree assuming that the company will first make the decision of whether to send the manuscript out for review and then the decision to accept or reject the manuscrit. (For cach blank, enter the probability associated with the event.) Decision Tree Description 750 Accept 85 Failure -350 15 Favorable 750 Accept Success 421 Failure -350 Reed Success 750 Acept 7213 webssigt 0 + Success 7213 750 -350 Flure 2787 Do Not Review (b) Assuming the manuscript review process is free, using the expected value approach, determine the optimal decision strategy Do not review, and accept Review, and then always accept Always accept Always reject. Review, and then accept of favorable or rejectif unfavorable. (If the manuscript review costs $5,000, what is your recommendation? Do not review, and accept Review, and then always accept. Always accept Always reject. Review, and then accept if favorable or reject if unfavorable X (d) What is the expected value of perfect information (in $)? EVPES What does this EVPI suggest for the company? cedentemente no hem (c) If the manuscript review costs $5,000, what is your recommendation? O Do not review, and accept. Review, and then always accept Always accept Always reject. Review, and then accept if favorable or reject if unfavorable. X (d) What is the expected value of perfect information (in $)? EVPI = $ What does this EVPI suggest for the company? This EVPI suggest a better procedure for assessing the market potential for the textbook may be worthwhile Need Help? Raad Submit Answer Viewing Saved Work Revert to Last Response Submit Assignment Save Assignment Progress