Question: Hey I need help with this problem, if you can provide detail on how you got the answer thats be great! This is a 2

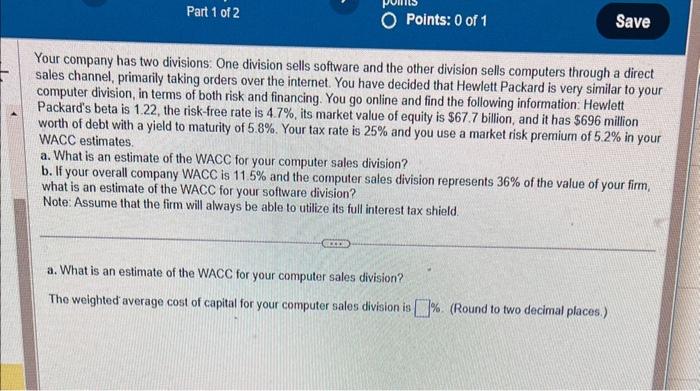

Your company has two divisions: One division sells software and the other division sells computers through a direct sales channel, primarily taking orders over the internet. You have decided that Hewlett Packard is very similar to your computer division, in terms of both risk and financing. You go online and find the following information: Hewlett Packard's beta is 1.22 , the risk-free rate is 4.7%, its market value of equity is $67.7 billion, and it has $696 million worth of debt with a yield to maturity of 5.8%. Your tax rate is 25% and you use a market risk premium of 5.2% in your WACC estimates. a. What is an estimate of the WACC for your computer sales division? b. If your overall company WACC is 11.5% and the computer sales division represents 36% of the value of your firm, what is an estimate of the WACC for your software division? Note: Assume that the firm will always be able to utilize its full interest tax shield. a. What is an estimate of the WACC for your computer sales division? The weighted average cost of capital for your computer sales division is \%. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts