Question: Hey I need help with this problem, if you can provide detail on how you got the answer thats be great! A retail coffee company

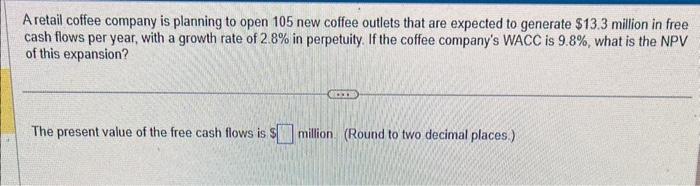

A retail coffee company is planning to open 105 new coffee outlets that are expected to generate $13.3 million in free cash flows per year, with a growth rate of 2.8% in perpetuity. If the coffee company's WACC is 9.8%, what is the NPV of this expansion? The present value of the free cash flows is $ million. (Round to two decimal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts