Question: Hey there I need help with this question that I missed the lecture on. Practice Questions Chapter 9 Your firm has estimated the following cash

Hey there I need help with this question that I missed the lecture on.

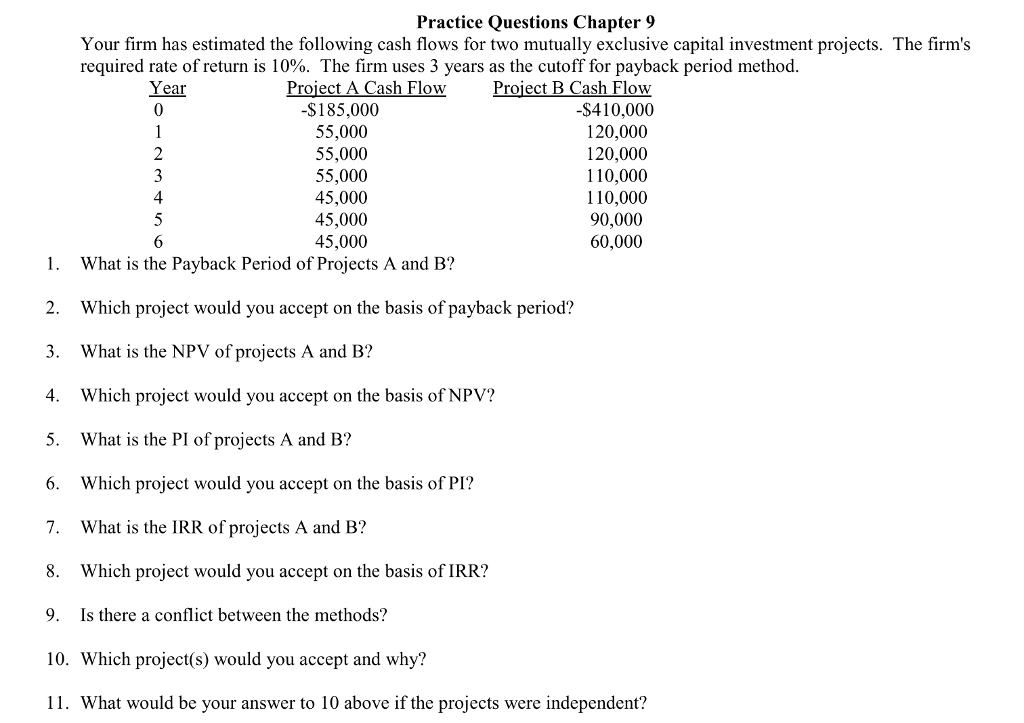

Practice Questions Chapter 9 Your firm has estimated the following cash flows for two mutually exclusive capital investment projects. The firm's required rate of return is 10%. The firm uses 3 years as the cutoff for payback period method Year Proiect A Cash Flow -$185,000 55,000 55,000 55,000 45,000 45,000 45,000 Proiect B Cash Flow -$410,000 120,000 120,000 110,000 110,000 90,000 60,000 3 4 1. What is the Payback Period of Projects A and B? 2. Which project would you accept on the basis of payback period? 3. What is the NPV of projects A and B? 4. Which project would you accept on the basis of NPV? 5. What is the PI of projects A and B? 6. Which project would you accept on the basis of PI? 7. What is the IRR of projects A and B? 8. Which project would you accept on the basis of IRR? 9. Is there a conflict between the methods? 10. Which project(s) would you accept and why? 11. What would be your answer to 10 above if the projects were independent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts