Question: i need some to solve these question along complete explanation and solution Assignment & Practice Questions Note: Attempt even questions only for assignment TVM Q1.

i need some to solve these question along complete explanation and solution

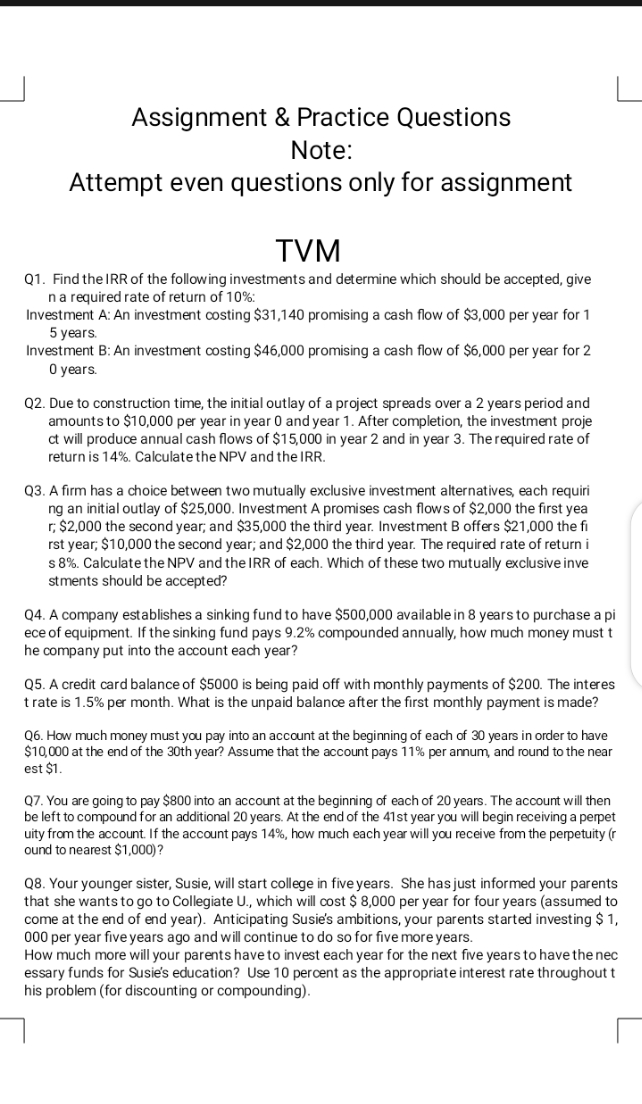

Assignment & Practice Questions Note: Attempt even questions only for assignment TVM Q1. Find the IRR of the following investments and determine which should be accepted, give n a required rate of return of 10% Investment A: An investment costing $31,140 promising a cash flow of $3,000 per year for 1 5 years. Investment B: An investment costing $46,000 promising a cash flow of $6,000 per year for 2 0 years. Q2. Due to construction time, the initial outlay of a project spreads over a 2 years period and amounts to $10,000 per year in year 0 and year 1. After completion, the investment proje ct will produce annual cash flows of $15,000 in year 2 and in year 3. The required rate of return is 14%. Calculate the NPV and the IRR. Q3. A firm has a choice between two mutually exclusive investment alternatives, each requiri ng an initial outlay of $25,000. Investment A promises cash flows of $2,000 the first yea r; $2,000 the second year; and $35,000 the third year. Investment B offers $21,000 the fi rst year, $10,000 the second year; and $2,000 the third year. The required rate of return i s 8%. Calculate the NPV and the IRR of each. Which of these two mutually exclusive inve stments should be accepted? Q4. A company establishes a sinking fund to have $500,000 available in 8 years to purchase a pi ece of equipment. If the sinking fund pays 9.2% compounded annually, how much money must t he company put into the account each year? Q5. A credit card balance of $5000 is being paid off with monthly payments of $200. The interes t rate is 1.5% per month. What is the unpaid balance after the first monthly payment is made? Q6. How much money must you pay into an account at the beginning of each of 30 years in order to have $10,000 at the end of the 30th year? Assume that the account pays 11% per annum, and round to the near est $1. Q7. You are going to pay $800 into an account at the beginning of each of 20 years. The account will then be left to compound for an additional 20 years. At the end of the 41st year you will begin receiving a perpet uity from the account. If the account pays 14%, how much each year will you receive from the perpetuity (r ound to nearest $1,000)? Q8. Your younger sister, Susie, will start college in five years. She has just informed your parents that she wants to go to Collegiate U., which will cost $ 8,000 per year for four years (assumed to come at the end of end year). Anticipating Susie's ambitions, your parents started investing $ 1, 000 per year five years ago and will continue to do so for five more years. How much more will your parents have to invest each year for the next five years to have the nec essary funds for Susie's education? Use 10 percent as the appropriate interest rate throughout t his problem (for discounting or compounding)