Question: Hhow do u do this The net present value (NPV) for Epiphany's Project is closest to: Use the information for the question(s) below. Epiphany Industries

Hhow do u do this

Hhow do u do this

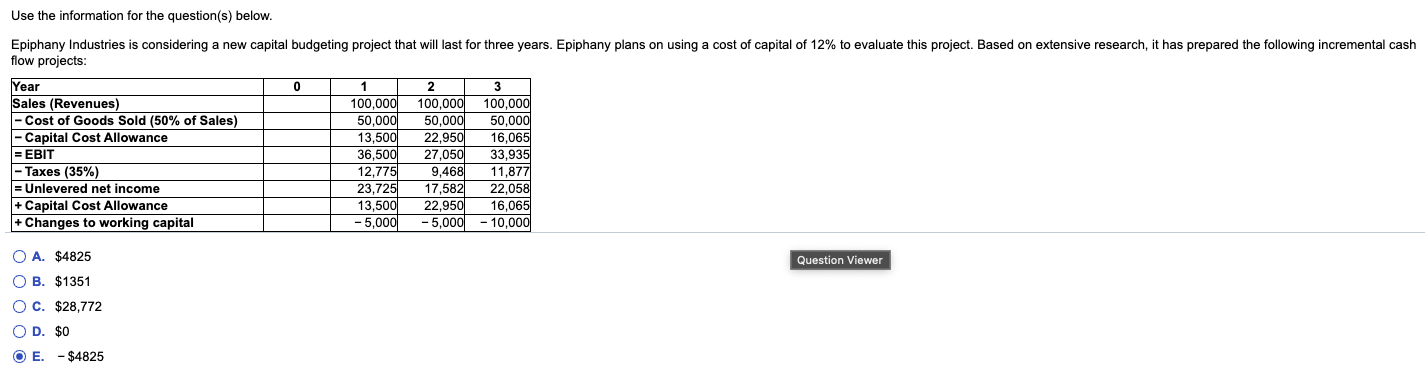

The net present value (NPV) for Epiphany's Project is closest to:

Use the information for the question(s) below. Epiphany Industries is considering a new capital budgeting project that will last for three years. Epiphany plans on using a cost of capital of 12% to evaluate this project. Based on extensive research, it has prepared the following incremental cash flow projects: 0 Year Sales (Revenues) - Cost of Goods Sold (50% of Sales) - Capital Cost Allowance = EBIT - Taxes (35%) = Unlevered net income + Capital Cost Allowance + Changes to working capital 1 100,000 50,000 13,500 36,500 12,7751 23,725 13,500 - 5,000 2 3 100,000 100,000 50,000 50,000 22,950 16,065 27,050 33,935 9,468 11,877 17,5821 22,058 22,950 16,065 - 5,000 - 10,000 Question Viewer O A. $4825 OB. $1351 O C. $28,772 OD$ D. $0 O E. - $4825 Use the information for the question(s) below. Epiphany Industries is considering a new capital budgeting project that will last for three years. Epiphany plans on using a cost of capital of 12% to evaluate this project. Based on extensive research, it has prepared the following incremental cash flow projects: 0 Year Sales (Revenues) - Cost of Goods Sold (50% of Sales) - Capital Cost Allowance = EBIT - Taxes (35%) = Unlevered net income + Capital Cost Allowance + Changes to working capital 1 100,000 50,000 13,500 36,500 12,7751 23,725 13,500 - 5,000 2 3 100,000 100,000 50,000 50,000 22,950 16,065 27,050 33,935 9,468 11,877 17,5821 22,058 22,950 16,065 - 5,000 - 10,000 Question Viewer O A. $4825 OB. $1351 O C. $28,772 OD$ D. $0 O E. - $4825

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts