Question: Hi all - looking for help with following multi-part question. Thank you! Problem 19-05A a1-a3, b1, c-d The following CVP income statements are available for

Hi all - looking for help with following multi-part question. Thank you!

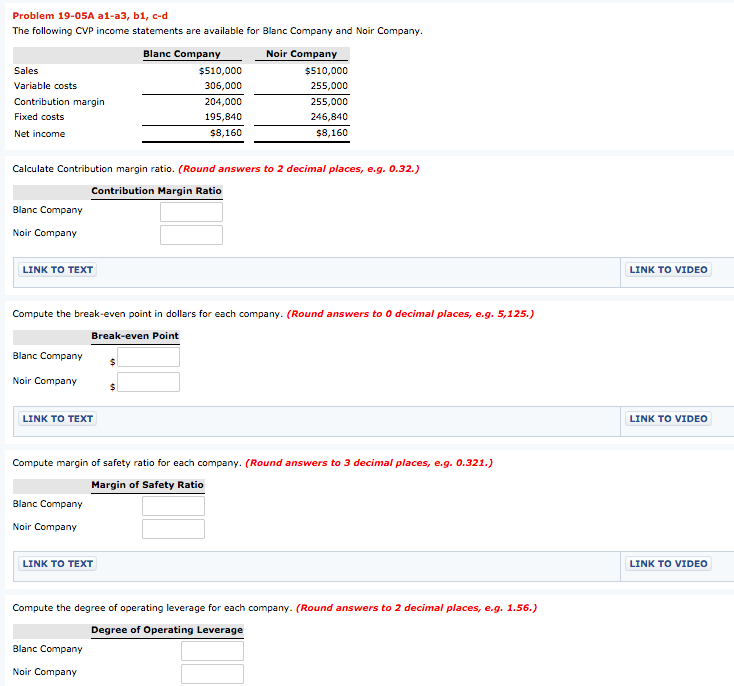

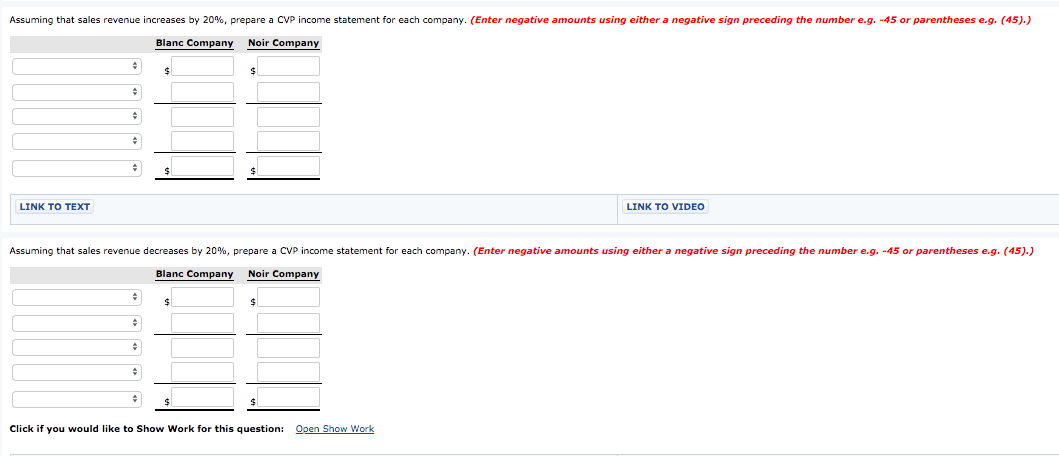

Problem 19-05A a1-a3, b1, c-d The following CVP income statements are available for Blanc Company and Noir Company. Blanc Company Noir Company Sales $510,000 $510,000 Variable costs 306,000 255,000 Contribution margin 204,000 255,000 Fixed costs 195,840 246,840 Net income $8,160 $8,160 Calculate Contribution margin ratio. (Round answers to 2 decimal places, e.g. 0.32.) Contribution Margin Ratio Blanc Company Noir Company LINK TO TEXT LINK TO VIDEO Compute the break-even point in dollars for each company. (Round answers to 0 decimal places, e.g. 5,125.) Break-even Point Blanc Company Noir Company LINK TO TEXT LINK TO VIDEO Compute margin of safety ratio for each company. (Round answers to 3 decimal places, e.g. 0.321.] Margin of Safety Ratio Blanc Company Noir Company LINK TO TEXT LINK TO VIDEO Compute the degree of operating leverage for each company. (Round answers to 2 decimal places, e.g. 1.56.) Degree of Operating Leverage Blanc Company Noir CompanyAssuming that sales revenue increases by 20%, prepare a CVP income statement for each company. ( Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Blanc Company Noir Company LINK TO TEXT LINK TO VIDEO Assuming that sales revenue decreases by 20%, prepare a CVP income statement for each company. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Blanc Company Noir Company Click if you would like to Show Work for this question: Open Show Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts