Question: Hi. Am stuck here. Help with step by step solution. QUESTION ONE Company A and B are in the same risk class and are identical

Hi. Am stuck here. Help with step by step solution.

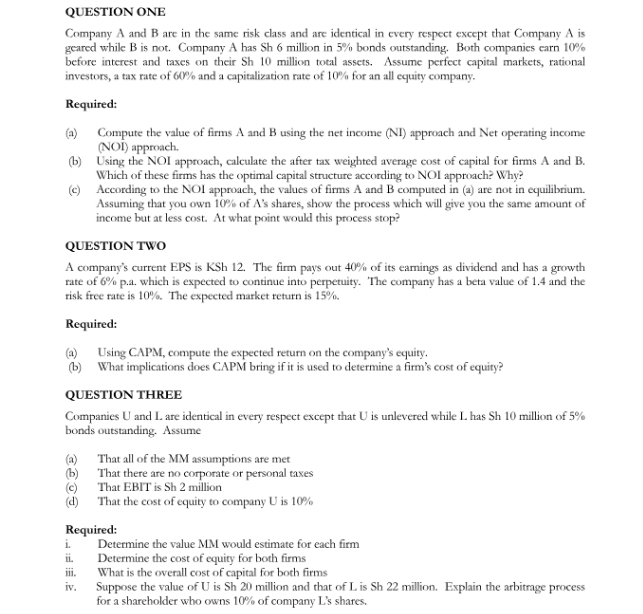

QUESTION ONE Company A and B are in the same risk class and are identical in every respect except that Company A is geared while B is not. Company A has Sh 6 million in 5% bonds outstanding. Both companies carn 10% before interest and taxes on their Sh 10 million total assets. Assume perfect capital markets, rational investors, a tax rate of 60% and a capitalization rate of 10% for an all equity company. Required: (a) Compute the value of firms A and B using the net income (NI) approach and Net operating income (NOD) approach. (b) Using the NOI approach, calculate the after tax weighted average cost of capital for firms A and B. Which of these firms has the optimal capital structure according to NOI approach? Why? (c) According to the NOI approach, the values of firms A and B computed in (a) are not in equilibrium. Assuming that you own 10% of A's shares, show the process which will give you the same amount of income but at less cost. At what point would this process stop? QUESTION TWO A company's current EPS is KSh 12. The firm pays out 40% of its earnings as dividend and has a growth rate of 6% p.a. which is expected to continue into perpetuity. The company has a beta value of 1.4 and the risk free rate is 10%. The expected market return is 15%. Required: a) Using CAPM, compute the expected return on the company's equity. (b) What implications does CAPM bring if it is used to determine a firm's cost of equity? QUESTION THREE Companies U and L are identical in every respect except that U is unlevered while L. has Sh 10 million of 5% bonds outstanding. Assume (a) That all of the MM assumptions are met (b) That there are no corporate or personal taxes (c) That EBIT is Sh 2 million (d That the cost of equity to company U is 10% Required: Determine the value MM would estimate for each firm IL. Determine the cost of equity for both firms iii. What is the overall cost of capital for both firms iv . Suppose the value of U is Sh 20 million and that of L is Sh 22 million. Explain the arbitrage process for a shareholder who owns 10% of company L's shares

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts