Question: hi can anyone help me with this problem question?? its mangerial accounting and i keep on getting the 2 wrong so if anyone knows it

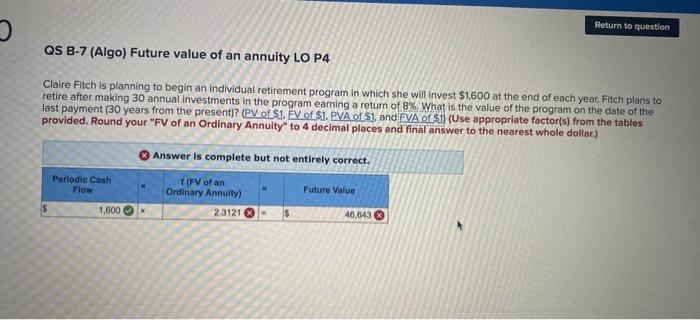

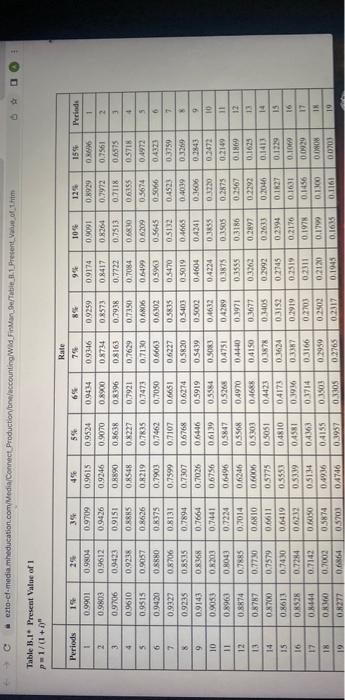

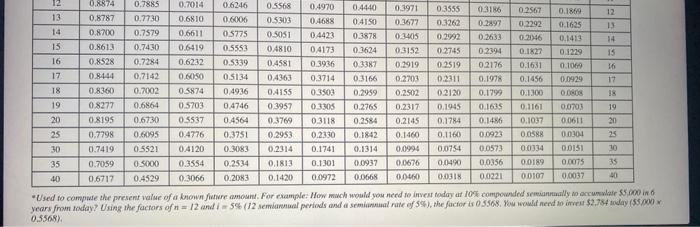

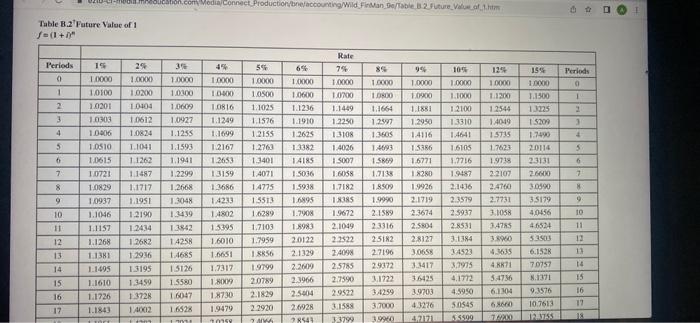

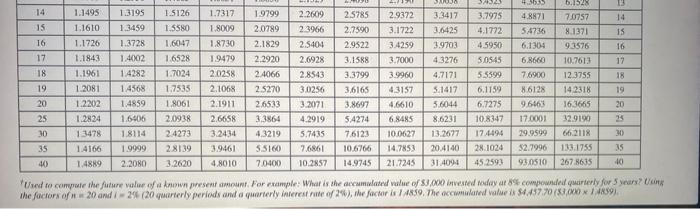

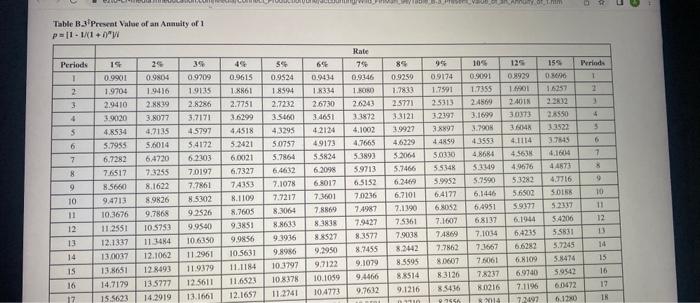

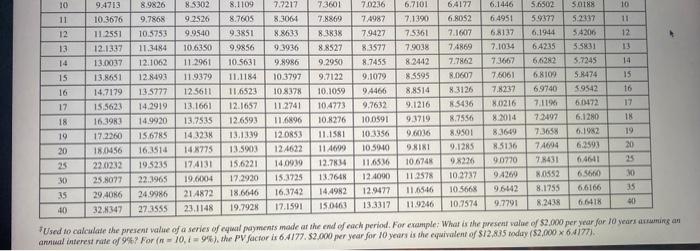

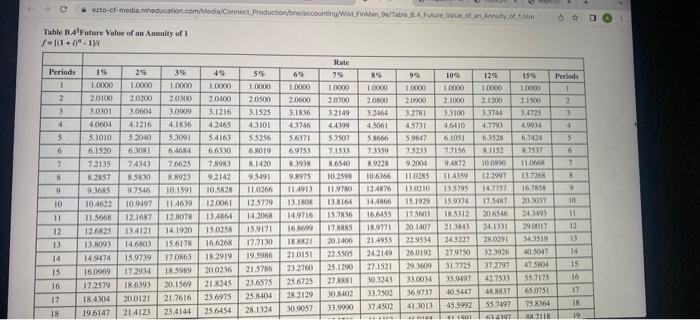

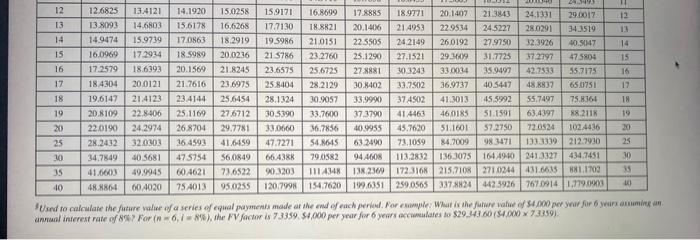

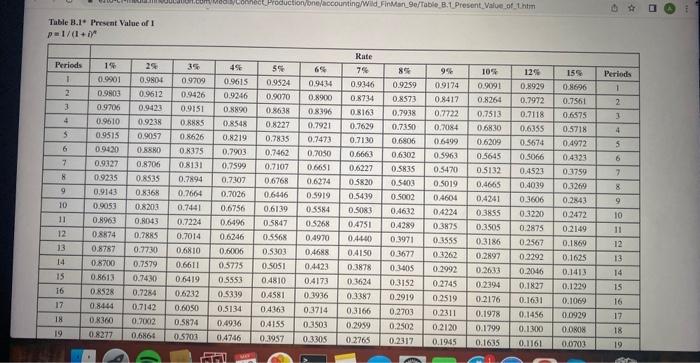

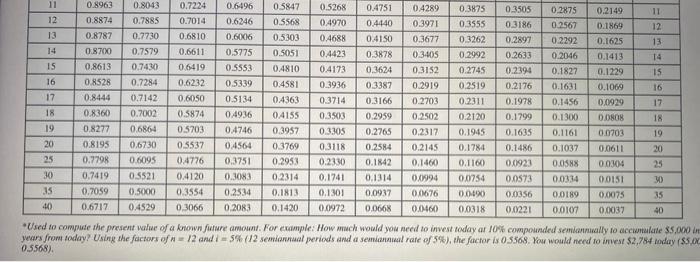

QS B-7 (Algo) Future value of an annuity LO P4 Claire Fitch is planning to begin an individual retirement program in which she will invest $1,600 at the end of each year. Fitch plans to retire after making 30 annual investments in the program earning a return of 8%. What is the value of the program on the date of the last payment (30 years from the present)? (PV of \$1. EV of \$1, PVA of \$1, and:EVA of \$1) (Use appropriate factor(s) from the tables provided. Round your "FV of an Ordinary Annuity" to 4 decimal places and final answer to the nearest whole dollar.) Table B.t* Present Value of I p=1/(1+)n 0.5568). Table B. 2' Fature Value of 1 f=(1+)n TUudt to compate the future value of a drown preseat awount. For example: What is the accumwlatd walue of 53,000 invested naday at 34 compounded quarienly for 5 y ears? Uaing Table B 3f Proscat Walae of an Anauity of 1 TUsed to calculake the present value of a series of equal payments made at the end of each period. For example: What is the j.resent value of 52.000 per year far 10 years aziwints an Table B.AlFutere Value of an AnEuity of 1 f=f(1+nn1) Table B.1* Proseat Value of 1 p=1/(1+i)n "Used to compuste the present value of a known firture amount. For example: How mach would you need to inwest today at 10% compounded semiarnially to acciunakile 35 , Ooo years from today? Using the factors of A=12 and i=5% (12 semiannaal periods and a semiansial rate of 5% es), the factor is 0.5568 . Your would necd so imvest $2,784 moday ($5,0 0.5568)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts