Question: hi can i get help Chapter 1 Foundational 15 6 Pantof 0.83 Seppel Bock S Required information The Foundational 15 (Alge) (LO1-1, LO1-2, LO1-3, LO1-4,

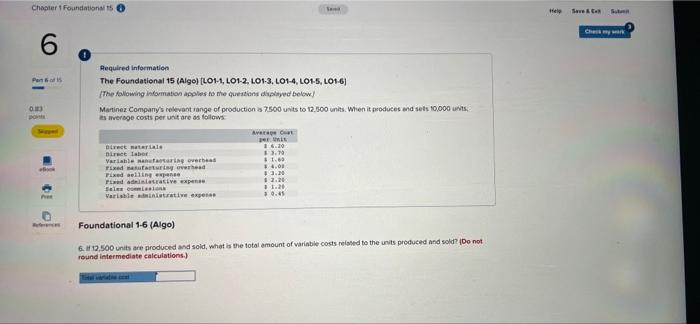

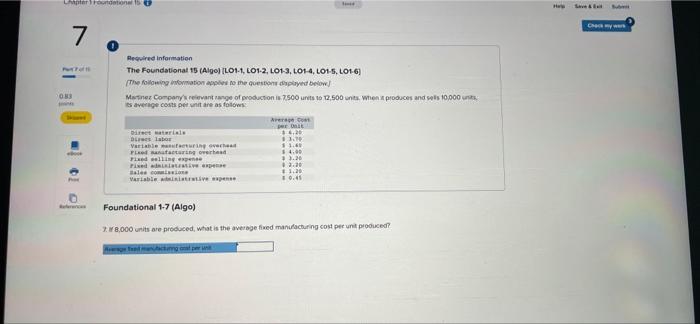

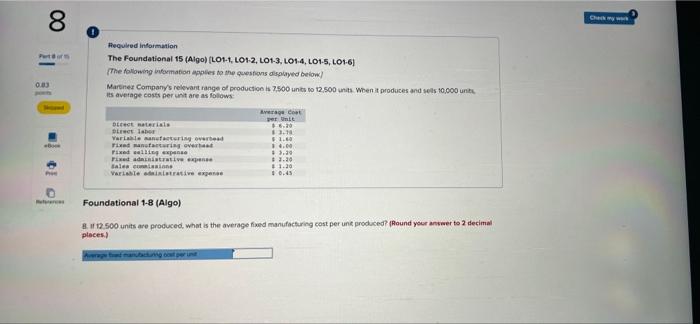

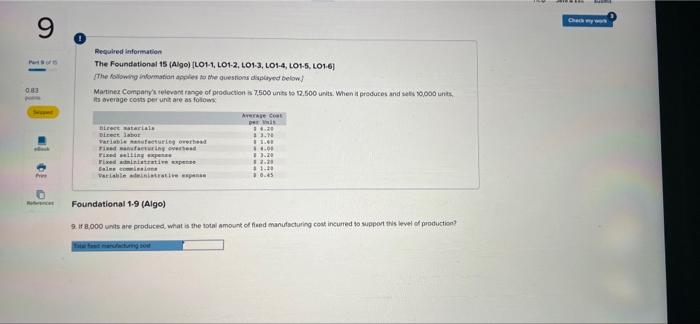

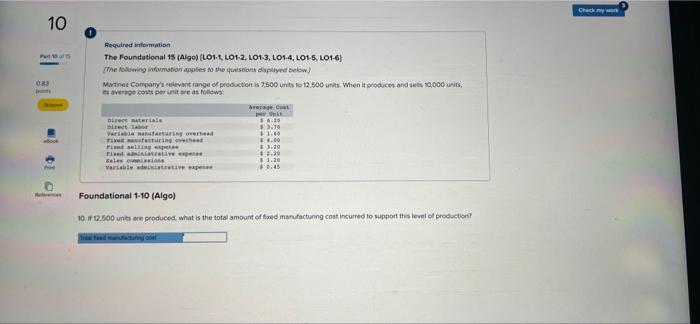

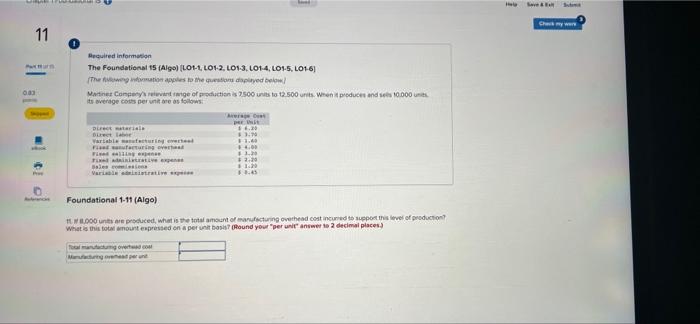

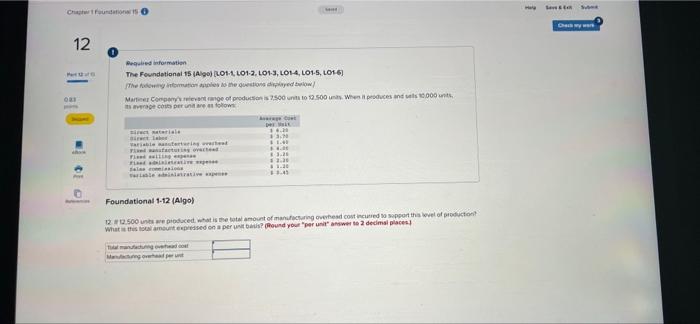

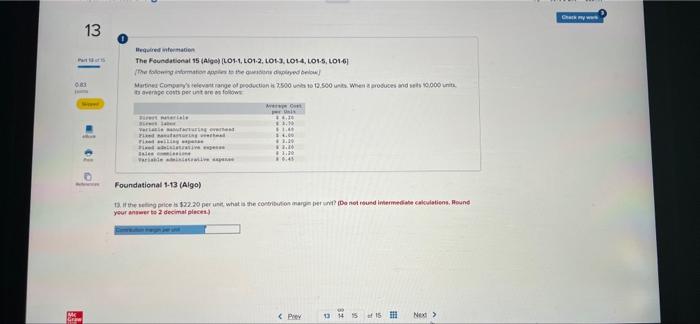

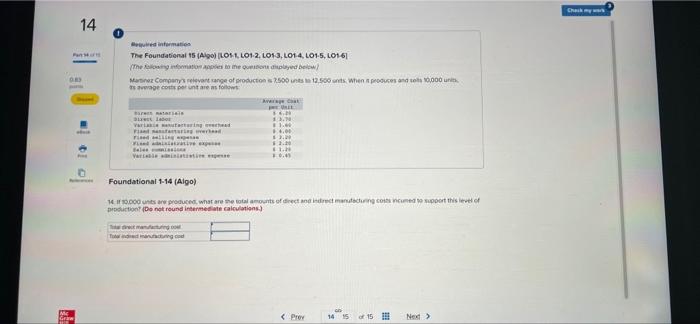

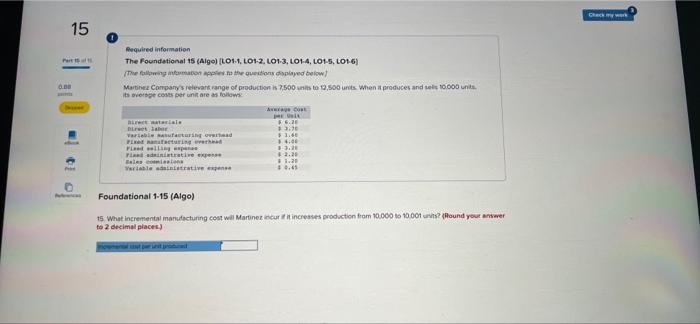

Chapter 1 Foundational 15 6 Pantof 0.83 Seppel Bock S Required information The Foundational 15 (Alge) (LO1-1, LO1-2, LO1-3, LO1-4, LO1-5, LO1-6) [The following information applies to the questions displayed below) Martinez Company's relevant range of production is 7.500 units to 12.500 units. When it produces and sets 10,000 units as average costs per unit are as follows Average C Direct materiale per unit 4.20 Direct labor $3.70 Variable manufacturing overhead $1.60 $4.00 Fixed manufacturing overhead Fixed selling expense 43.20 Find administrative expense Sales commissions $2.20 #1.20 Variable administrative expens $0.45 Foundational 1-6 (Algo) 6. If 12,500 units are produced and sold, what is the total amount of variable costs related to the units produced and sold? (Do not round intermediate calculations.) Help Sub Chemark Save & C Chapter Foundationer 15 7 083 - 01 of Required information The Foundational 15 (Algo) [LO1-1, LO1-2, LO1-3, LO1-4, LO1-5, LO1-6) [The following information applies to the questions displayed below Martinez Company's relevant range of production is 7.500 units to 12,500 units. When it produces and sells 10,000 units its average costs per unit are as follows Average Co per Dat $4.20 Direct materials Dins labor $ 3.70 11.40 $4.00 Variable manufacturing overhed Fleed anafacturing overhead Fixed selling expense Fixed administrative expe Bales commissione $3.20 03.20 1:20 0.45 Variable inistrative pen Foundational 1-7 (Algo) 28,000 units are produced, what is the average fixed manufacturing cost per unit produced? Read actung anat per un Hap Save & Sub Check my werk 8 Perdor 0.03 book DE Required information The Foundational 15 (Algo) (LO1-1, LO1-2, LO1-3, LO1-4, LO1-5, LO1-6) (The following information applies to the questions displayed below) Martinez Company's relevant range of production is 7,500 units to 12,500 units. When it produces and sells 10,000 unit Its average costs per unit are as follows Average Cost per Unit $6.20 Direct materials Direct labor $3.18 F1.40 Variable manufacturing overbead Fixed manufacturing overhead Fixed selling expense 14.00 Fixed administrative expense $3.39 3.20 1.20 Sales commission Variable inistrative expense Foundational 1-8 (Algo) 8. If 12.500 units are produced, what is the average fixed manufacturing cost per unit produced? (Round your answer to 2 decimal places) Average and manufacturing out per un 9 P 0.83 pom k lo Required information The Foundational 15 (Algo) (LO1-1, LO1-2, LO1-3, LO1-4, LO1-5, LO1-6] [The following information applies to the questions displayed below) Martinez Company's relevant range of production is 7,500 units to 12,500 units. When it produces and sets 10,000 units its everage costs per unit are as follows Average Coat DHE this 14.20 Birect materials Direct labor $ 3.70 Variable manufacturing overhead F1.4 rised anfacturing overed $4.00 Fized selling expense 13.20 Fixed administrative expens 2.2 Sains commission 41.20 0.45 Variable administrative spe Foundational 1-9 (Algo) 9. If 8,000 units are produced, what is the total amount of fixed manufacturing cost incurred to support this level of production? Tatar fast manufacturing o 10 Prof 0.83 j Scopel Required information The Foundational 15 (Algo) (LO1-1, LO1-2, LO1-3, LO1-4, LO1-5, LO1-6) [The following information applies to the questions displayed below! Martinez Company's relevant range of production is 7,500 units to 12.500 units. When it produces and sells 10,000 units, es average costs per unit are as follows: direct materials Average Cost par Unit $4.20 $ 3.70 Direct labor Variable manufacturing overhead $1.00 -Tired musstarturing ovathend- 84.00 Find selling expense $3.20 4.2.20 Fixed sinistrative exp Sales comissions $1.20 Variable sinistrative exp $8.45 Foundational 1-10 (Algo) 10. If 12.500 units are produced, what is the total amount of fixed manufacturing cost incured to support this level of production? fedcting Check my work HEARTTUNARO 11 Putturs 0.03 Shpped Ac bod Required information The Foundational 15 (Algo) (LO1-1, LO1-2, LO1-3, LO1-4, LO1-5, L01-6) The following information apples to the questions displayed below Martinez Company's relevant range of production is 7.500 units to 12.500 units. When it produces and sels 10.000 units its average costs per unit are as follows Average C Direct materials per hit $4.20 Direct Labor $ 3.70 11.40 Variable manufacturing evected Ffacturing overhead Fiding expens 1600 4.1.20 #2.20 Fix adinistrative expens Baies commission $1.29 Variable distrative 11.45 Foundational 1-11 (Algo) 18,000 units are produced, what is the total amount of manufacturing overhead cost incurred to support this level of production? What is this total amount expressed on a per unit basis? (Round your "per unit answer to 2 decimal places) Total manufactumg overtad cost Manufacturing over He Check my werk Chapter 1 Foundation 150 12 Per 081 DE of w Required information The Foundational 15 (Alge) (LO1-1, L01-2, LO1-3, LO1-4, LO1-5, LO1-6) Martinez Company's relevant range of production is 7,500 units to 12.500 units. When it produces and sells 10.000 units as average costs per unit are as follows irect nateriale AC per i 14.30 13.3 Bir aber Variable startering overhead FLA FL Ffacturing ovated Find siling expe 13.20 12.30 FLANE tivess Salas comissions 4.3.20 variable administrative Foundational 1-12 (Algo) 12 #12.500 units are produced, what is the total amount of manufacturing overhead cost incurred to support this level of production What is this total amount expressed on a per unit basis? (Round your "per unit" answer to 2 decimal places Tual manufacturing overhead cost Malang ove Subs Check my werk 13 M G Part 1 083 To Required information The Foundational 15 (Alge) (LO1-1, LO1-2, LO1-3, LOS-4, LO1-5, L016) (The following information applies to the questions displayed below Martines Company's relevant range of production is 2500 units to 12.500 units. When a produces and sets 10.000 unit its average costs per unt are as follows were Cort Piret nateriale per Unis *4.10 be 13.10 Veriai tarring over $1.4 $4.00 Tiling p 4.3.20 Filtration expe 12.20 Isles a #3.20 cetative pen 0:45 Foundational 1-13 (Algo) 13. If the seling price is $22.20 per unit, what is the contribution margin per unit? Do not round intermediate calculations, Round your answer to 2 decimal places) Chack my werk 14 Pa 0.83 10 m Required information The Foundational 15 (Algo) (LO1-1, LO1-2, LO1-3, LO1-4, LO1-5, LO1-6] (The following information applies to the questions displayed below) Martinez Company's relevant range of production 2500 unts to 12.500 unts when a produces and sells 10,000 units. as average costs per unit are as follows Average Cost E aren atari FAN 13.7 Set Labor Varanged $1.00 $4.00 Flandring verd rised selling p Finisative expe $3.00 $.2.20 flession 11.8 Variable initiation expe 10.09 Foundational 1-14 (Algo) 14 I 10,000 units are produced, what are the total amounts of direct and indirect manufacturing costs incumed to support this level of production? (Do not round intermediate calculations) det manufacturing.com Check my w 15 Part 15 0.00 10 to Required information The Foundational 15 (Algo) (LO1-1, LO1-2, LO1-3, LO1-4, LO1-5, LO1-6) (The following information applies to the questions displayed below) Martinez Company's relevant range of production is 7,500 units to 12,500 units. When it produces and sells 10.000 units. its average costs per unit are as follows Average E pe sit $6.20 Birect materials 13.06 Direct labor Variable sufacturing overtad $ 1.40 3.4.00 Fixed facturing Fland selling expans Fland 3.3.20 dinistrative expense 42.20 Bales commission $ 1.20 Variable administrative expense 0.45 Foundational 1-15 (Algo) 15. What incremental manufacturing cost will Martinez incur if it increases production from 10.000 to 10.001 units? (Round your answer to 2 decimal places) Check my werk Chapter 1 Foundational 15 6 Pantof 0.83 Seppel Bock S Required information The Foundational 15 (Alge) (LO1-1, LO1-2, LO1-3, LO1-4, LO1-5, LO1-6) [The following information applies to the questions displayed below) Martinez Company's relevant range of production is 7.500 units to 12.500 units. When it produces and sets 10,000 units as average costs per unit are as follows Average C Direct materiale per unit 4.20 Direct labor $3.70 Variable manufacturing overhead $1.60 $4.00 Fixed manufacturing overhead Fixed selling expense 43.20 Find administrative expense Sales commissions $2.20 #1.20 Variable administrative expens $0.45 Foundational 1-6 (Algo) 6. If 12,500 units are produced and sold, what is the total amount of variable costs related to the units produced and sold? (Do not round intermediate calculations.) Help Sub Chemark Save & C Chapter Foundationer 15 7 083 - 01 of Required information The Foundational 15 (Algo) [LO1-1, LO1-2, LO1-3, LO1-4, LO1-5, LO1-6) [The following information applies to the questions displayed below Martinez Company's relevant range of production is 7.500 units to 12,500 units. When it produces and sells 10,000 units its average costs per unit are as follows Average Co per Dat $4.20 Direct materials Dins labor $ 3.70 11.40 $4.00 Variable manufacturing overhed Fleed anafacturing overhead Fixed selling expense Fixed administrative expe Bales commissione $3.20 03.20 1:20 0.45 Variable inistrative pen Foundational 1-7 (Algo) 28,000 units are produced, what is the average fixed manufacturing cost per unit produced? Read actung anat per un Hap Save & Sub Check my werk 8 Perdor 0.03 book DE Required information The Foundational 15 (Algo) (LO1-1, LO1-2, LO1-3, LO1-4, LO1-5, LO1-6) (The following information applies to the questions displayed below) Martinez Company's relevant range of production is 7,500 units to 12,500 units. When it produces and sells 10,000 unit Its average costs per unit are as follows Average Cost per Unit $6.20 Direct materials Direct labor $3.18 F1.40 Variable manufacturing overbead Fixed manufacturing overhead Fixed selling expense 14.00 Fixed administrative expense $3.39 3.20 1.20 Sales commission Variable inistrative expense Foundational 1-8 (Algo) 8. If 12.500 units are produced, what is the average fixed manufacturing cost per unit produced? (Round your answer to 2 decimal places) Average and manufacturing out per un 9 P 0.83 pom k lo Required information The Foundational 15 (Algo) (LO1-1, LO1-2, LO1-3, LO1-4, LO1-5, LO1-6] [The following information applies to the questions displayed below) Martinez Company's relevant range of production is 7,500 units to 12,500 units. When it produces and sets 10,000 units its everage costs per unit are as follows Average Coat DHE this 14.20 Birect materials Direct labor $ 3.70 Variable manufacturing overhead F1.4 rised anfacturing overed $4.00 Fized selling expense 13.20 Fixed administrative expens 2.2 Sains commission 41.20 0.45 Variable administrative spe Foundational 1-9 (Algo) 9. If 8,000 units are produced, what is the total amount of fixed manufacturing cost incurred to support this level of production? Tatar fast manufacturing o 10 Prof 0.83 j Scopel Required information The Foundational 15 (Algo) (LO1-1, LO1-2, LO1-3, LO1-4, LO1-5, LO1-6) [The following information applies to the questions displayed below! Martinez Company's relevant range of production is 7,500 units to 12.500 units. When it produces and sells 10,000 units, es average costs per unit are as follows: direct materials Average Cost par Unit $4.20 $ 3.70 Direct labor Variable manufacturing overhead $1.00 -Tired musstarturing ovathend- 84.00 Find selling expense $3.20 4.2.20 Fixed sinistrative exp Sales comissions $1.20 Variable sinistrative exp $8.45 Foundational 1-10 (Algo) 10. If 12.500 units are produced, what is the total amount of fixed manufacturing cost incured to support this level of production? fedcting Check my work HEARTTUNARO 11 Putturs 0.03 Shpped Ac bod Required information The Foundational 15 (Algo) (LO1-1, LO1-2, LO1-3, LO1-4, LO1-5, L01-6) The following information apples to the questions displayed below Martinez Company's relevant range of production is 7.500 units to 12.500 units. When it produces and sels 10.000 units its average costs per unit are as follows Average C Direct materials per hit $4.20 Direct Labor $ 3.70 11.40 Variable manufacturing evected Ffacturing overhead Fiding expens 1600 4.1.20 #2.20 Fix adinistrative expens Baies commission $1.29 Variable distrative 11.45 Foundational 1-11 (Algo) 18,000 units are produced, what is the total amount of manufacturing overhead cost incurred to support this level of production? What is this total amount expressed on a per unit basis? (Round your "per unit answer to 2 decimal places) Total manufactumg overtad cost Manufacturing over He Check my werk Chapter 1 Foundation 150 12 Per 081 DE of w Required information The Foundational 15 (Alge) (LO1-1, L01-2, LO1-3, LO1-4, LO1-5, LO1-6) Martinez Company's relevant range of production is 7,500 units to 12.500 units. When it produces and sells 10.000 units as average costs per unit are as follows irect nateriale AC per i 14.30 13.3 Bir aber Variable startering overhead FLA FL Ffacturing ovated Find siling expe 13.20 12.30 FLANE tivess Salas comissions 4.3.20 variable administrative Foundational 1-12 (Algo) 12 #12.500 units are produced, what is the total amount of manufacturing overhead cost incurred to support this level of production What is this total amount expressed on a per unit basis? (Round your "per unit" answer to 2 decimal places Tual manufacturing overhead cost Malang ove Subs Check my werk 13 M G Part 1 083 To Required information The Foundational 15 (Alge) (LO1-1, LO1-2, LO1-3, LOS-4, LO1-5, L016) (The following information applies to the questions displayed below Martines Company's relevant range of production is 2500 units to 12.500 units. When a produces and sets 10.000 unit its average costs per unt are as follows were Cort Piret nateriale per Unis *4.10 be 13.10 Veriai tarring over $1.4 $4.00 Tiling p 4.3.20 Filtration expe 12.20 Isles a #3.20 cetative pen 0:45 Foundational 1-13 (Algo) 13. If the seling price is $22.20 per unit, what is the contribution margin per unit? Do not round intermediate calculations, Round your answer to 2 decimal places) Chack my werk 14 Pa 0.83 10 m Required information The Foundational 15 (Algo) (LO1-1, LO1-2, LO1-3, LO1-4, LO1-5, LO1-6] (The following information applies to the questions displayed below) Martinez Company's relevant range of production 2500 unts to 12.500 unts when a produces and sells 10,000 units. as average costs per unit are as follows Average Cost E aren atari FAN 13.7 Set Labor Varanged $1.00 $4.00 Flandring verd rised selling p Finisative expe $3.00 $.2.20 flession 11.8 Variable initiation expe 10.09 Foundational 1-14 (Algo) 14 I 10,000 units are produced, what are the total amounts of direct and indirect manufacturing costs incumed to support this level of production? (Do not round intermediate calculations) det manufacturing.com Check my w 15 Part 15 0.00 10 to Required information The Foundational 15 (Algo) (LO1-1, LO1-2, LO1-3, LO1-4, LO1-5, LO1-6) (The following information applies to the questions displayed below) Martinez Company's relevant range of production is 7,500 units to 12,500 units. When it produces and sells 10.000 units. its average costs per unit are as follows Average E pe sit $6.20 Birect materials 13.06 Direct labor Variable sufacturing overtad $ 1.40 3.4.00 Fixed facturing Fland selling expans Fland 3.3.20 dinistrative expense 42.20 Bales commission $ 1.20 Variable administrative expense 0.45 Foundational 1-15 (Algo) 15. What incremental manufacturing cost will Martinez incur if it increases production from 10.000 to 10.001 units? (Round your answer to 2 decimal places) Check my werk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts