Question: Hi can i please get help with this 7 Part 7 of 15 083 ponts Hel Required information The Foundational 15 (Algo) (LO1-1, LO1-2, LO1-3,

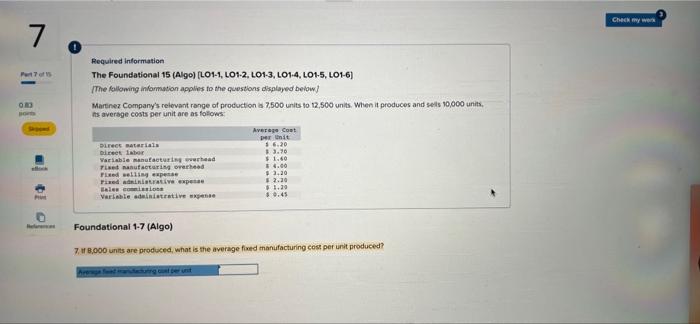

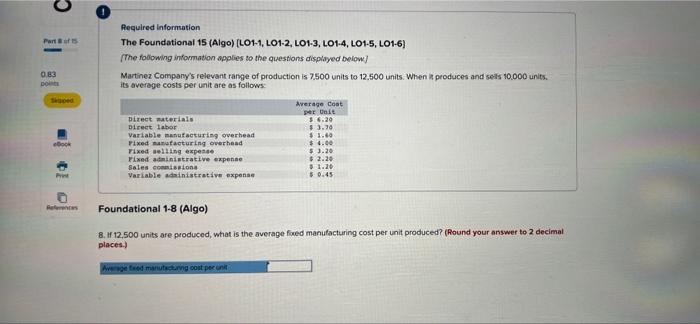

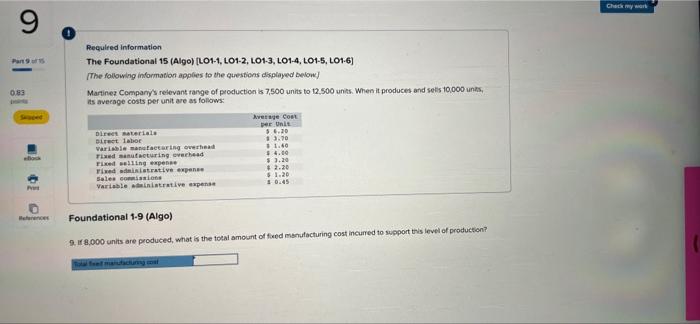

7 Part 7 of 15 083 ponts Hel Required information The Foundational 15 (Algo) (LO1-1, LO1-2, LO1-3, LO1-4, LO1-5, LO1-6) [The following information applies to the questions displayed below Martinez Company's relevant range of production is 7,500 units to 12,500 units. When it produces and sells 10,000 units, its average costs per unit are as follows: Average Cont per unit $.6.20 Direct materials Direct labor $ 3.70 Variable manufacturing overhead $ 1.40 rised nanufacturing overhead $4.00 Fixed selling expesse $3.20 Fixed administrative expe $ 2.30 $1.29 Sales commission Variable administrative expense $9.45 Foundational 1-7 (Algo) 7. If 8,000 units are produced, what is the average fixed manufacturing cost per unit produced? Check my werk Part of 0.83 points ebook Pr Required information The Foundational 15 (Algo) (LO1-1, LO1-2, LO1-3, LO1-4, LO1-5, LO1-6) [The following information applies to the questions displayed below] Martinez Company's relevant range of production is 7,500 units to 12.500 units. When it produces and sells 10,000 units. its average costs per unit are as follows: Average Cost per Unit 3.6.20 Direct materials Direct labor $ 3.70 Variable manufacturing overhead $ 1.60 Fixed manufacturing overhead $ 4.00 Fixed selling expense $ 3.20 $2.20 Fixed administrative expense Sales commissions $1.20 Variable administrative expense $0.45 Foundational 1-8 (Algo) 8. If 12,500 units are produced, what is the average fixed manufacturing cost per unit produced? (Round your answer to 2 decimal places) Average feed manufacturing cost per unit 9 Part 915 0.83 Block P References Required information The Foundational 15 (Algo) (LO1-1, LO1-2, LO1-3, LO1-4, LO1-5, LO1-6) [The following information applies to the questions displayed below) Martinez Company's relevant range of production is 7,500 units to 12.500 units. When it produces and sells 10,000 units, its average costs per unit are as follows: Average Cost Direct materiale per Unit $6.20 Direct labor $ 3.70 Variable manufacturing overhead $1.40 $ 4.00 Fixed manufacturing overhead Fixed selling expense $ 3.20 $2.20 Fixed administrative expense Sales commissions $1.20 Variable administrative expense Foundational 1-9 (Algo) 9. If 8,000 units are produced, what is the total amount of fixed manufacturing cost incurred to support this level of production? Toll feed maiufacturing coat Check my work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts