Question: Hi, can some one help me with this question especially (a) and (b). I am confused about the answers that why the expected return is

Hi, can some one help me with this question especially (a) and (b). I am confused about the answers that why the expected return is substituted in rather than the beta? And also is it okay to use SML for inefficient portfolio, as I once read that"SML is suitable for efficient portfolio and individual assets". Thanks in advance!

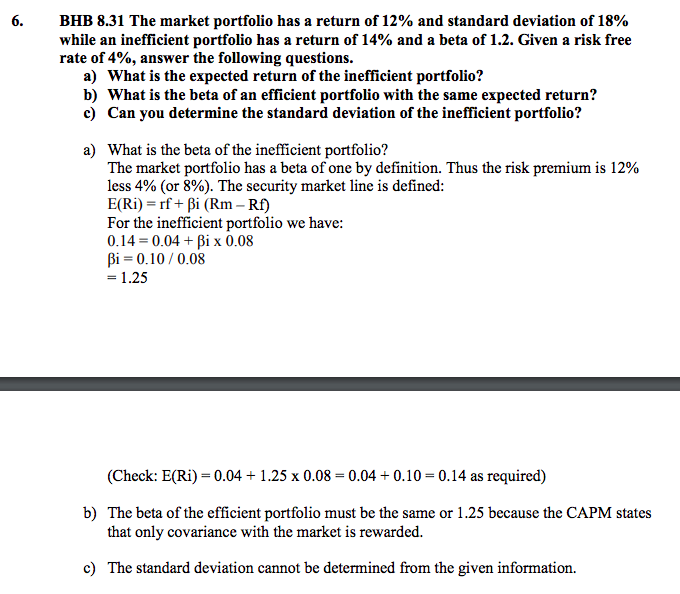

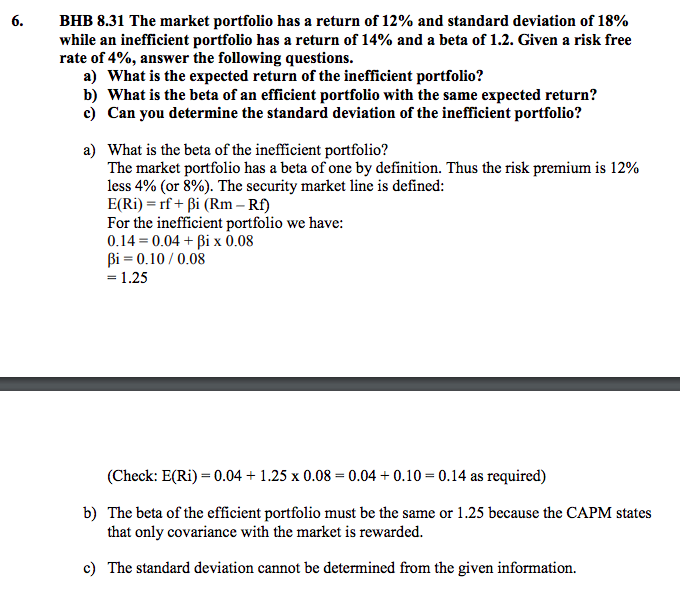

BBB 3.31 The market portfolio has a return of 12% and standard deviation of 13% while an inefficient portfolio has a return of 14% and a beta of 1.2. Given a risk free rate of 4%, answer the folowing questions. a) 'Wbat is the expected return of the inefcient portfolio? b] What is the beta of an efficient portfolio with the same expected return? c) Can you determine the standard deviation of the inefcient portfolio? a] 1What is the beta of the inefcient portfolio? The market portfolio has a beta of one by denition. Thus the risk premium is 12% less 4% (or 8%]. The securityr market line is dened: E{Ri] = rf+ |3i {Rm -111) For the inefcient portfolio we have: I114 = are + Bi a one |3i = .1 I I108 = 1.25 (Check: EiRi) = and. + 125 it runs = 0.04 + 0.10 = 0.14 as required} b] The beta of the efcient portfolio must be the same or 1.25 because the CAPM states that onlyIr covariance with the market is rewarded. c] The standard deviation cannot be determined from the given infonnation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts