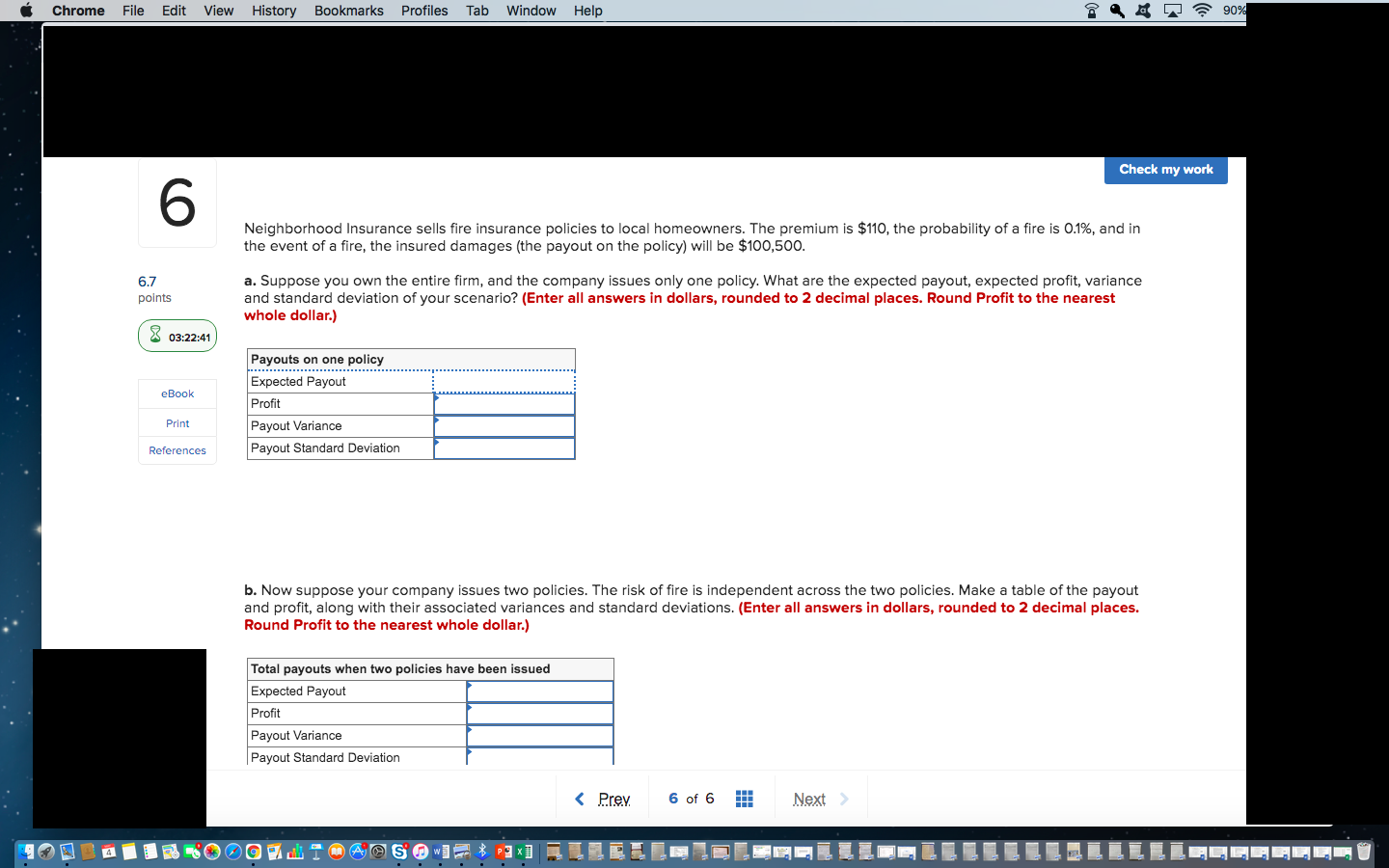

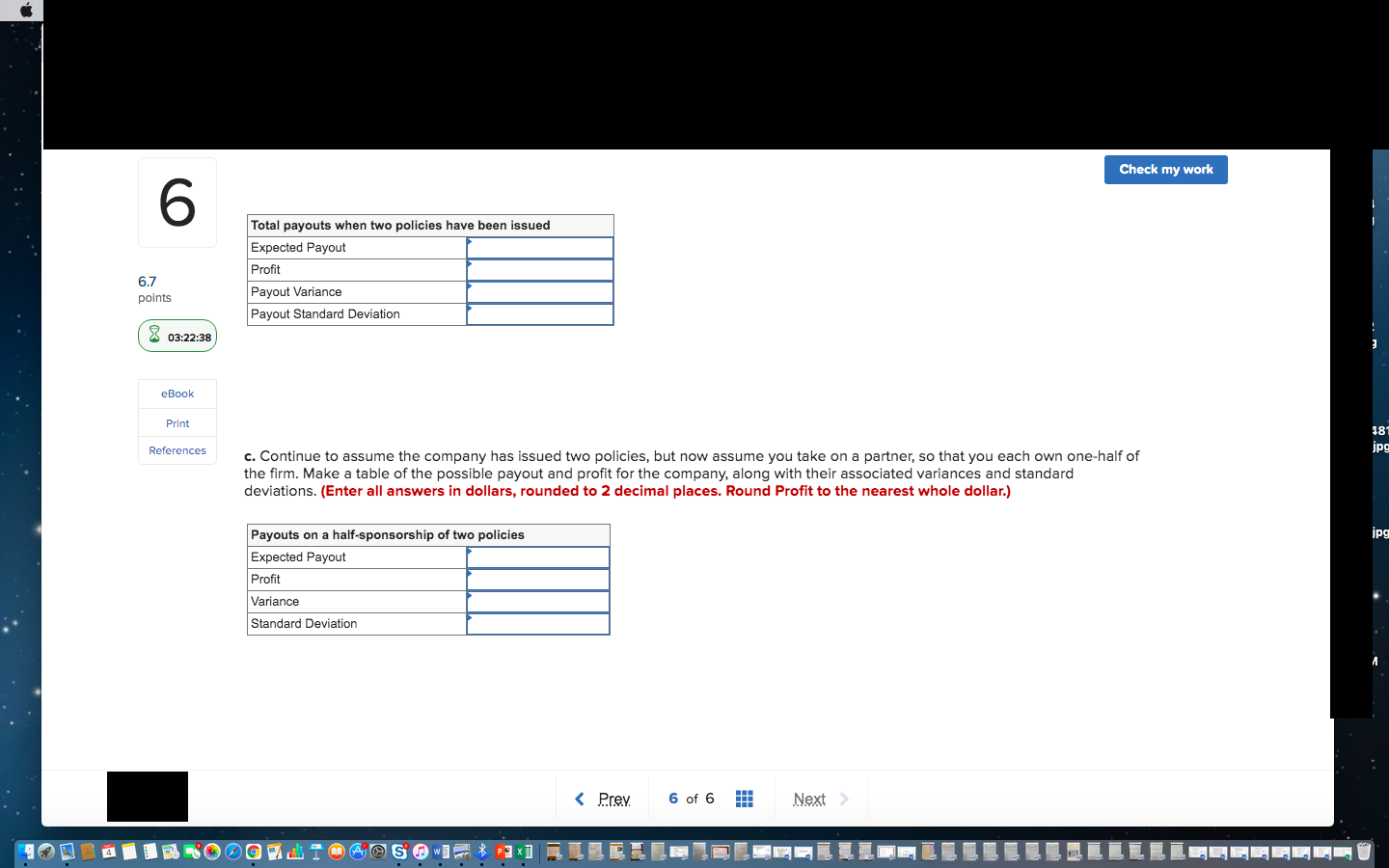

Question: Hi can someone help with this problem would be very helpful. P.S nothing is missing. Thank you. Chrome File Edit View History Bookmarks Profiles Tab

Hi can someone help with this problem would be very helpful. P.S nothing is missing. Thank you.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts