Question: QUESTION 4 PARTNERSHIPS (20) The information given below was extracted from the accounting records of Salmon Traders, a partnership business with Sally and Monty as

QUESTION 4

PARTNERSHIPS

(20)

The information given below was extracted from the accounting records of Salmon Traders, a partnership business with Sally and Monty as partners. The financial year ends on the last day of February each year.

REQUIRED

Prepare the following accounts in the General ledger of Salmon Traders:

4.1 Current a/c: Monty (Balance the account.)

(7)

4.2 Appropriation account (Close off the account.)

(13)

INFORMATION

Balances in the ledger on 28 February 2017

R

Capital: Sally

400 000

Capital: Monty

200 000

Current a/c: Sally (01 March 2016)

20 000

(DR)

Current a/c: Monty (01 March 2016)

33 000

(CR)

Drawings: Sally

200 000

Drawings: Monty

180 000

The following must be taken into account:

(a)

The net profit according to the Profit and Loss account amounted to R500 000 on 28 February 2017.

(b)

The partnership agreement makes provision for the following:

?

Interest on capital must be provided at 15% per annum on the balances in the capital accounts. Note: Sally increased his capital by R100 000 on 01 September 2016. Monty decreased his capital by R100 000 on the same date. The capital changes have been recorded.

The partners are entitled to the following monthly salaries:

Sally

R12 000

Monty

R13 000

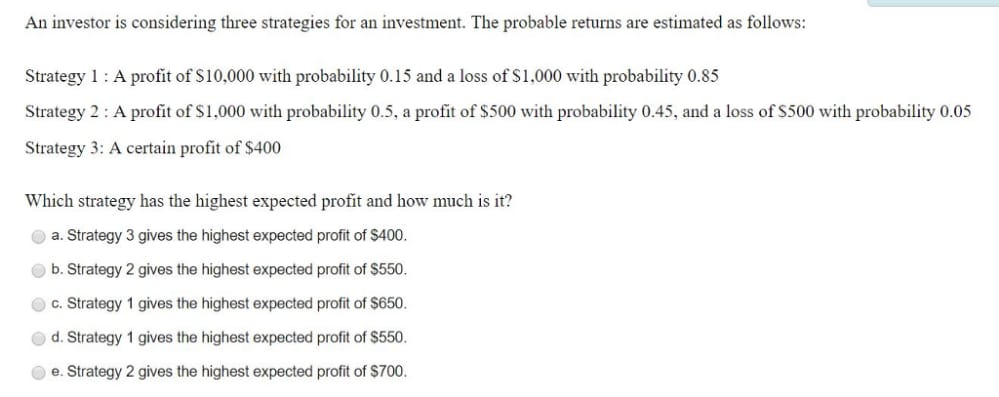

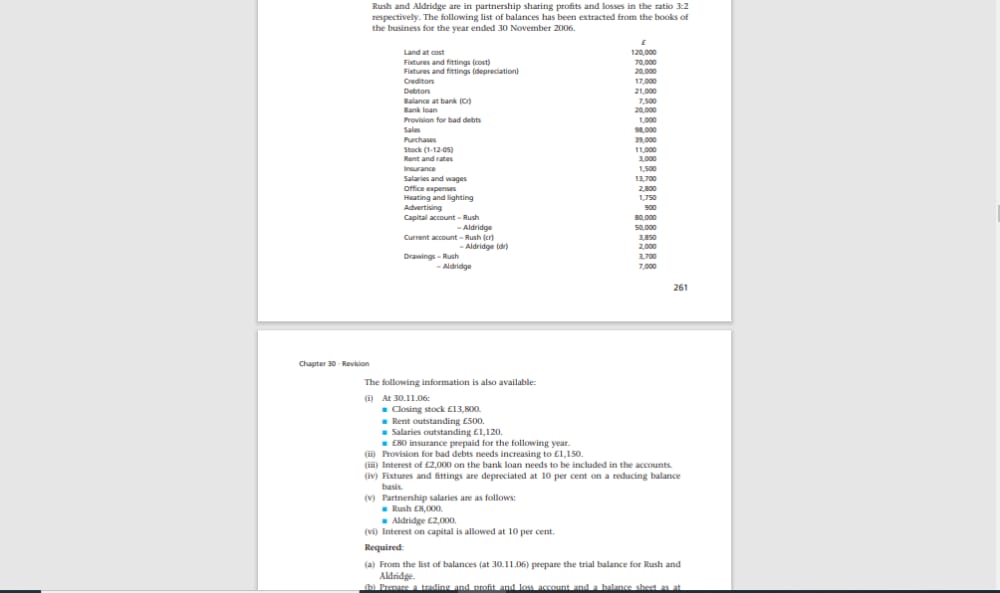

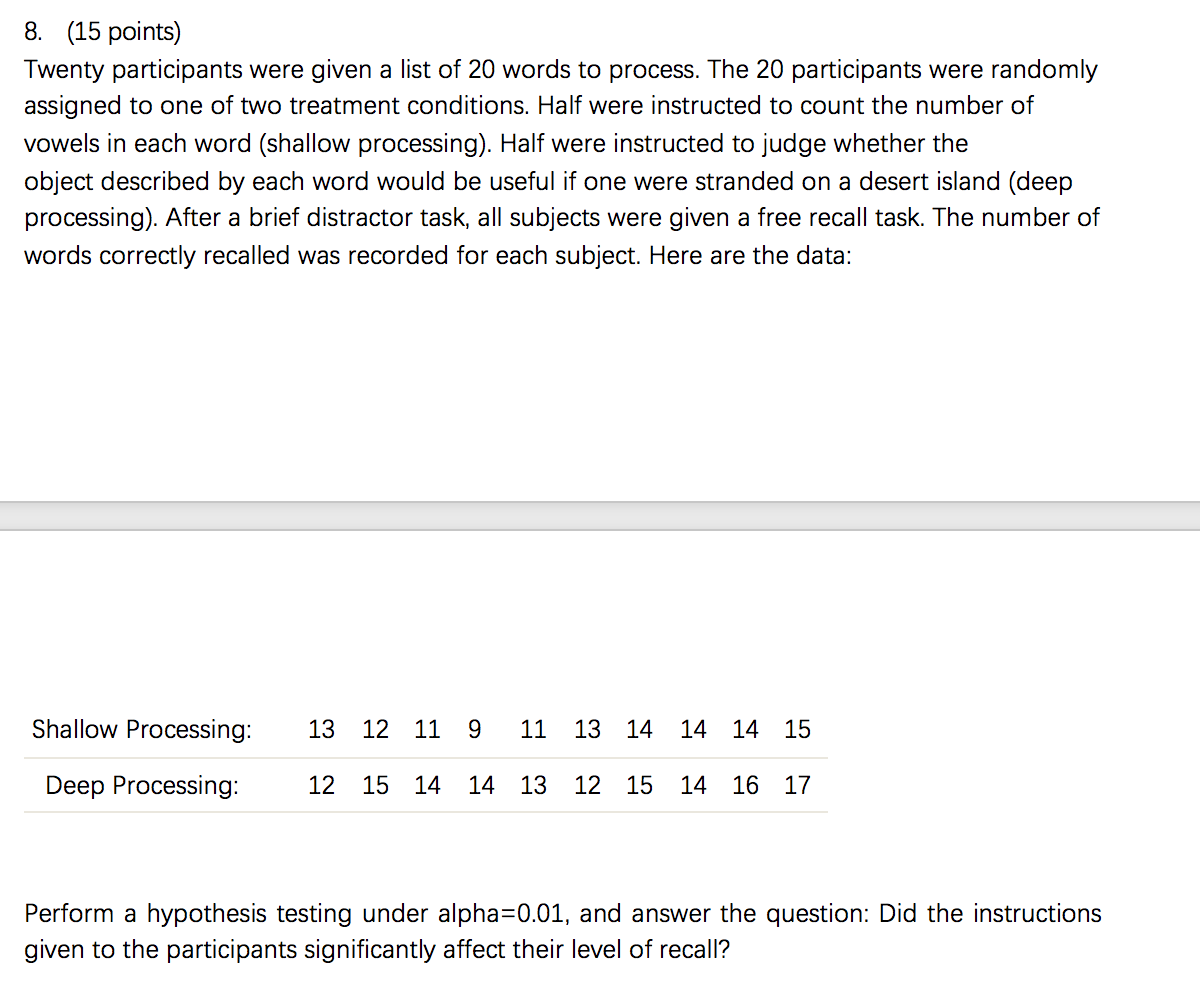

An investor is considering three strategies for an investment. The probable returns are estimated as follows: Strategy 1 : A profit of $10,000 with probability 0.15 and a loss of $1,000 with probability 0.85 Strategy 2 : A profit of $1,000 with probability 0.5, a profit of $500 with probability 0.45, and a loss of $500 with probability 0.05 Strategy 3: A certain profit of $400 Which strategy has the highest expected profit and how much is it? a. Strategy 3 gives the highest expected profit of $400. b. Strategy 2 gives the highest expected profit of $550. c. Strategy 1 gives the highest expected profit of $650. d. Strategy 1 gives the highest expected profit of $550. e. Strategy 2 gives the highest expected profit of $700.Rush and Aldridge are in partnership sharing profits and losses in the ratio 1:2 respectively. The following list of balances has been extracted from the books of the business for the year ended 30 November 2006. Land at must 170,800 Fixtures and fittings boost) Fixtures and fittings (depreciation) 17.300 Dutton 7.100 Freshion for bad debt 1 1,800 Bunt and notes 1800 1.500 Salaries and wages 12 700 2.800 Hunting and lighting 900 Capital account - Bush Aldridge 50.800 Current account - Rush jer] 1.850 -Aldridge for 2.800 Drawings - Rush 1.700 - Aldridge 7.800 261 Chapter 30 - Revision The following information is also available: (i) At 30.I1.06 Closing stock E13,800. Rent outstanding (500. Salaries outstanding El, 120. (80 insurance prepaid for the following year. (in Provision for bad debts needs Increasing to Cl,150. tim Interest of 12,000 on the bank loan needs to be included in the accounts (Wv) Fixtures and fittings are depreciated at 10 per cent on a reducing balance (v) Partnership salaries are as follows Bush CH,000. Aldridge (2.000, (v)) Interest on capital is allowed at 10 per cent. Required (a) From the list of balances (at 10.11,06) prepare the trial balance for Bush and8. (15 points) Twenty participants were given a list of 20 words to process. The 20 participants were randomly assigned to one of two treatment conditions. Half were instructed to count the number of vowels in each word (shallow processing). Half were instructed to judge whether the object described by each word would be useful if one were stranded on a desert island (deep processing). After a brief distractor task, all subjects were given a free recall task. The number of words correctly recalled was recorded for each subject. Here are the data: Shallow Processing: 13 12 11 9 11 13 14 14 14 15 Deep Processing: 12 15 14 14 13 12 15 14 16 1? Perform a hypothesis testing under alpha=0.01, and answer the question: Did the instructions given to the participants significantly affect their level of recall