Question: Hi, can someone please help me solve this question please? Thanks! Question 1: Your friend has decided to purchase a new car and has found

Hi, can someone please help me solve this question please? Thanks!

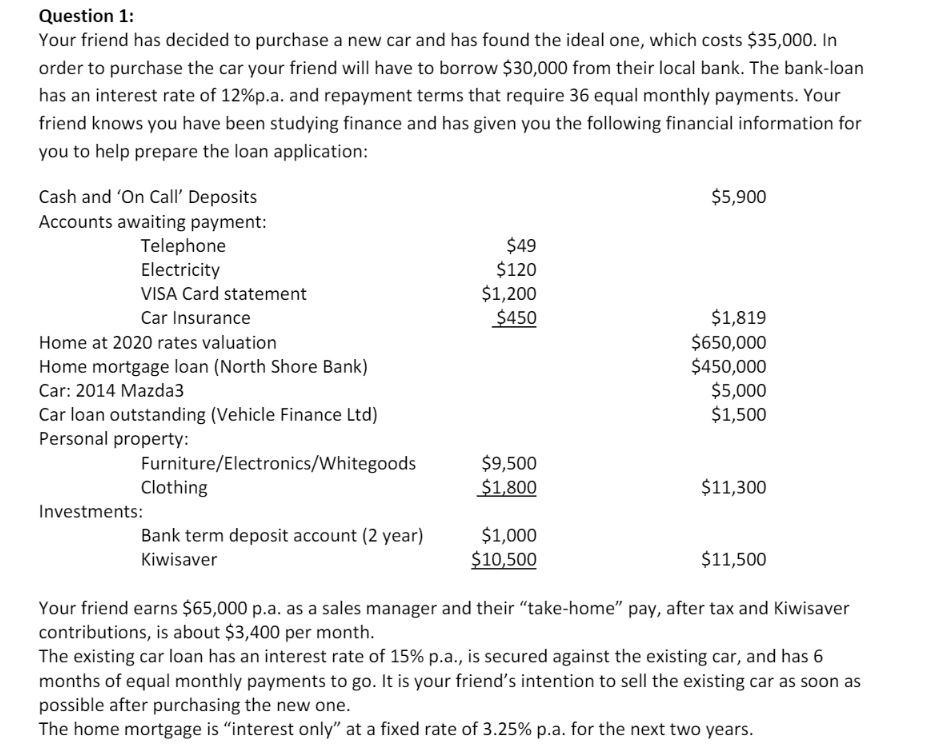

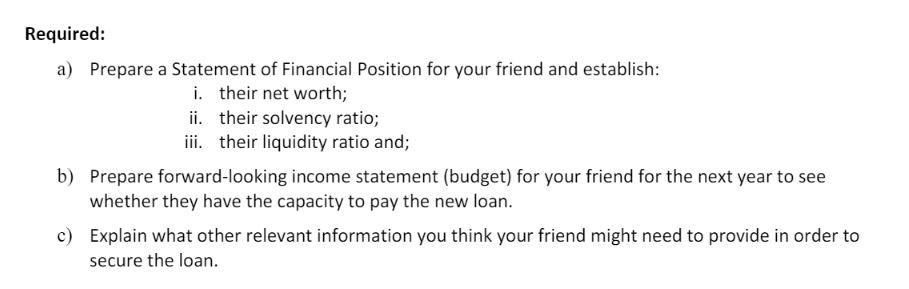

Question 1: Your friend has decided to purchase a new car and has found the ideal one, which costs $35,000. In order to purchase the car your friend will have to borrow $30,000 from their local bank. The bank-loan has an interest rate of 12%p.a. and repayment terms that require 36 equal monthly payments. Your friend knows you have been studying finance and has given you the following financial information for you to help prepare the loan application: $5,900 $49 $120 $1,200 $450 Cash and 'On Call Deposits Accounts awaiting payment: Telephone Electricity VISA Card statement Car Insurance Home at 2020 rates valuation Home mortgage loan (North Shore Bank) Car: 2014 Mazda3 Car loan outstanding (Vehicle Finance Ltd) Personal property: Furniture/Electronics/Whitegoods Clothing Investments: Bank term deposit account (2 year) Kiwisaver $1,819 $650,000 $450,000 $5,000 $1,500 $9,500 $1,800 $11,300 $1,000 $10,500 $11,500 Your friend earns $65,000 p.a. as a sales manager and their take-home" pay, after tax and Kiwisaver contributions, is about $3,400 per month. The existing car loan has an interest rate of 15% p.a., is secured against the existing car, and has 6 months of equal monthly payments to go. It is your friend's intention to sell the existing car as soon as possible after purchasing the new one. The home mortgage is interest only" at a fixed rate of 3.25% p.a. for the next two years. Required: a) Prepare a statement of Financial Position for your friend and establish: i. their net worth; ii. their solvency ratio; iii. their liquidity ratio and; b) Prepare forward-looking income statement (budget) for your friend for the next year to see whether they have the capacity to pay the new loan. c) Explain what other relevant information you think your friend might need to provide in order to secure the loan. Question 1: Your friend has decided to purchase a new car and has found the ideal one, which costs $35,000. In order to purchase the car your friend will have to borrow $30,000 from their local bank. The bank-loan has an interest rate of 12%p.a. and repayment terms that require 36 equal monthly payments. Your friend knows you have been studying finance and has given you the following financial information for you to help prepare the loan application: $5,900 $49 $120 $1,200 $450 Cash and 'On Call Deposits Accounts awaiting payment: Telephone Electricity VISA Card statement Car Insurance Home at 2020 rates valuation Home mortgage loan (North Shore Bank) Car: 2014 Mazda3 Car loan outstanding (Vehicle Finance Ltd) Personal property: Furniture/Electronics/Whitegoods Clothing Investments: Bank term deposit account (2 year) Kiwisaver $1,819 $650,000 $450,000 $5,000 $1,500 $9,500 $1,800 $11,300 $1,000 $10,500 $11,500 Your friend earns $65,000 p.a. as a sales manager and their take-home" pay, after tax and Kiwisaver contributions, is about $3,400 per month. The existing car loan has an interest rate of 15% p.a., is secured against the existing car, and has 6 months of equal monthly payments to go. It is your friend's intention to sell the existing car as soon as possible after purchasing the new one. The home mortgage is interest only" at a fixed rate of 3.25% p.a. for the next two years. Required: a) Prepare a statement of Financial Position for your friend and establish: i. their net worth; ii. their solvency ratio; iii. their liquidity ratio and; b) Prepare forward-looking income statement (budget) for your friend for the next year to see whether they have the capacity to pay the new loan. c) Explain what other relevant information you think your friend might need to provide in order to secure the loan

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts