Question: Hi, can someone please help me with these three problems? thanks! I added the concepts that are provided in my assignment. Hope it can help.

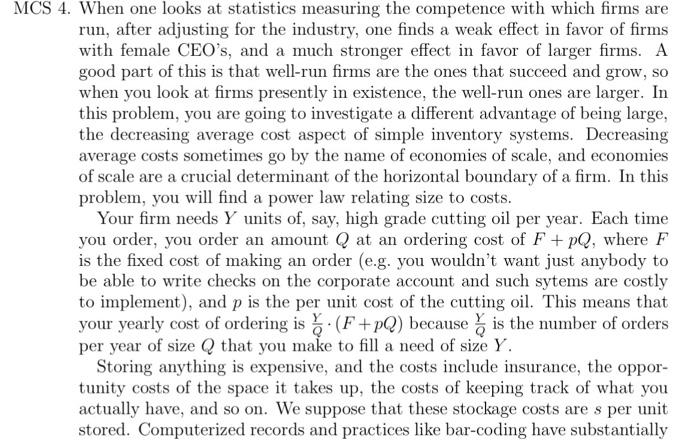

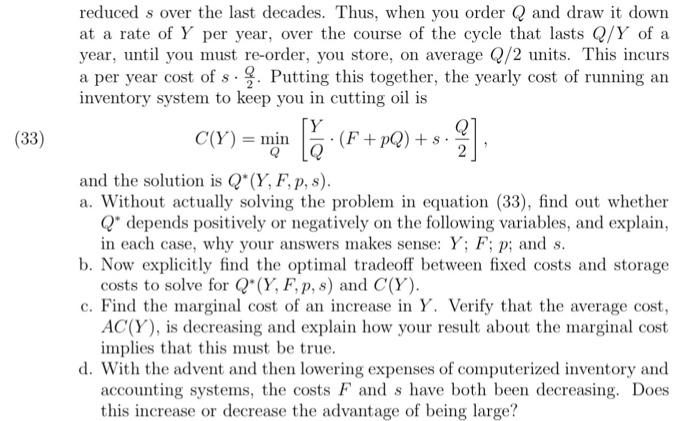

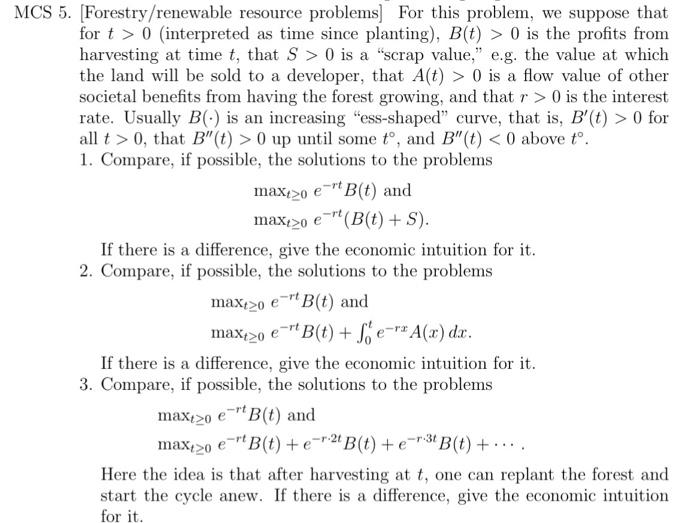

MCS 4. When one looks at statistics measuring the competence with which firms are run, after adjusting for the industry, one finds a weak effect in favor of firms with female CEO's, and a much stronger effect in favor of larger firms. A good part of this is that well-run firms are the ones that succeed and grow, so when you look at firms presently in existence, the well-run ones are larger. In this problem, you are going to investigate a different advantage of being large, the decreasing average cost aspect of simple inventory systems. Decreasing average costs sometimes go by the name of economies of scale, and economies of scale are a crucial determinant of the horizontal boundary of a firm. In this problem, you will find a power law relating size to costs. Your firm needs Y units of, say, high grade cutting oil per year. Each time you order, you order an amount Q at an ordering cost of F+pQ, where F is the fixed cost of making an order (e.g. you wouldn't want just anybody to be able to write checks on the corporate account and such sytems are costly to implement), and p is the per unit cost of the cutting oil. This means that your yearly cost of ordering is (F+pQ) because is the number of orders per year of size Q that you make to fill a need of size Y. Storing anything is expensive, and the costs include insurance, the oppor- tunity costs of the space it takes up, the costs of keeping track of what you actually have, and so on. We suppose that these stockage costs are s per unit stored. Computerized records and practices like bar-coding have substantially reduced s over the last decades. Thus, when you order Q and draw it down at a rate of Y per year, over the course of the cycle that lasts Q/Y of a year, until you must re-order, you store, on average Q/2 units. This incurs a per year cost of s... Putting this together, the yearly cost of running an inventory system to keep you in cutting oil is C(Y) = min (F+pQ)+s: (33) li and the solution is Q*(Y, F, p, s). a. Without actually solving the problem in equation (33), find out whether Q" depends positively or negatively on the following variables, and explain, in each case, why your answers makes sense: Y; F; p; and s. b. Now explicitly find the optimal tradeoff between fixed costs and storage costs to solve for Q*(Y, F,p, s) and C(Y). c. Find the marginal cost of an increase in Y. Verify that the average cost, AC(Y), is decreasing and explain how your result about the marginal cost implies that this must be true. d. With the advent and then lowering expenses of computerized inventory and accounting systems, the costs F and s have both been decreasing. Does this increase or decrease the advantage of being large? MCS 5. Forestry/renewable resource problems for this problem, we suppose that for t > 0 (interpreted as time since planting), B(t) > 0 is the profits from harvesting at time t, that S > 0 is a "scrap value," e.g. the value at which the land will be sold to a developer, that Alt) > 0 is a flow value of other societal benefits from having the forest growing, and that r > 0 is the interest rate. Usually B(-) is an increasing ess-shaped" curve, that is, B'(t) > 0 for all t > 0, that B"(t) > 0 up until some t, and B"(t) o e-"B(t) and maxe30 e-" (B(t) +S). If there is a difference, give the economic intuition for it. 2. Compare, if possible, the solutions to the problems maxe20 e-B(t) and maxtzo e-" B(t) + Se-** A(x) dx. If there is a difference, give the economic intuition for it. 3. Compare, if possible, the solutions to the problems maxx>0 e" B(t) and e-"B(t) +er 2B(t) + e +3+B(t) +.... Here the idea is that after harvesting at t, one can replant the forest and start the cycle anew. If there is a difference, give the economic intuition for it. e : - max+20 MCS 6. For this problem, we again suppose that for t > 0, B(t) > 0, that S > 0 is a "scrap value," that At) > 0 is a flow value. Now we have two interest rates, p'>r>0. 1. Compare, if possible, the solutions to the problems maxrzo e-"B(t) and maxt>o e-"B(t). If there is a difference, give the economic intuition for it. 2. Compare, if possible, the solutions to the problems maxx>0 e-B(t) + *Ax) dx and + S maxe>0 "B(t) + e-"'* A(x) dx. If there is a difference, give the economic intuition for it. 3. Compare, if possible, the solutions to the problems maxtzo e-"B(t) + 2B(t) + 3+B(t) + ... and max 20 e-"'t B(t) +e+-24 B(t) +e+:31B(t) +. and r. If there is a difference, give the economic intuition for it. 5. COMPARATIVE STATICS WITH DERIVATIVES We now turn to determining the dependence of behavior, x*(0), on 0. In particular, we will often be interested in knowing whether or not the following kind of monotone results hold: if 6 >, then x* (6) > x*(0); or if 6 > 0, then x*(0)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts