Question: HI :) can you please solve this. Thank you!! :) I am not sure if levred beta (b)=1.62 Thanks! Corporations allowed to deduct interest payments

HI :) can you please solve this. Thank you!! :)

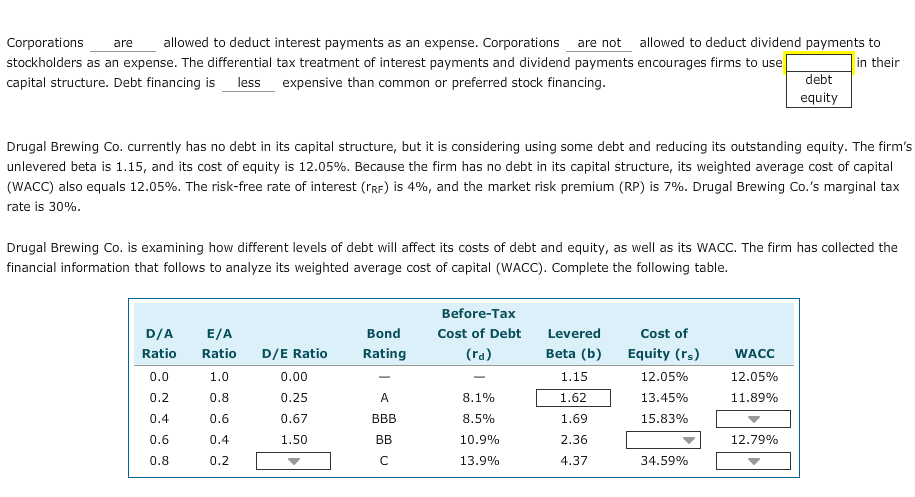

I am not sure if levred beta (b)=1.62

Thanks!

Corporations allowed to deduct interest payments as an expense. Corporations allowed to deduct dividend payments to stockholders as an expense. The differential tax treatment of interest payments and dividend payments encourages firms to use in their capital structure. Debt financing is expensive than common or preferred stock financing. Drugal Brewing Co. currently has no debt in its capital structure, but it is considering using some debt and reducing its outstanding equity. The firm's unlevered beta is 1.15, and its cost of equity is 12.05%. Because the firm has no debt in its capital structure, its weighted average cost of capital (WACC) also equals 12.05%. The risk-free rate of interest (trf) is 4%, and the market risk premium (RP) is 7%. Drugal Brewing Co.'s marginal tax rate is 30%. Drugal Brewing Co. is examining how different levels of debt will affect its costs of debt and equity, as well as its WACC. The firm has collected the financial information that follows to analyze its weighted average cost of capital (WACC). Complete the following table

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts