Question: I keep getting these answers incorrect. Please help. Answers for fill in the blank at the top #1 Corporations ... allowed to deduct interest payments

I keep getting these answers incorrect. Please help.

Answers for fill in the blank at the top

#1 Corporations ... allowed to deduct interest payments (are / are not)

#2 Corporations ... allowed to deduct dividend payments to stockholders (are / are not)

#3 encourages firms to use ... in their capital structure (equity/ debt)

#4 Debt financing is ... expensive than common or preferred (more / less)

I will make sure to thumbs up if correct, thank you!

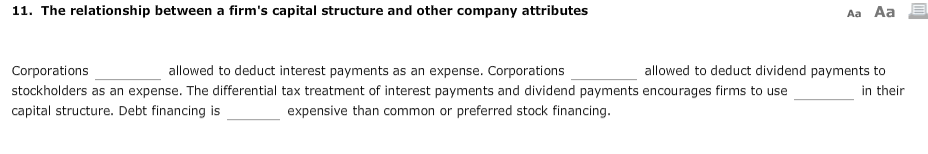

11. The relationship between a firm's capital structure and other company attributes Aa Aa Corporations stockholders as an expense. The differential tax treatment of interest payments and dividend payments encourages firms to use capital structure. Debt financing is allowed to deduct interest payments as an expense. Corporations allowed to deduct dividend payments to in their expensive than common or preferred stock financing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts