Question: Hi, Could you please help me answer the 4 questions below? I need the correct answer, and if possible, a brief explanation. Thanks very much

Hi,

Could you please help me answer the 4 questions below? I need the correct answer, and if possible, a brief explanation. Thanks very much :)

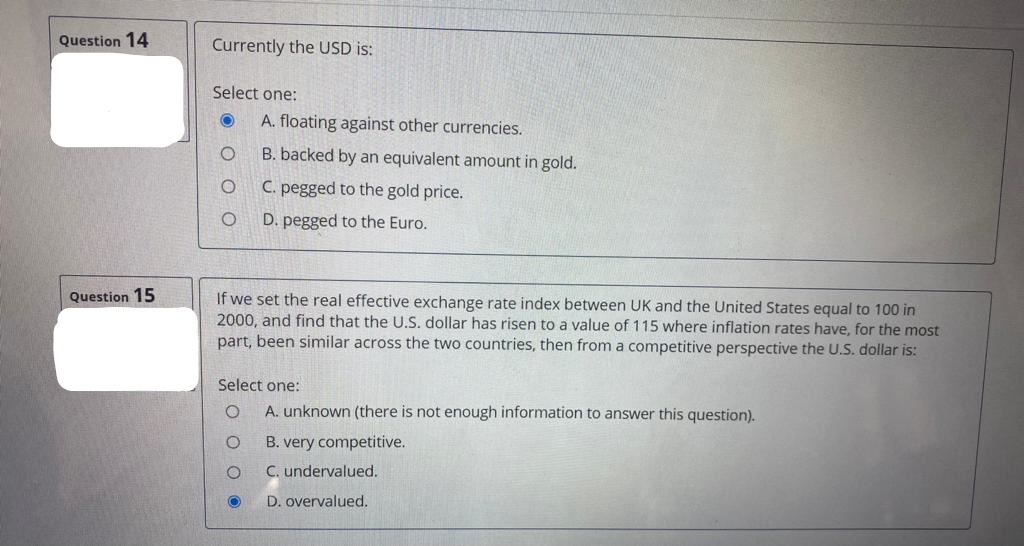

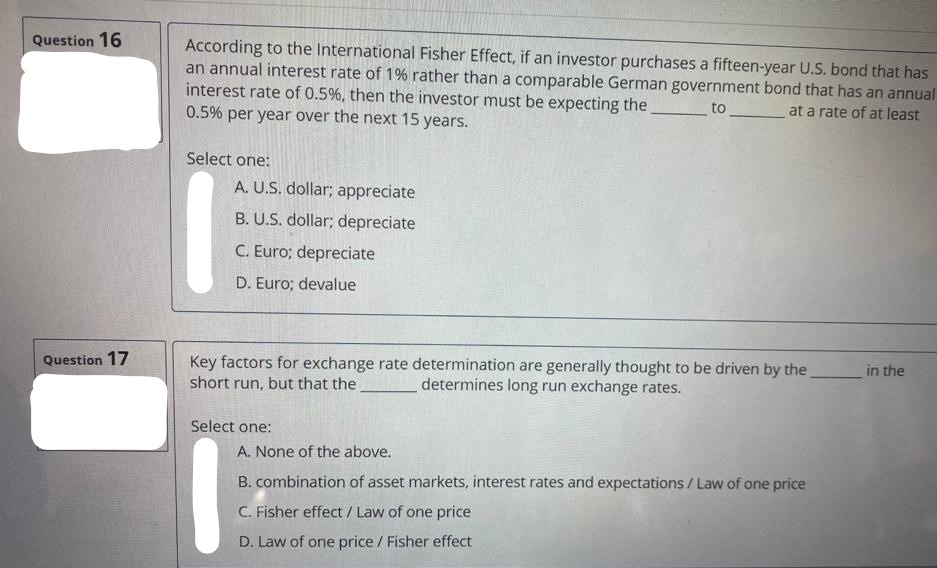

Question 14 Currently the USD is: Select one: A. floating against other currencies. O B. backed by an equivalent amount in gold. C. pegged to the gold price. O D. pegged to the Euro. Question 15 If we set the real effective exchange rate index between UK and the United States equal to 100 in 2000, and find that the U.S. dollar has risen to a value of 115 where inflation rates have, for the most part, been similar across the two countries, then from a competitive perspective the U.S. dollar is: Select one: O A. unknown (there is not enough information to answer this question). O B. very competitive. O C. undervalued. O D. overvalued.Question 16 According to the International Fisher Effect, if an investor purchases a fifteen-year U.S. bond that has an annual interest rate of 1% rather than a comparable German government bond that has an annual interest rate of 0.5%, then the investor must be expecting the to _ at a rate of at least 0.5% per year over the next 15 years. Select one: A. U.S. dollar; appreciate B. U.S. dollar; depreciate C. Euro; depreciate D. Euro; devalue Question 17 Key factors for exchange rate determination are generally thought to be driven by the in the short run, but that the determines long run exchange rates. Select one: A. None of the above. B. combination of asset markets, interest rates and expectations / Law of one price C. Fisher effect / Law of one price D. Law of one price / Fisher effect

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts