Question: Hi everyone. I NEED AN ANSWER TO THIS QUESTION (NO TOO MUCH EXPLANATION), I'M NOT HAVE TOO MUCH TIME. Jurisdiction of Australia Please , I

Hi everyone.

I NEED AN ANSWER TO THIS QUESTION (NO TOO MUCH EXPLANATION), I'M NOT HAVE TOO MUCH TIME.

Jurisdiction of Australia

Please, I only need a short answer please please, I don't have too much time.

AS SIMPLE AS YOU CAN PLEASE!! I BEG YOU!!

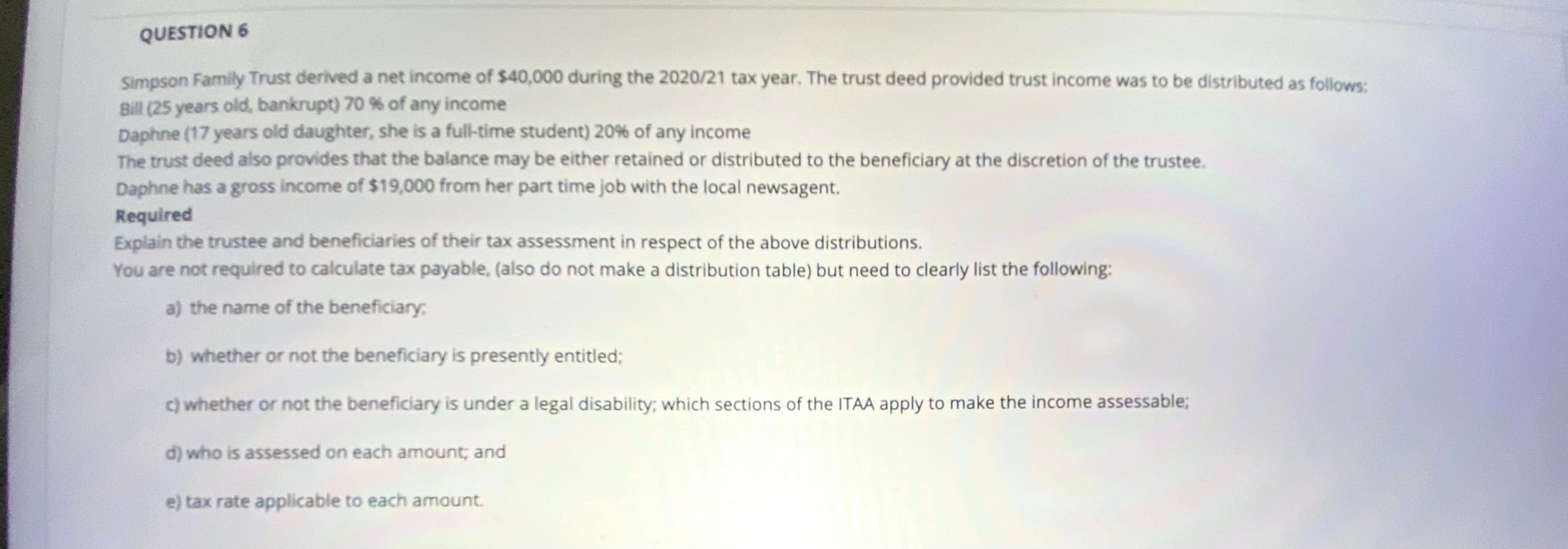

CoursHeroTranscribedText: QUESTION 6 Simpson Family Trust derived a net income of $40,000 during the 2020/21 tax year. The trust deed provided trust income was to be distributed as follows: Bill (25 years old, bankrupt) 70 % of any income Daphne (17 years old daughter, she is a full-time student) 20% of any income The trust deed also provides that the balance may be either retained or distributed to the beneficiary at the discretion of the trustee. Daphne has a gross income of $19,000 from her part time job with the local newsagent. Required Explain the trustee and beneficiaries of their tax assessment in respect of the above distributions. You are not required to calculate tax payable, (also do not make a distribution table) but need to clearly list the following: a) the name of the beneficiary. b) whether or not the beneficiary is presently entitled; c) whether or not the beneficiary is under a legal disability; which sections of the ITAA apply to make the income assessable; d) who is assessed on each amount; and e) tax rate applicable to each amount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts