Question: Hi everyone. I NEED ANSWER FOR THIS QUESTION (NO TOO MUCH EXPLANATION), I'M NOT HAVE TOO MUCH TIME. Jurisdiction of Australia Please , I only

Hi everyone.

I NEED ANSWER FOR THIS QUESTION (NO TOO MUCH EXPLANATION), I'M NOT HAVE TOO MUCH TIME.

Jurisdiction of Australia

Please, I only need short answer please please, I don't have too much time.

AS SIMPLE AS YOU CAN PLEASE!! I BEG YOU!!

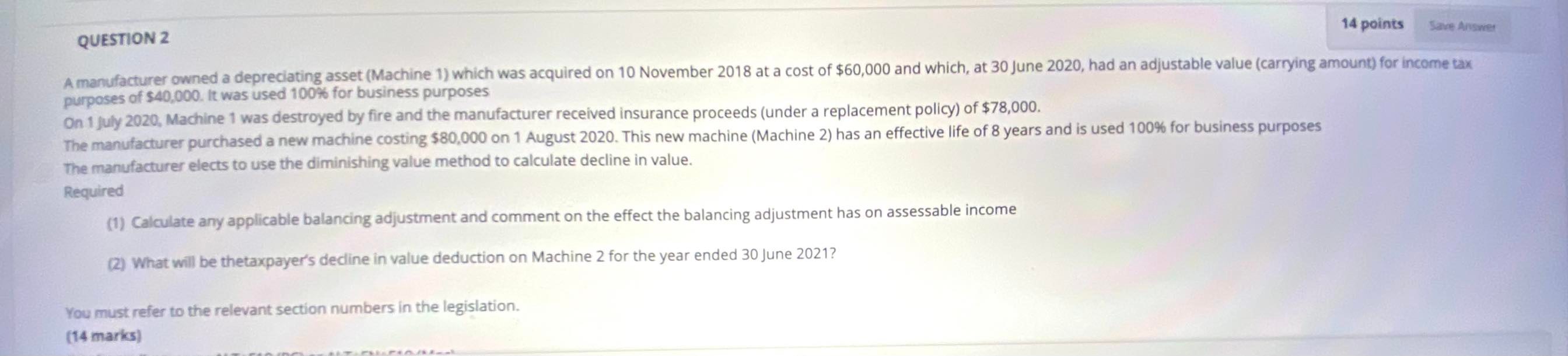

QUESTION 2 14 points Save Answer A manufacturer owned a depreciating asset (Machine 1) which was acquired on 10 November 2018 at a cost of $60,000 and which, at 30 June 2020, had an adjustable value (carrying amount) for income tax purposes of $40,000. It was used 100% for business purposes On 1 July 2020, Machine 1 was destroyed by fire and the manufacturer received insurance proceeds (under a replacement policy) of $78,000. The manufacturer purchased a new machine costing $80,000 on 1 August 2020. This new machine (Machine 2) has an effective life of 8 years and is used 100% for business purposes The manufacturer elects to use the diminishing value method to calculate decline in value. Required (1) Calculate any applicable balancing adjustment and comment on the effect the balancing adjustment has on assessable income (2) What will be thetaxpayer's decline in value deduction on Machine 2 for the year ended 30 June 2021? You must refer to the relevant section numbers in the legislation. (14 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts