Question: Hi expert please answer same making same tables as required to put it fields Javonte Co. set standards of 2 hours of direct labor per

Hi expert please answer same making same tables as required to put it fields

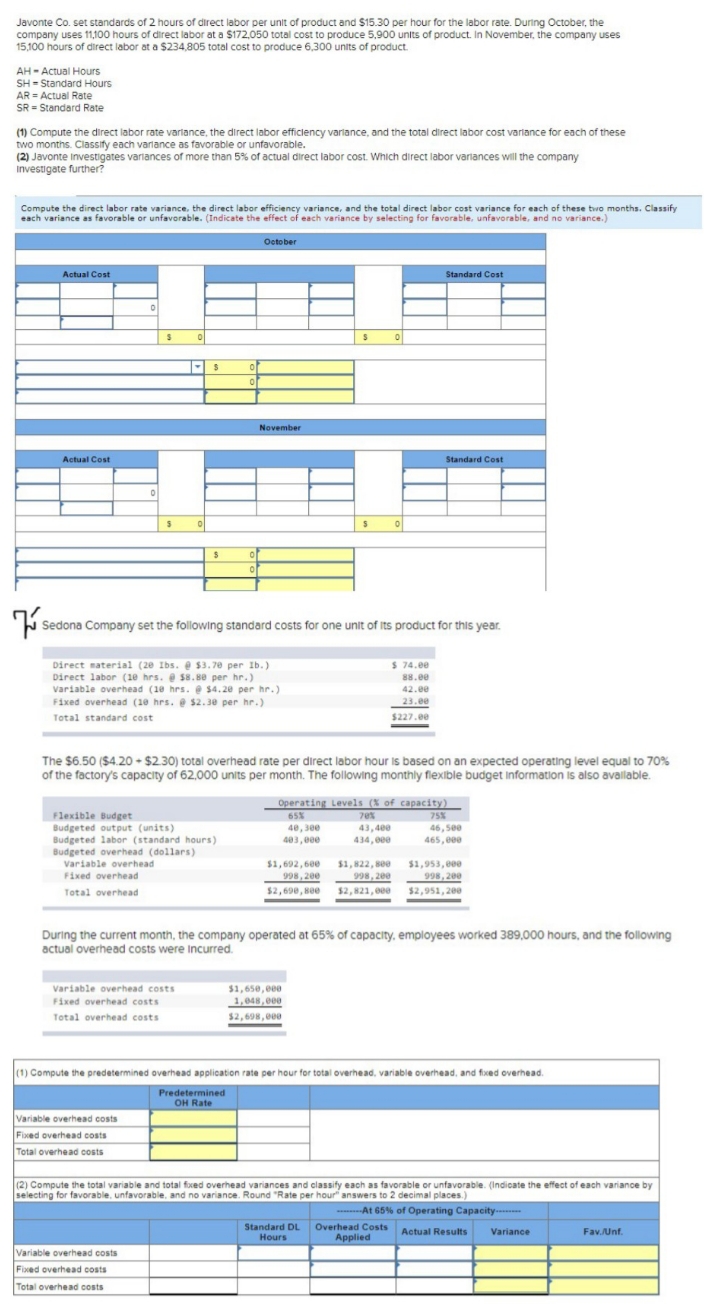

Javonte Co. set standards of 2 hours of direct labor per unit of product and $15.30 per hour for the labor rate. During October, the company uses 11,100 hours of direct labor at a $172,050 total cost to produce 5,900 units of product. In November, the company uses 15,100 hours of direct labor at a $234,805 total cost to produce 6,300 units of product. AH - Actual Hours SH = Standard Hours AR = Actual Rate SR = Standard Rate (1) Compute the direct labor rate variance, the direct labor efficiency variance, and the total direct labor cost variance for each of these two months. Classify each variance as favorable or unfavorable. (2) Javonte Investigates variances of more than 5% of actual direct labor cost. Which direct labor variances will the company Investigate further? Compute the direct labor rate variance, the direct labor efficiency variance, and the total direct labor cost variance for each of these two months. Classify each variance as favorable or unfavorable. (Indicate the effect of each variance by selecting for favorable, unfavorable, and no variance.) Detober Actual Cost Standard Cost of November Actual Cost Standard Cost Sedona Company set the following standard costs for one unit of its product for this year. Direct material (20 Ibs. @ $3.70 per 1b.) $ 74.00 Direct labor (10 hrs. @ $8.80 per hr.) 88.00 Variable overhead (10 hrs. @ $4.20 per hr. ) 42.00 Fixed overhead (10 hrs. @ $2.30 per hr.) Total standard cost $227.0e The $6.50 ($4.20 + $2.30) total overhead rate per direct labor hour is based on an expected operating level equal to 70% of the factory's capacity of 62,000 units per month. The following monthly flexible budget Information is also available. Operating Levels (X of capacity) Flexible Budget 65% 75% Budgeted output (units) 40, 380 43,408 46, 508 Budgeted labor (standard hours) 403,080 434,090 465,090 Budgeted overhead (dollars) Variable overhead $1, 692, 600 $1, 822, 800 $1,953,090 Fixed overhead 998, 206 998, 200 998, 200 Total overhead $2, 690, Bee $2,821,090 $2,951,200 During the current month, the company operated at 65% of capacity, employees worked 389,000 hours, and the following actual overhead costs were Incurred. Variable overhead costs $1, 650, ees Fixed overhead costs 1, 048, 908 Total overhead costs $2, 698, 028 (1) Compute the predetermined overhead application rate per hour for total overhead, variable overhead, and fixed overhead. Predetermined OH Rate Variable overhead costs Fixed overhead costs Total overhead costs (2) Compute the total variable and total fored overhead variances and classify each as favorable or unfavorable. (Indicate the effect of each variance by selecting for favorable, unfavorable, and no variance. Round "Rate per hour" answers to 2 decimal places.) -...-.At 65% of Operating Capacity..... Standard DL Overhead Costs Hours Applied Actual Results Variance Fav./Unf. Variable overhead costs Fixed overhead costs Total overhead costs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts