Question: Hi guys can anyone help me solve this please? Also can you the whole work so I can understand. Thank you Name: Date: FIN 304-Assessment

Hi guys can anyone help me solve this please? Also can you the whole work so I can understand. Thank you

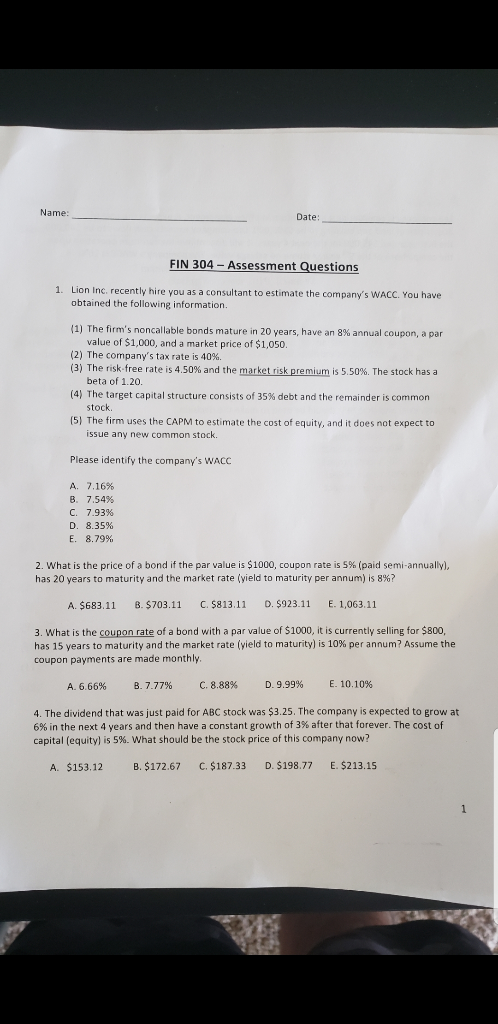

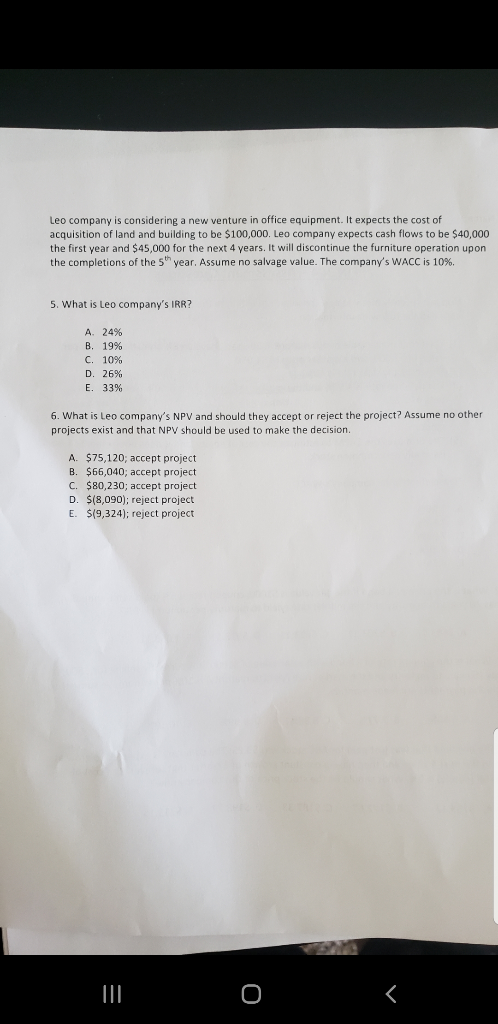

Name: Date: FIN 304-Assessment Questions 1. Lion Inc. recently hire you as a consultant to estimate the company's WACC. You have obtained the following information. 1) The firm's noncallable bonds mature in 20 years, have an 8% annual coupon, a par value of $1,000, and a market price of $1,050. (2) The company's tax rate is 40%. (3) The risk-free rate is 4.50% and the marketrsk premium is 5.50%. The stock has a beta of 1.20. (4) The target capital structure consists of 35% debt and the remainder is common stock (5) The firm uses the CAPM to estimate the cost of equity, and it does not expect to issue any new common stock Please identify the company's WACC A. 7.16% B. 7.54% C. 7.93% D. 8.35% E. 8.79% 2, what is the price of a bond if the par value is $1000, coupon rate is 5% (paid semi-annually), has 20 years to maturity and the market rate (yield to maturity per annum) is 8%? A. $683.11 8. $703.11 C.$813.11 D. $923.11 E. 1,063.1:1 3. What is the coupon rate of a bond with a par value of S1000, it is currently selling for $800 has 15 years to maturity and the market rate (yield to maturity) is 10% per annum? Assume the coupon payments are made monthly D' 9.99% E.10.10% C, 8.88% B, 7.77% A, 6.66% 4. The dividend that was just paid for ABC stock was $3.25. The company is expected to grow at 6% in the next 4 years and then have a constant growth of 3% after that forever. The cost of capital (equity) is 5%, what should be the stock price of this company now? C. $187.33 D.S198.77 E, S213.15 B.$172.67 A. $153.12 Leo company is considering a new venture in office equipment. It expects the cost of acquisition of land and building to be $100,000. Leo company expects cash flows to be $40,000 the first year and $45,000 for the next 4 years. It will discontinue the furniture operation upon the completions of the 5th year. Assume no salvage value. The company's WACC is 10%. 5. What is Leo company's IRR? A. 24% B. 19% C. 10% D. 26% E. 33% 6. What is Leo company's NPV and should they accept or reject the project? Assume no other projects exist and that NPV should be used to make the decision A. $75,120; accept project B. $66,040; accept project C. $80,230; accept project D. $(8,090); reject project E. $(9,324); reject project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts