Question: Hi, I know the solution is given for A (why are we using PV for growing annuity and multiplying that by 1/(1+r)^n i. what formula

Hi, I know the solution is given for A (why are we using PV for growing annuity and multiplying that by 1/(1+r)^n i. what formula is that because PV is C/(1+r)^n so why is it one instead of C and why are we using these formulas? Also can you explain how we can get n for these questions and I do not understand B.

Hi, I know the solution is given for A (why are we using PV for growing annuity and multiplying that by 1/(1+r)^n i. what formula is that because PV is C/(1+r)^n so why is it one instead of C and why are we using these formulas? Also can you explain how we can get n for these questions and I do not understand B.

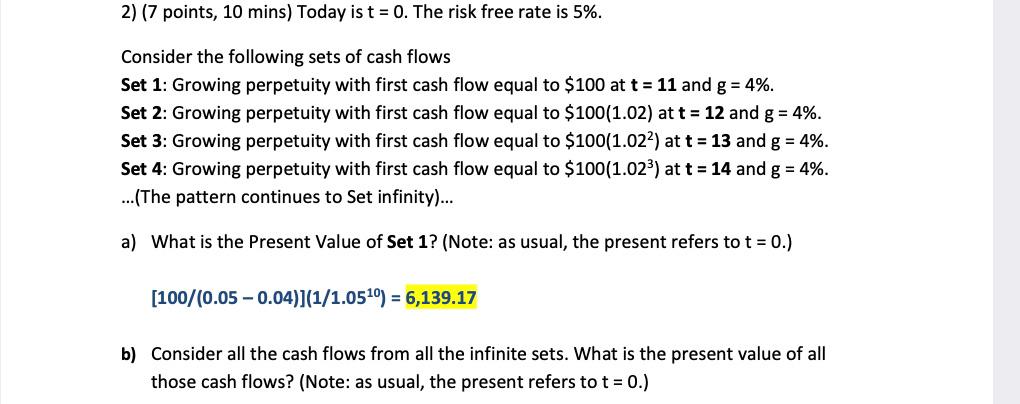

2) (7 points, 10 mins) Today is t = 0. The risk free rate is 5%. Consider the following sets of cash flows Set 1: Growing perpetuity with first cash flow equal to $100 at t = 11 and g = 4%. Set 2: Growing perpetuity with first cash flow equal to $100(1.02) at t = 12 and g = 4%. Set 3: Growing perpetuity with first cash flow equal to $100(1.022) at t = 13 and g = 4%. Set 4: Growing perpetuity with first cash flow equal to $100(1.023) at t = 14 and g = 4%. ...(The pattern continues to Set infinity)... a) What is the Present Value of Set 1? (Note: as usual, the present refers to t = 0.) [100/(0.05 -0.04)](1/1.0510) = 6,139.17 b) Consider all the cash flows from all the infinite sets. What is the present value of all those cash flows? (Note: as usual, the present refers to t = 0.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts