Question: Hi - I need help understanding your answer to this part I thought no entries needed for goodwill. And how do I adjust for the

Hi - I need help understanding your answer to this part

I thought no entries needed for goodwill. And how do I adjust for the difference in depreciable assets?

Thanks!

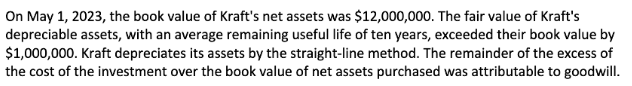

On May 1,2023 , the book value of Kraft's net assets was $12,000,000. The fair value of Kraft's depreciable assets, with an average remaining useful life of ten years, exceeded their book value by $1,000,000. Kraft depreciates its assets by the straight-line method. The remainder of the excess of the cost of the investment over the book value of net assets purchased was attributable to goodwill

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts