Question: hi! I need help using the PROVIDED excel sheet to calculate my answer. please help me figure out which calculator to use and where to

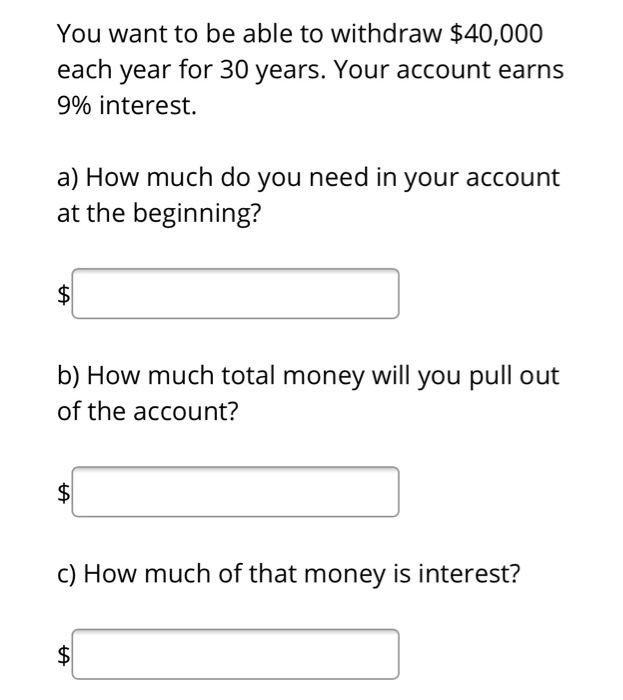

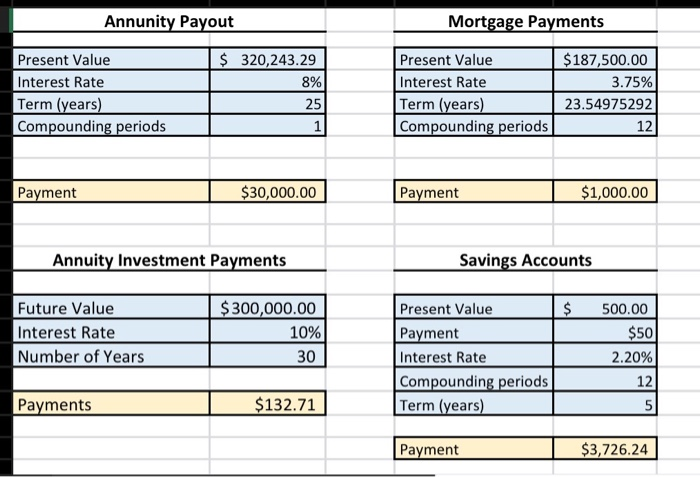

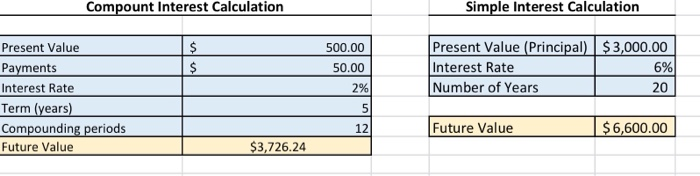

You want to be able to withdraw $40,000 each year for 30 years. Your account earns 9% interest. a) How much do you need in your account at the beginning? ta b) How much total money will you pull out of the account? TA c) How much of that money is interest? $ Annunity Payout Mortgage Payments Present Value Interest Rate Term (years) Compounding periods $ 320,243.29 8% 25 1 Present Value Interest Rate Term (years) Compounding periods $187,500.00 3.75% 23.54975292 12 Payment $30,000.00 Payment $1,000.00 Annuity Investment Payments Savings Accounts $ Future Value Interest Rate Number of Years $ 300,000.00 10% 30 Present Value Payment Interest Rate Compounding periods Term (years) 500.00 $50 2.20% 12 Payments $132.71 5 Payment $3,726.24 Compount Interest Calculation Simple Interest Calculation 500.00 $ $ 50.00 Present Value (Principal) $3,000.00 Interest Rate 6% Number of Years 20 2% Present Value Payments Interest Rate Term (years) Compounding periods Future Value 5 12 Future Value $6,600.00 $3,726.24

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts