Question: hi! I need help using the PROVIDED excel sheet to calculate my answer. please help me figure out which calculator to use and where to

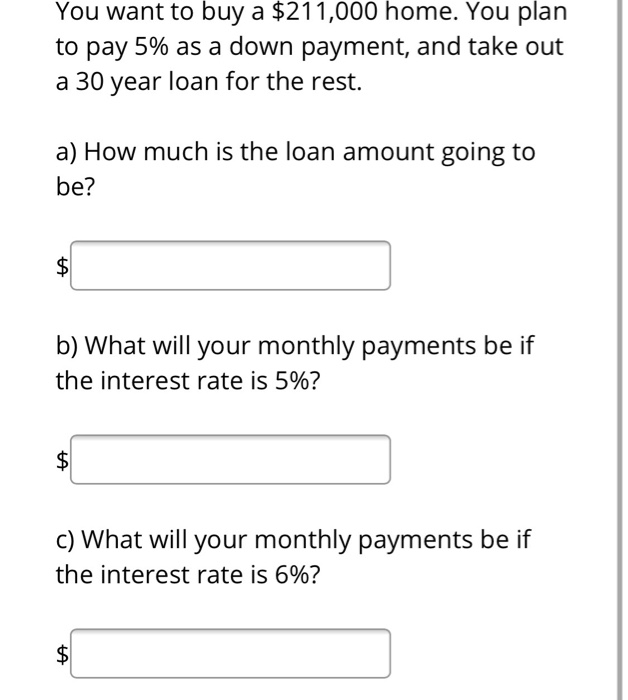

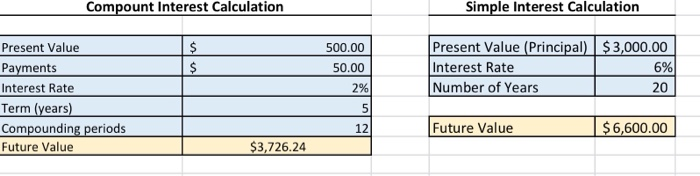

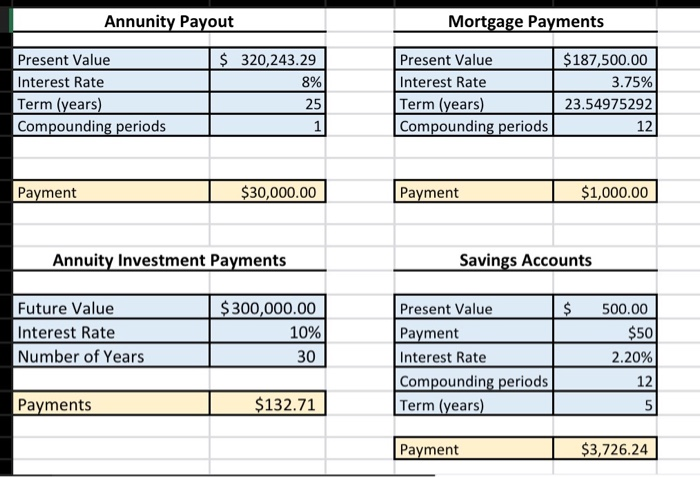

You want to buy a $211,000 home. You plan to pay 5% as a down payment, and take out a 30 year loan for the rest. a) How much is the loan amount going to be? $ b) What will your monthly payments be if the interest rate is 5%? $ c) What will your monthly payments be if the interest rate is 6%? $ Compount Interest Calculation Simple Interest Calculation 500.00 $ $ 50.00 Present Value (Principal) $3,000.00 Interest Rate 6% Number of Years 20 2% Present Value Payments Interest Rate Term (years) Compounding periods Future Value 5 12 Future Value $6,600.00 $3,726.24 Annunity Payout Mortgage Payments Present Value Interest Rate Term (years) Compounding periods $ 320,243.29 8% 25 1 Present Value Interest Rate Term (years) Compounding periods $187,500.00 3.75% 23.54975292 12 Payment $30,000.00 Payment $1,000.00 Annuity Investment Payments Savings Accounts $ Future Value Interest Rate Number of Years $ 300,000.00 10% 30 Present Value Payment Interest Rate Compounding periods Term (years) 500.00 $50 2.20% 12 Payments $132.71 5 Payment $3,726.24

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts