Question: Hi, I need help with this exercise, please provide a detail explanation step by step. El 1-2 Depreciation Methods Sorter Company purchased equipment for $200,000

Hi, I need help with this exercise, please provide a detail explanation step by step.

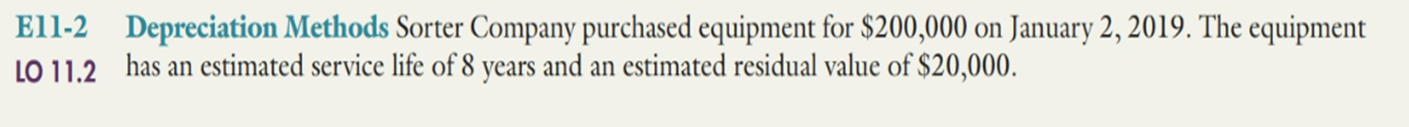

El 1-2 Depreciation Methods Sorter Company purchased equipment for $200,000 on January 2, 2019. The equipment [0 11.2 has an estimated service life of 8 years and an estimated residual value of $20,000. Required: Compute the depreciation expense for 2019 under each of the following methods: 1. straight-line 2. sum-of-thc-years'-digits 3. double-declining-balance 4. Next Level What effect does the depreciation of the equipment have on the analysis of rate of return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts