Question: Hi, I need some help and guidance with this problem and so far no one got the right calculations. Here is the question and some

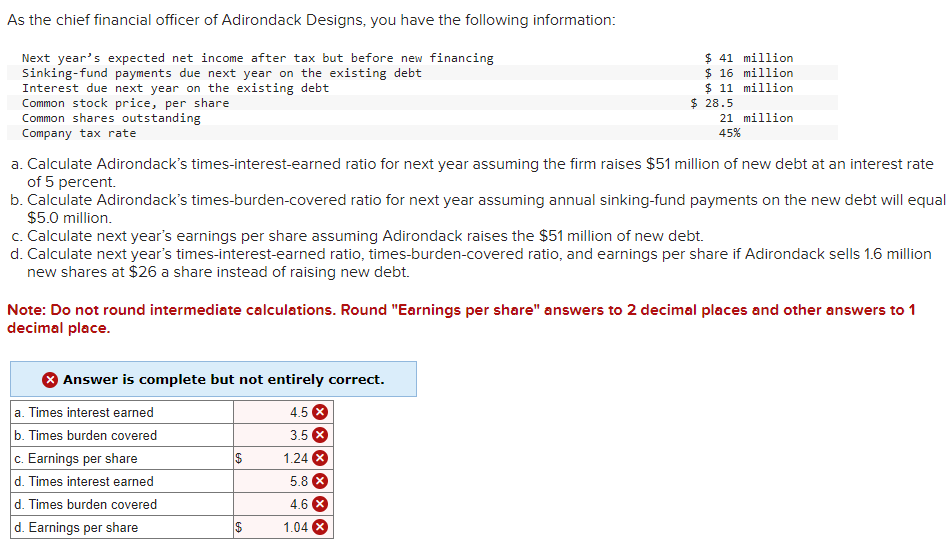

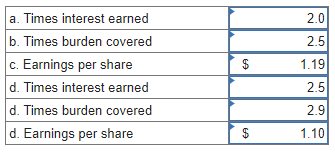

Hi, I need some help and guidance with this problem and so far no one got the right calculations. Here is the question and some of the wrong calculations. The second image is wrong as well. They are all wrong.

a. Calculate Adirondack's times-interest-earned ratio for next year assuming the firm raises $51 million of new debt at an interest rate of 5 percent. b. Calculate Adirondack's times-burden-covered ratio for next year assuming annual sinking-fund payments on the new debt will equal $5.0 million. c. Calculate next year's earnings per share assuming Adirondack raises the $51 million of new debt. d. Calculate next year's times-interest-earned ratio, times-burden-covered ratio, and earnings per share if Adirondack sells 1.6 million new shares at $26 a share instead of raising new debt. Note: Do not round intermediate calculations. Round "Earnings per share" answers to 2 decimal places and other answers to 1 decimal place. Answer is complete but not entirely correct. a. Calculate Adirondack's times-interest-earned ratio for next year assuming the firm raises $51 million of new debt at an interest rate of 5 percent. b. Calculate Adirondack's times-burden-covered ratio for next year assuming annual sinking-fund payments on the new debt will equal $5.0 million. c. Calculate next year's earnings per share assuming Adirondack raises the $51 million of new debt. d. Calculate next year's times-interest-earned ratio, times-burden-covered ratio, and earnings per share if Adirondack sells 1.6 million new shares at $26 a share instead of raising new debt. Note: Do not round intermediate calculations. Round "Earnings per share" answers to 2 decimal places and other answers to 1 decimal place. Answer is complete but not entirely correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts