Question: Hi I really do not understand how they got these answers can someone explain the step by step please it would be GREATLY appreciated I

Hi I really do not understand how they got these answers can someone explain the step by step please it would be GREATLY appreciated I am very lost

Hi I really do not understand how they got these answers can someone explain the step by step please it would be GREATLY appreciated I am very lost

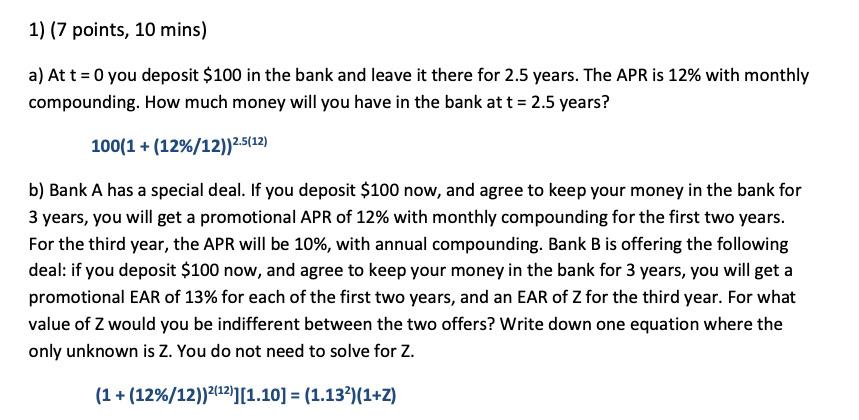

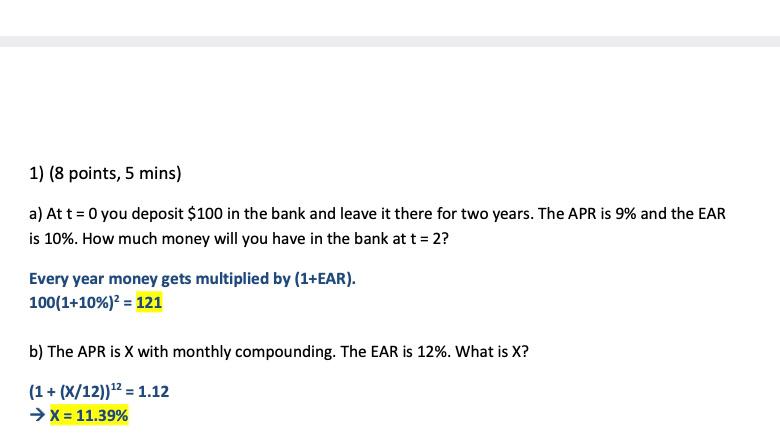

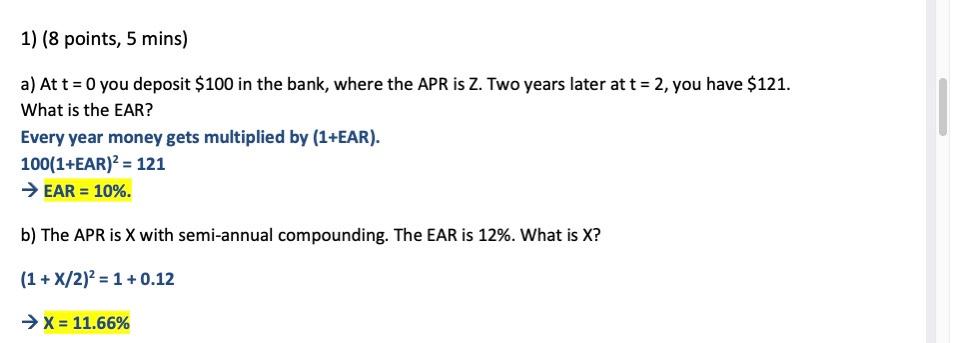

1) (7 points, 10 mins) a) At t = 0 you deposit $100 in the bank and leave it there for 2.5 years. The APR is 12% with monthly compounding. How much money will you have in the bank at t = 2.5 years? 100(1 + (12%/12))2.5(12) b) Bank A has a special deal. If you deposit $100 now, and agree to keep your money in the bank for 3 years, you will get a promotional APR of 12% with monthly compounding for the first two years. For the third year, the APR will be 10%, with annual compounding. Bank B is offering the following deal: if you deposit $100 now, and agree to keep your money in the bank for 3 years, you will get a promotional EAR of 13% for each of the first two years, and an EAR of Z for the third year. For what value of Z would you be indifferent between the two offers? Write down one equation where the only unknown is Z. You do not need to solve for Z. (1 + (12%/12))212)][1.10) = (1.132)(1+z) 1) (8 points, 5 mins) a) At t = 0 you deposit $100 in the bank and leave it there for two years. The APR is 9% and the EAR is 10%. How much money will you have in the bank at t = 2? Every year money gets multiplied by (1+EAR). 100(1+10%)2 = 121 b) The APR is X with monthly compounding. The EAR is 12%. What is X? (1 + (X/12))^2 = 1.12 X = 11.39% 1) (8 points, 5 mins) a) At t = 0 you deposit $100 in the bank, where the APR is Z. Two years later at t = 2, you have $121. What is the EAR? Every year money gets multiplied by (1+EAR). 100(1+EAR)2 = 121 EAR = 10%. b) The APR is X with semi-annual compounding. The EAR is 12%. What is X? (1 + X/2)2 = 1 + 0.12 X = 11.66%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts