Question: Hi I uploaded different parts separate someone uploaded same answer to every part this is the part A answer please please solve part B will

Hi I uploaded different parts separate someone uploaded same answer to every part

this is the part A answer please please solve part B will upvote in 30 minutes

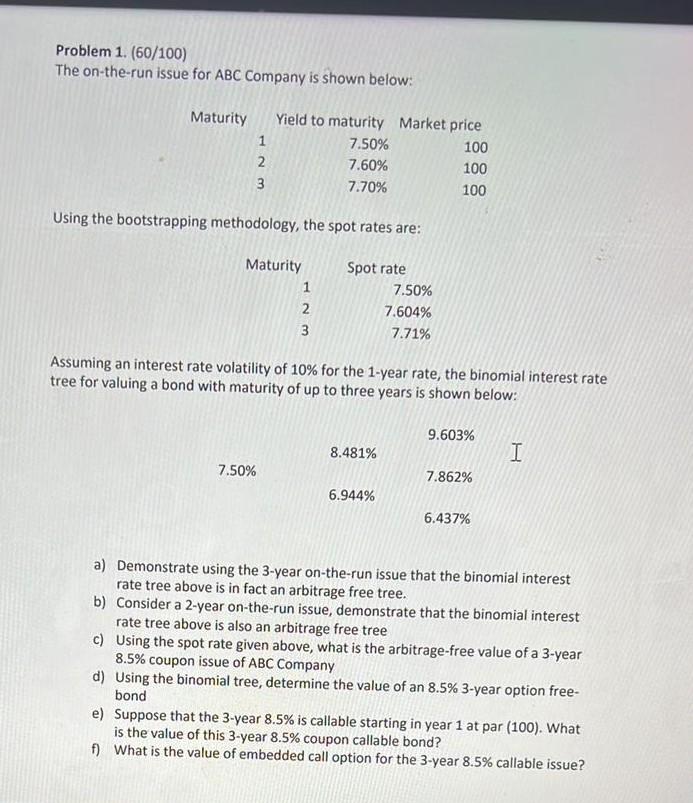

Problem 1. (60/100) The on-the-run issue for ABC Company is shown below: Using the bootstrapping methodology, the spot rates are: Assuming an interest rate volatility of 10% for the 1 -year rate, the binomial interest rate tree for valuing a bond with maturity of up to three years is shown below: a) Demonstrate using the 3 -year on-the-run issue that the binomial interest rate tree above is in fact an arbitrage free tree. b) Consider a 2-year on-the-run issue, demonstrate that the binomial interest rate tree above is also an arbitrage free tree c) Using the spot rate given above, what is the arbitrage-free value of a 3 -year 8.5% coupon issue of ABC Company d) Using the binomial tree, determine the value of an 8.5\% 3-year option freebond e) Suppose that the 3 -year 8.5% is callable starting in year 1 at par (100). What is the value of this 3 -year 8.5% coupon callable bond? f) What is the value of embedded call option for the 3 -year 8.5% callable issue? Solution :- According to collect from the data Let us assume that the data as followed by. As per given data, The on-the-run issue for the Colonials Company is shown below: Maturity To be continued the calculations parts are:- Binomial interest rate. 2-year on the run issue. f2=(1+s2)2/1+s11 =(1+3.7547%)2/1+3.5000%/1 =4.01% Therefore, binomial interest rate is 4.01% 3 -year on The run issue. f3=(1+s3)3/(1+s2)21 =(1+4.0134%)3/(1+3.7547%)21 24.53% There fore, binomial interest rate is 4.53\%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts