Question: Hi, I would like to know how to solve this question Question 1 1. 5 pts Joe's BBQ Supply began operations in 2016 and adopted

Hi,

I would like to know how to solve this question

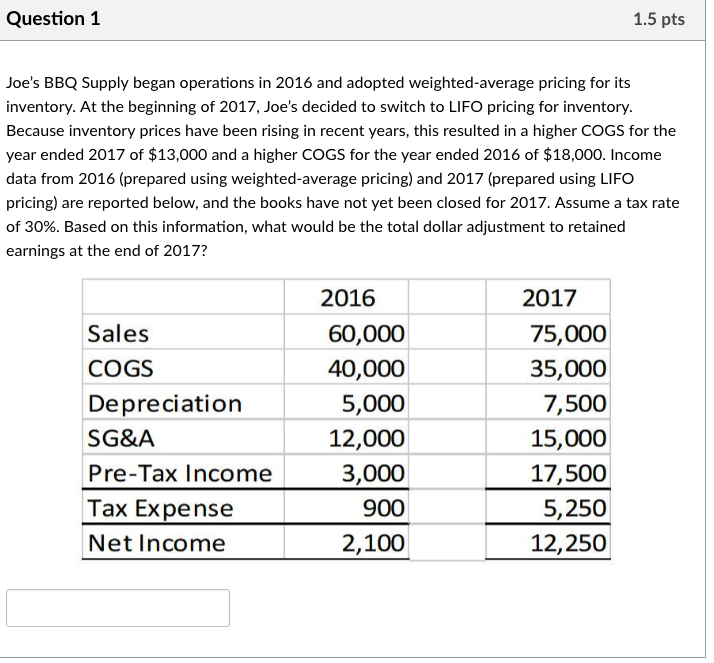

Question 1 1. 5 pts Joe's BBQ Supply began operations in 2016 and adopted weighted- average pricing for its inventory . At the beginning of 2017 , Joe's decided to switch to LIFO pricing for inventory . Because inventory prices have been rising in recent years , this resulted in a higher COGS for the year ended 2017 of $ 13, 000 and a higher COGS for the year ended 2016 of $18. 000 . Income data from 2016 ( prepared using weighted - average pricing ) and 2017 ( prepared using LIFO pricing ) are reported below , and the books have not yet been closed for 2017 . Assume a tax rate of 30%6 . Based on this information , what would be the total dollar adjustment to retained Earnings at the end of 2017 ?) 2016 2017 Sales 50, 000 75, 000 COGS 40, 000 35, 000 Depreciation 5 , 000 7, 500 SG&A 12, 000 15, 000 Pre - Tax Income 3, 000 17 , 500 Tax Expense 900 5 , 250 Net Income 2 , 100 12 , 250Question 2 0. 5 pts Would you debit or credit retained earnings for the adjustment calculated in question 1 ?" O Debit @ Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts