Question: HI, I'm very lost on solving this problem since I do not know how to solve for the applied overhead cost when there is no

HI, I'm very lost on solving this problem since I do not know how to solve for the applied overhead cost when there is no written estimated overhead cost. Can someone demonstrate step through step of the problem?

HI, I'm very lost on solving this problem since I do not know how to solve for the applied overhead cost when there is no written estimated overhead cost. Can someone demonstrate step through step of the problem?

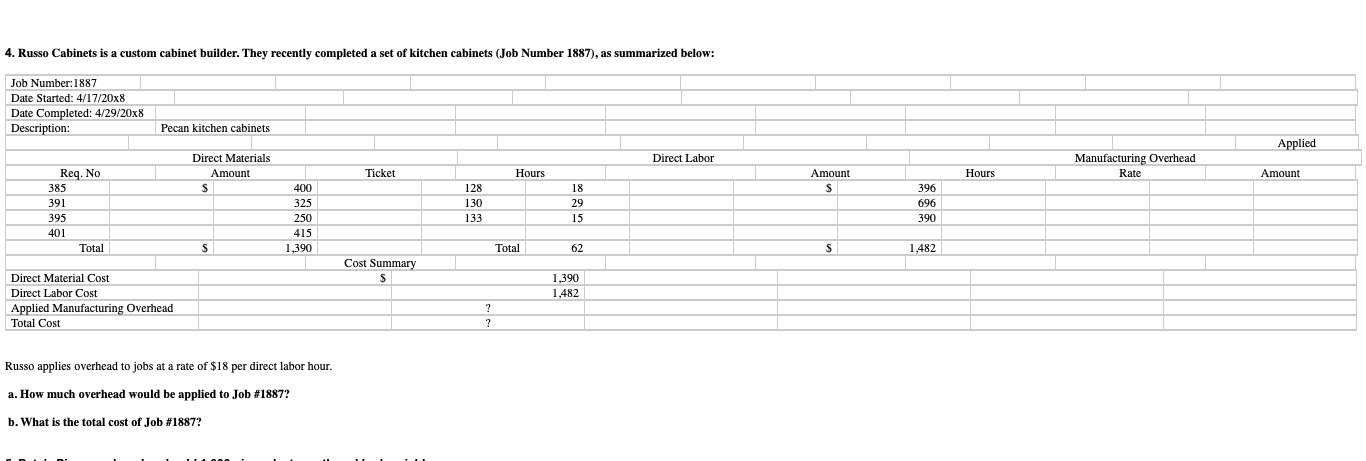

4. Russo Cabinets is a custom cabinet builder. They recently completed a set of kitchen cabinets (Job Number 1887), as summarized below: Job Number:1887 Date Started: 4/17/20x8 Date Completed: 4/29/20x8 Description: Pecan kitchen cabinets Applied Direct Labor Direct Materials Amount s Manufacturing Overhead Rate Ticket Hours Hours Amount Amount $ Req. No 385 391 395 401 Total 400 325 250 415 1,390 128 130 133 18 29 15 396 696 390 S Total 62 S 1,482 Cost Summary S 1,390 1,482 Direct Material Cost Direct Labor Cost Applied Manufacturing Overhead Total Cost ? ? Russo applies overhead to jobs at a rate of $18 per direct labor hour. a. How much overhead would be applied to Job #18872 b. What is the total cost of Job #1887

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts