Question: Hi, just after the multiple choice answer to these homework question to cross check. TIA Question 1). Which of the following are most likely to

Hi, just after the multiple choice answer to these homework question to cross check. TIA

Hi, just after the multiple choice answer to these homework question to cross check. TIA

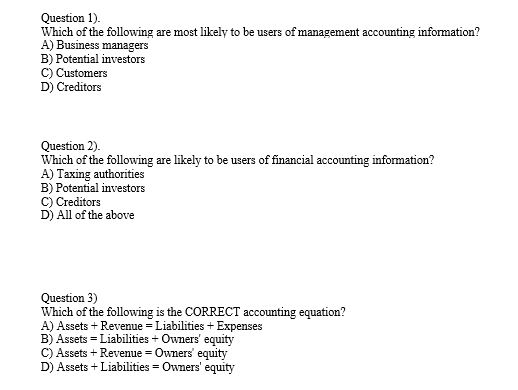

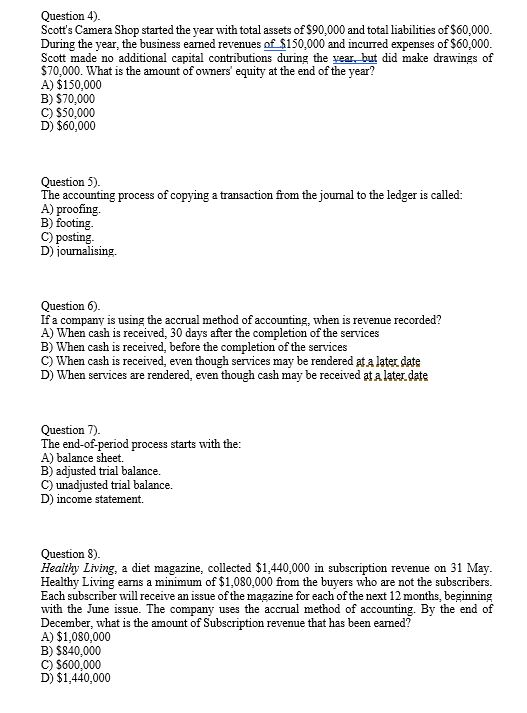

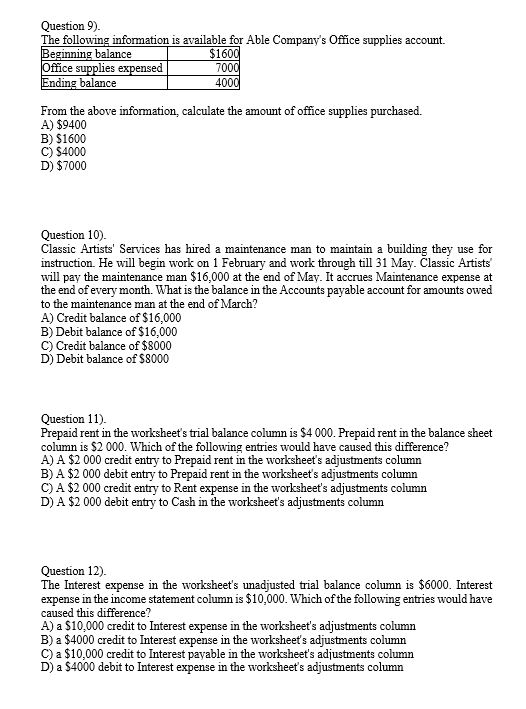

Question 1). Which of the following are most likely to be users of management accounting information? A) Business managers B) Potential investors C) Customers D) Creditors Question 2). Which of the following are likely to be users of financial accounting information? A) Taxing authorities B) Potential investors C) Creditors D) All of the above Question 3) Which of the following is the CORRECT accounting equation? A) Assets + Revenue = Liabilities + Expenses B) Assets = Liabilities + Owners' equity C) Assets + Revenue = Owners' equity D) Assets + Liabilities = Owners' equity Question 4). Scott's Camera Shop started the year with total assets of $90,000 and total liabilities of $60,000. During the year, the business earned revenues of $150,000 and incurred expenses of $60,000. Scott made no additional capital contributions during the rear, but did make drawings of $70,000. What is the amount of owners' equity at the end of the year? A) $150,000 B) $70,000 C) $50,000 D) $60,000 Question 5). The accounting process of copying a transaction from the journal to the ledger is called: A) proofing. B) footing C) posting D) journalising. Question 6). If a company is using the accrual method of accounting, when is revenue recorded? A) When cash is received, 30 days after the completion of the services B) When cash is received, before the completion of the services C) When cash is received, even though services may be rendered at a later date D) When services are rendered, even though cash may be received at a later date Question 7). The end-of-period process starts with the: A) balance sheet B) adjusted trial balance. C) unadjusted trial balance. D) income statement. Question 8). Healthy Living, a diet magazine, collected $1,440,000 in subscription revenue on 31 May. Healthy Living eams a minimum of $1,080.000 from the buyers who are not the subscribers. Each subscriber will receive an issue of the magazine for each of the next 12 months, beginning with the June issue. The company uses the accrual method of accounting. By the end of December, what is the amount of Subscription revenue that has been eamed? A) $1,080,000 B) $840,000 C) $600,000 D) $1,440,000 Question 9). The following information is available for Able Company's Office supplies account. Beginning balance $1600 Office supplies expensed 7000 Ending balance 4000 From the above information, calculate the amount of office supplies purchased. A) $9400 B) $1600 C) $4000 D) $7000 Question 10). Classic Artists' Services has hired a maintenance man to maintain a building they use for instruction. He will begin work on 1 February and work through till 31 May. Classic Artists will pay the maintenance man $16,000 at the end of May. It accrues Maintenance expense at the end of every month. What is the balance in the Accounts payable account for amounts owed to the maintenance man at the end of March? A) Credit balance of $16,000 B) Debit balance of $16,000 C) Credit balance of $8000 D) Debit balance of $8000 Question 11). Prepaid rent in the worksheet's trial balance column is $4 000. Prepaid rent in the balance sheet column is $2 000. Which of the following entries would have caused this difference? A) A $2 000 credit entry to Prepaid rent in the worksheet's adjustments column B) A $2 000 debit entry to Prepaid rent in the worksheet's adjustments column C) A $2 000 credit entry to Rent expense in the worksheet's adjustments column D) A $2 000 debit entry to cash in the worksheet's adjustments column Question 12). The Interest expense in the worksheet's unadjusted trial balance column is $6000. Interest expense in the income statement column is $10,000. Which of the following entries would have caused this difference? A) a $10,000 credit to Interest expense in the worksheet's adjustments column B) a $4000 credit to Interest expense in the worksheet's adjustments column C) a $10,000 credit to Interest payable in the worksheet's adjustments column D) a $4000 debit to Interest expense in the worksheet's adjustments column

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts