Question: hi, please answer all if them. 15 In preparing a company's statement of cash flows for the most recent year, the following information is available:

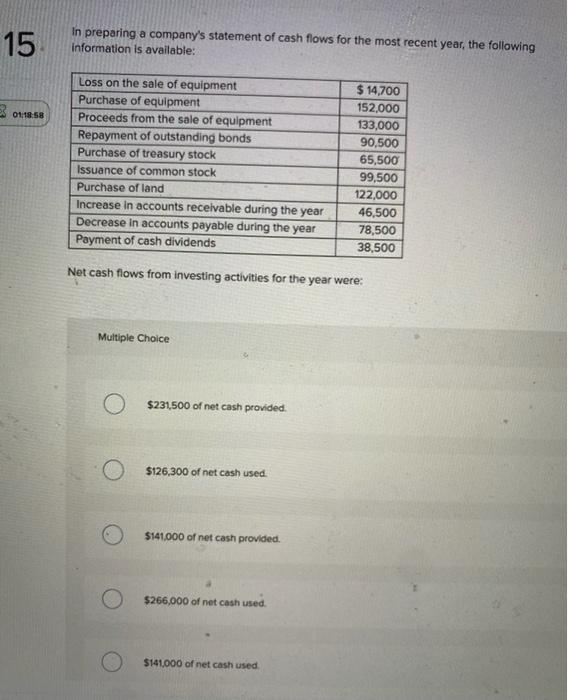

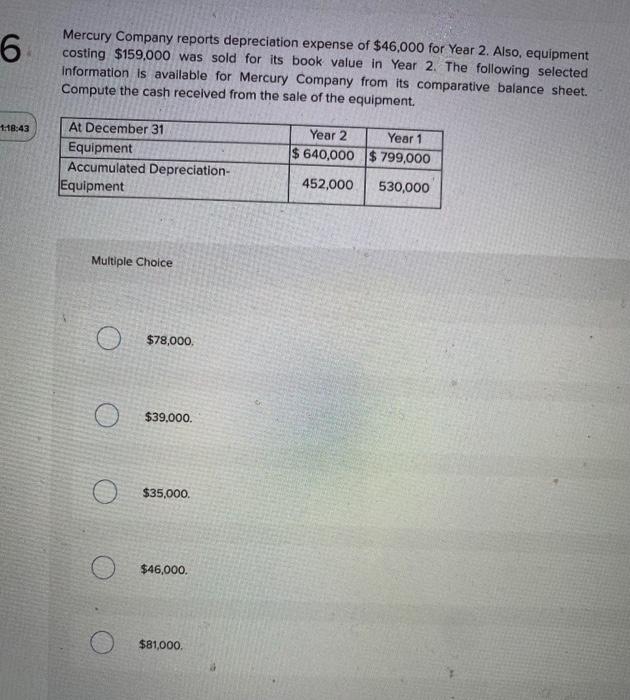

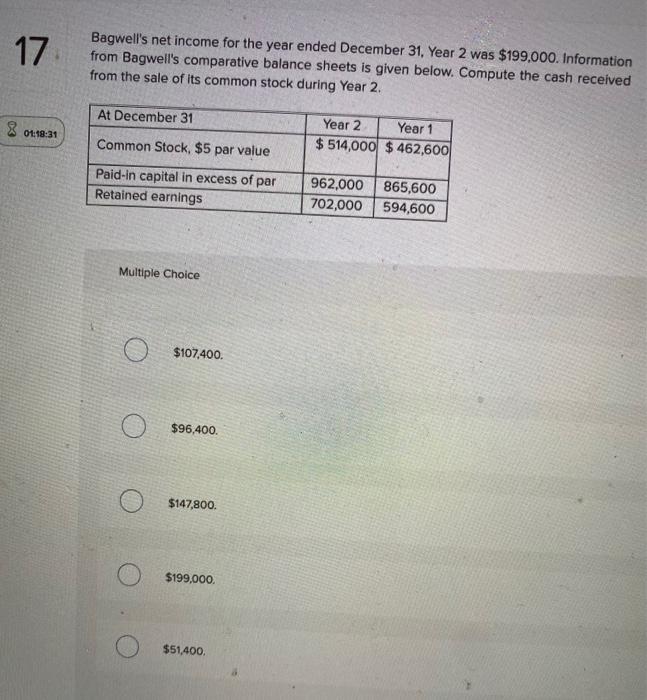

15 In preparing a company's statement of cash flows for the most recent year, the following information is available: 01:18:58 Loss on the sale of equipment Purchase of equipment Proceeds from the sale of equipment Repayment of outstanding bonds Purchase of treasury stock Issuance of common stock Purchase of land Increase in accounts receivable during the year Decrease in accounts payable during the year Payment of cash dividends $ 14,700 152,000 133,000 90,500 65,500 99,500 122,000 46,500 78,500 38,500 Net cash flows from investing activities for the year were: Multiple Choice O $231,500 of net cash provided $126,300 of net cash used. $141.000 of net cash provided. $266,000 of net cash used. $141.000 of net cash used 6 Mercury Company reports depreciation expense of $46,000 for Year 2. Also, equipment costing $159,000 was sold for its book value in Year 2. The following selected Information is available for Mercury Company from its comparative balance sheet. Compute the cash received from the sale of the equipment. 118:43 At December 31 Equipment Accumulated Depreciation- Equipment Year 2 Year 1 $ 640,000 $ 799,000 452,000 530,000 Multiple Choice $78,000 $39.000. $35,000 $46,000. $81,000. 17 Bagwell's net income for the year ended December 31, Year 2 was $199.000. Information from Bagwell's comparative balance sheets is given below. Compute the cash received from the sale of its common stock during Year 2. At December 31 01:18:31 Year 2 Year 1 $ 514,000 $ 462,600 Common Stock, $5 par value Paid-in capital in excess of par Retained earnings 962,000 865,600 702,000 594,600 Multiple Choice $107,400. $96,400. $147,800. $199,000 $51,400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts