Question: Hi Please assist with a fully detailed answer for Question 3 of Financial Management assignment QUESTION 4 (25) 4.1 Discuss dividend payout policy and whether

Hi Please assist with a fully detailed answer for Question 3 of Financial Management assignment

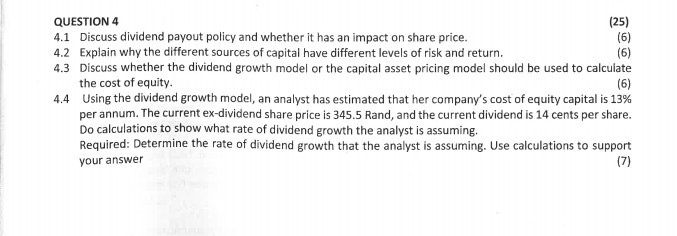

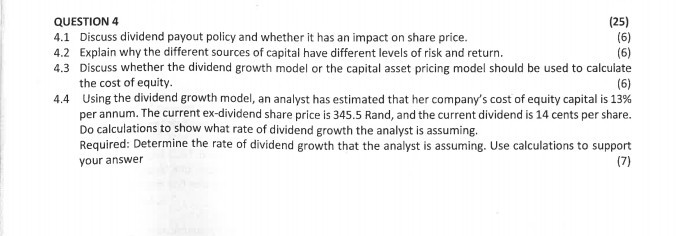

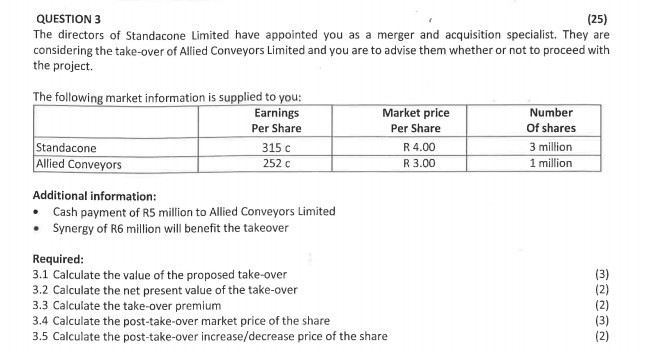

QUESTION 4 (25) 4.1 Discuss dividend payout policy and whether it has an impact on share price. (6) 4.2 Explain why the different sources of capital have different levels of risk and return. 4.3 Discuss whether the dividend growth model or the capital asset pricing model should be used to calculate the cost of equity. Using the dividend growth model, an analyst has estimated that her company's cost of equity capital is 13% per annum. The current ex-dividend share price is 345.5 Rand, and the current dividend is 14 cents per share. Do calculations to show what rate of dividend growth the analyst is assuming. Required: Determine the rate of dividend growth that the analyst is assuming. Use calculations to support your answer (7) QUESTION 4 (25) 4.1 Discuss dividend payout policy and whether it has an impact on share price. (6) 4.2 Explain why the different sources of capital have different levels of risk and return. 4.3 Discuss whether the dividend growth model or the capital asset pricing model should be used to calculate the cost of equity. Using the dividend growth model, an analyst has estimated that her company's cost of equity capital is 13% per annum. The current ex-dividend share price is 345.5 Rand, and the current dividend is 14 cents per share. Do calculations to show what rate of dividend growth the analyst is assuming. Required: Determine the rate of dividend growth that the analyst is assuming. Use calculations to support your answer (7) QUESTION 3 (25) The directors of Standacone Limited have appointed you as a merger and acquisition specialist. They are considering the take-over of Allied Conveyors Limited and you are to advise them whether or not to proceed with the project. The following market information is supplied to you: Earnings Per Share Standacone 315 C Allied Conveyors 252 C Market price Per Share R 4.00 R 3.00 Number Of shares 3 million 1 million Additional information: Cash payment of R5 million to Allied Conveyors Limited Synergy of R6 million will benefit the takeover Required: 3.1 Calculate the value of the proposed take-over 3.2 Calculate the net present value of the take-over 3.3 Calculate the take-over premium 3.4 Calculate the post-take-over market price of the share 3.5 Calculate the post-take-over increase/decrease price of the share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts