Question: Hi please help a) Compute Sundeuci's expected growth rate. b) Capital expenditure for FY2019 was $34 million and forecasted at $38 million for FY2020 Compute

Hi please help

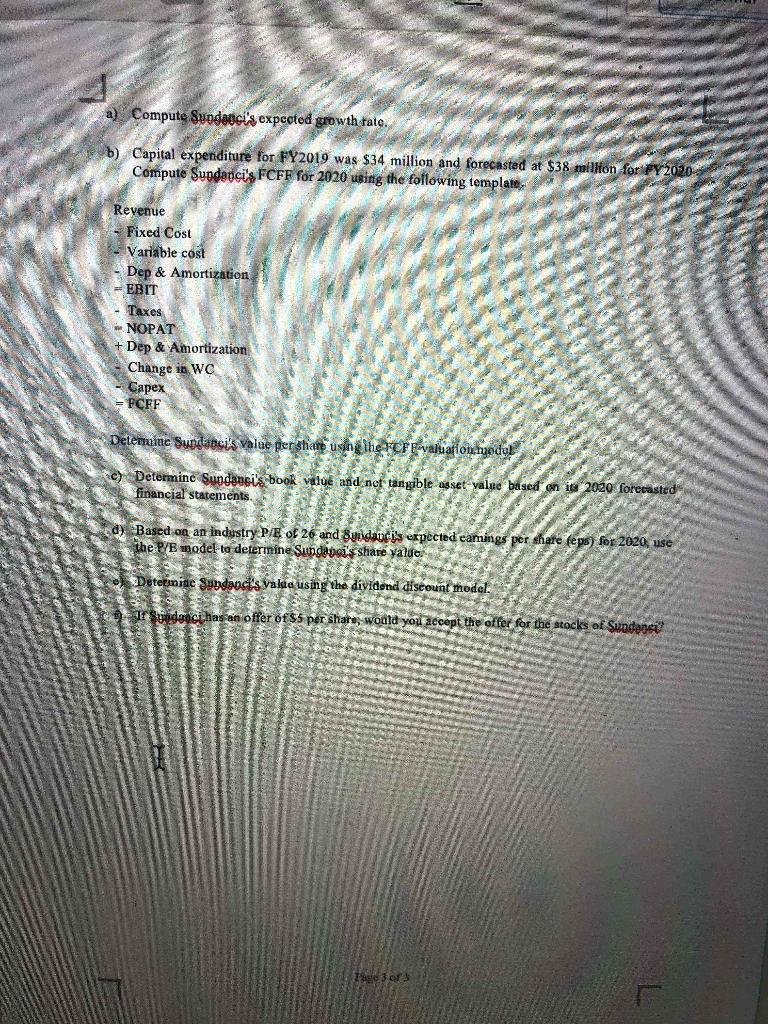

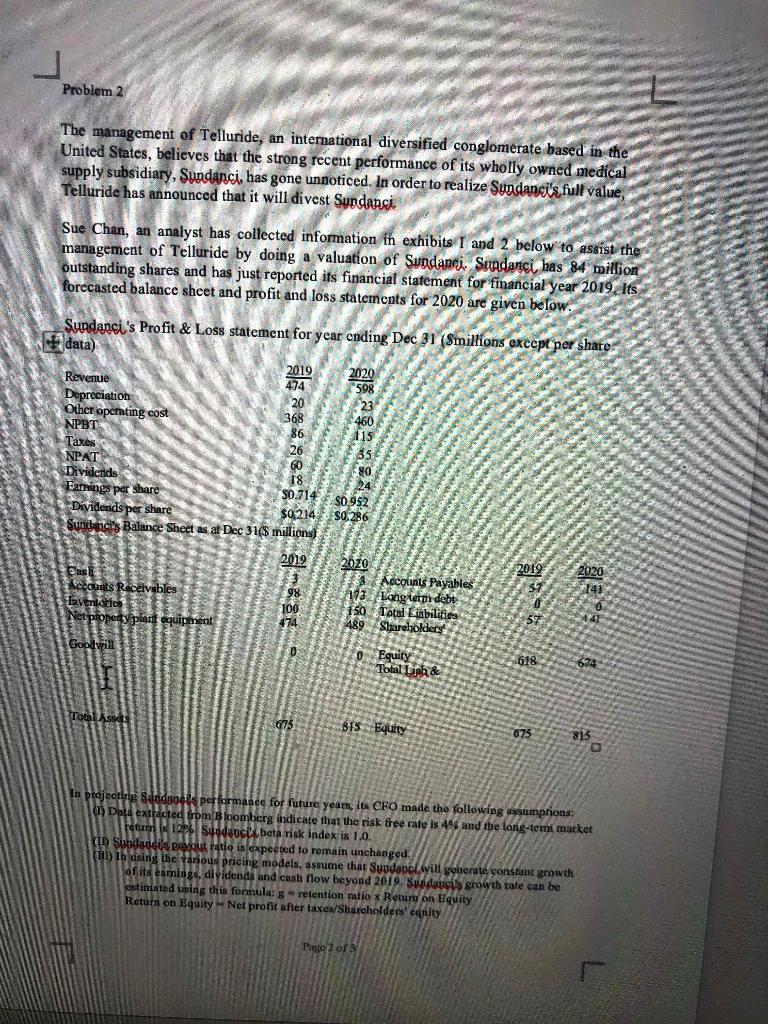

a) Compute Sundeuci's expected growth rate. b) Capital expenditure for FY2019 was $34 million and forecasted at $38 million for FY2020 Compute Sundarci's FCFF for 2020 using the following template, Revenue Fixed Cost Variable cost Dep & Amortization EBIT Taxes NOPAT + Dep & Amortization Change in WC Capex = FCFF Detenuine Suudlanci's value per share using the FF Fevaluatiounyodul c) Determine Suodansi's book value and net tangible asset value based on ise 2020 forecasted financial statements a) Based on an industry P/E of 26 and Sundanci's expected eamings per share fepu) for 2020, use the P/E model to determine Sundapoi's share valde o) Determide Sundanci's valua using the dividend discount model. be Ir Suodaoci has an offer of $5 per share, would you accept the offer for the stocks of Sunden Tage 3 Problem 2 The management of Telluride, an international diversified conglomerate based in the United States, believes that the strong recent performance of its wholly owned medical supply subsidiary, Sundanci, has gone unnoticed. In order to realize Sundanci's full value, Telluride has announced that it will divest Sundanci, Sue Chan, an analyst has collected information in exhibits 1 and 2 below to assist the management of Telluride by doing a valuation of Sundanci. Sundanci has 84 million outstanding shares and has just reported its financial statement for financial year 2019. Its forecasted balance sheet and profit and loss statements for 2020 are given below. Sundanci's Profit & Loss statement for year coding Dec 31 (Smillions except per share data) 2019 Revenue 2020 474 Depreciation Other operating cost NPBT 20 Taxis NPAT $0.714 50.952 Se Dividends Earnings per share Dividends per share $0214 $0.286 Sunland's Balance Sheet as a Dec 31(5 millions 2019 2020 East Accounts Payables Accounts Receivables 98 13 Long term debt Invenios 100 150 Total Liabilities Net property plast equipment 474 489 Shareholders Gaaaa 2019 2020 Goodwill 0 to Foot Linh & 618 674 675 815 Equity 675 815 In projecting Sodapet's performance for future years, its CFO made the following assumptions: (l) Dald extracted from Bloomberg indicate that the risk free rate is 4% and the long-temt market (ID Suodaucis beta risk index is 1.0. return Teen pessoat ratio is expeered to remain unchanged. (11) in using the various pricing models, assume that Suodabei will generate constant growth of its earings, dividends and cash flow beyond 2019. Swastopsis growth rate can be estimated using this formula: s retention natio x Return on Equity Return on Equity - Net profit after taxes/Shareholders' eqnity Payto Z of a) Compute Sundeuci's expected growth rate. b) Capital expenditure for FY2019 was $34 million and forecasted at $38 million for FY2020 Compute Sundarci's FCFF for 2020 using the following template, Revenue Fixed Cost Variable cost Dep & Amortization EBIT Taxes NOPAT + Dep & Amortization Change in WC Capex = FCFF Detenuine Suudlanci's value per share using the FF Fevaluatiounyodul c) Determine Suodansi's book value and net tangible asset value based on ise 2020 forecasted financial statements a) Based on an industry P/E of 26 and Sundanci's expected eamings per share fepu) for 2020, use the P/E model to determine Sundapoi's share valde o) Determide Sundanci's valua using the dividend discount model. be Ir Suodaoci has an offer of $5 per share, would you accept the offer for the stocks of Sunden Tage 3 Problem 2 The management of Telluride, an international diversified conglomerate based in the United States, believes that the strong recent performance of its wholly owned medical supply subsidiary, Sundanci, has gone unnoticed. In order to realize Sundanci's full value, Telluride has announced that it will divest Sundanci, Sue Chan, an analyst has collected information in exhibits 1 and 2 below to assist the management of Telluride by doing a valuation of Sundanci. Sundanci has 84 million outstanding shares and has just reported its financial statement for financial year 2019. Its forecasted balance sheet and profit and loss statements for 2020 are given below. Sundanci's Profit & Loss statement for year coding Dec 31 (Smillions except per share data) 2019 Revenue 2020 474 Depreciation Other operating cost NPBT 20 Taxis NPAT $0.714 50.952 Se Dividends Earnings per share Dividends per share $0214 $0.286 Sunland's Balance Sheet as a Dec 31(5 millions 2019 2020 East Accounts Payables Accounts Receivables 98 13 Long term debt Invenios 100 150 Total Liabilities Net property plast equipment 474 489 Shareholders Gaaaa 2019 2020 Goodwill 0 to Foot Linh & 618 674 675 815 Equity 675 815 In projecting Sodapet's performance for future years, its CFO made the following assumptions: (l) Dald extracted from Bloomberg indicate that the risk free rate is 4% and the long-temt market (ID Suodaucis beta risk index is 1.0. return Teen pessoat ratio is expeered to remain unchanged. (11) in using the various pricing models, assume that Suodabei will generate constant growth of its earings, dividends and cash flow beyond 2019. Swastopsis growth rate can be estimated using this formula: s retention natio x Return on Equity Return on Equity - Net profit after taxes/Shareholders' eqnity Payto Z of

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts